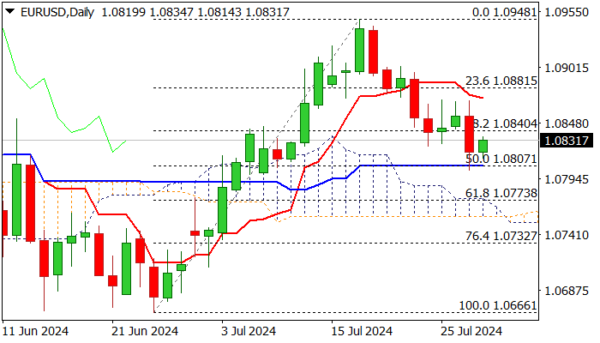

EURUSD edges higher on Tuesday morning after strong fall on Monday was contained by solid support at 1.0807 (daily Kijun-sen / 50% retracement of 1.0666/1.0948 rally) and also failed to register a daily close below cracked converged 55/200DMA’s (1.0815).

Monday’s downside rejection also left a bear-trap, generating an initial positive signal, which requires confirmation on lift above 1.0870 (lower platform of past four days, reinforced by daily Tenkan-sen) to indicate an end of corrective phase and shift near term focus higher.

Daily studies show MA’s in mixed setup, while momentum and RSI are currently neutral.

On the other hand, tomorrow’s twist of daily cloud could be magnetic and attract bears for attack at thinning cloud, break of which to activate negative scenario and risk deeper drop towards 1.0732 Fibo support (76.4%).

Eurozone preliminary Q2 GDP was in line with expectations but better than Q1, which provided some support to Euro, with German in inflation data (due later today) eyed for fresh signals.

Res: 1.0840; 1.0870; 1.0881; 1.0902.

Sup: 1.0814; 1.0802; 1.0758; 1.0732.