By RoboForex Analytical Department

Market sentiment remains dominated by escalating geopolitical tensions in Europe, which are dampening the euro’s outlook and fuelling demand for traditional safe-haven assets, notably the US dollar.

The dollar’s strength is further underpinned by the persistently hawkish rhetoric from the Federal Reserve. Officials continue to signal that interest rates will need to remain at their current levels for longer than previously anticipated. This stance is reinforced by resilient US inflation data, solidifying market expectations that the Fed will maintain its current policy course.

In stark contrast, the eurozone is grappling with a marked slowdown in business activity. The latest PMI data confirms a contraction across both manufacturing and services sectors. Against this deteriorating economic backdrop, the European Central Bank (ECB) has adopted a notably cautious tone, hinting at significant downside risks to growth. This growing monetary policy divergence with the US creates a fundamental imbalance, exacerbating the downward pressure on the single currency.

Consequently, the overall fundamental picture continues to favour the US dollar, suggesting further downside potential for the EUR/USD pair.

Technical Analysis: EUR/USD

H4 Chart:

On the H4 chart, EUR/USD is forming a tight consolidation range around the 1.1600 level, following a clear impulsive decline. This price action suggests the development of a third wave down. A decisive break below this consolidation range would signal the resumption of the bearish impulse, with an initial target at 1.1488. This bearish technical outlook is confirmed by the MACD indicator, whose signal line remains below zero and is pointing downward, indicating sustained selling momentum.

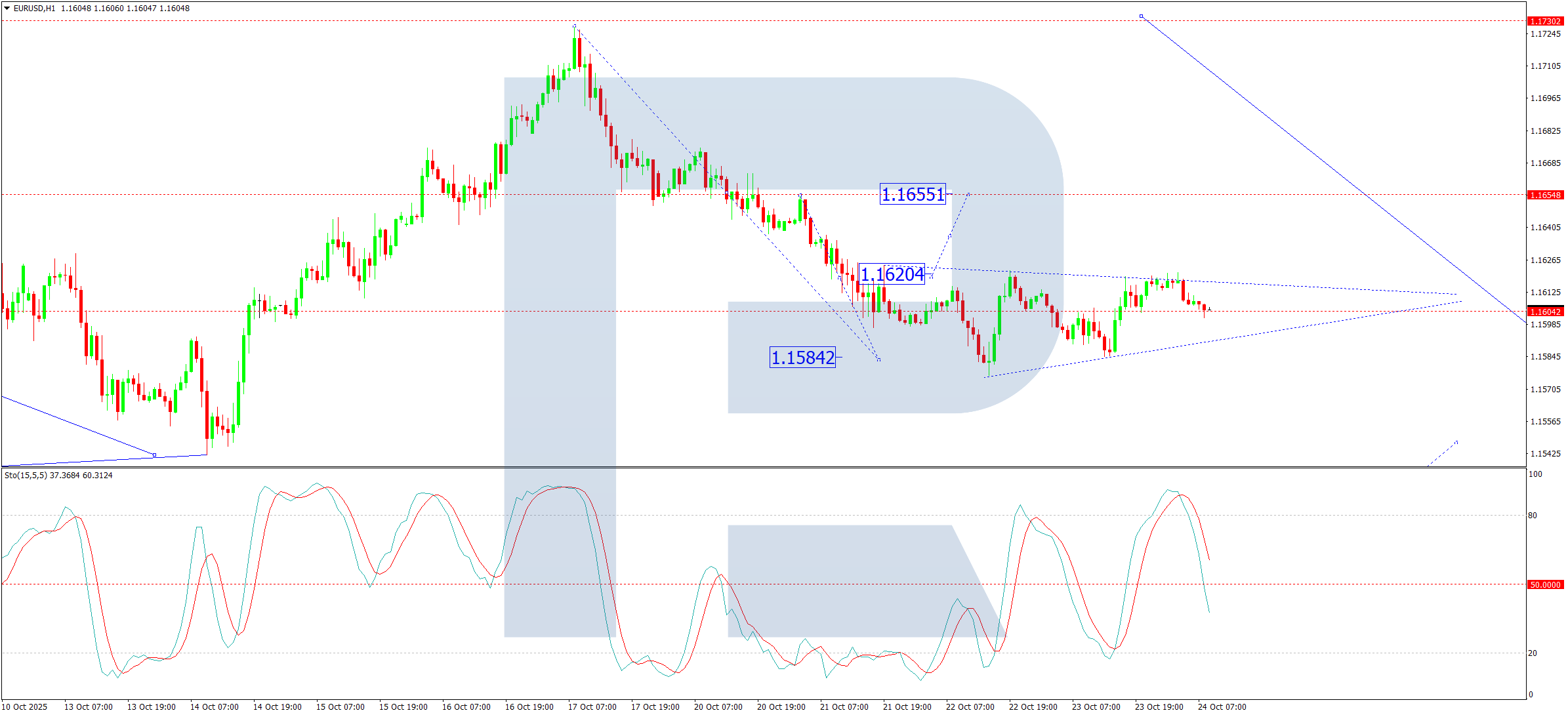

H1 Chart:

The H1 chart shows the completion of a downward wave to 1.1576, followed by a corrective move to 1.1620, effectively outlining the current consolidation zone. A break above this range could trigger a short-lived correction towards 1.1655 before the broader downtrend resumes, targeting 1.1500. Conversely, a break below the range would directly activate the bearish wave towards 1.1488, which is projected to complete the first leg of the larger third wave down. The Stochastic oscillator aligns with this view, with its signal line turning down from the 80 level and heading towards 20, reflecting building bearish momentum in the short term.

Conclusion

The combination of a supportive fundamental backdrop for the dollar and a deteriorating outlook for the eurozone maintains a bearish bias for EUR/USD. Technically, the pair appears to be pausing within a broader downtrend, with a breakdown below 1.1600 likely to trigger the next leg lower towards 1.1488.

Disclaimer:

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- EUR/USD Consolidates Ahead of Potential Further Losses Oct 24, 2025

- Oil prices surged following new sanctions against top Russian oil companies. The Mexican peso remains in demand Oct 23, 2025

- The British Pound Extends Its Losses Oct 23, 2025

- The new Prime Minister of Japan supports a loose monetary policy. Canada sees rising inflation Oct 22, 2025

- Strong corporate reports support stock indices. EU countries supported a plan to phase out imports of Russian oil and gas Oct 21, 2025

- EUR/USD Under Downward Pressure Oct 21, 2025

- The US stocks rise on easing trade tensions. Bitcoin falls amid new wave of risk in global markets Oct 20, 2025

- The Yen Extends its Correction Oct 20, 2025

- The US government shutdown extended until at least Monday. Silver prices hit new records Oct 17, 2025

- Australia’s labor market is cooling. The Canadian dollar is depreciating under the influence of falling oil prices Oct 16, 2025