The EUR/USD pair experienced a noticeable uptick yesterday, but failed to sustain its peak, settling at 1.0732 today. Early gains were buoyed by the initial outcomes from France’s parliamentary elections, which did not reflect the worst-case scenario, sparking a temporary surge in risk appetite and bolstering the euro.

However, last evening’s economic indicators from the U.S. painted a mixed picture, dampening the initial enthusiasm. The ISM Manufacturing Index for June dipped to 48.5 from 48.7, falling short of expectations and remaining below the pivotal 50-point mark that delineates expansion from contraction. Conversely, Markit’s Manufacturing PMI indicated a slight improvement, rising to 51.6 from 51.3.

Additionally, a report showed a 0.1% month-on-month decline in U.S. construction spending for May, a reversal from the previous increase of 0.3% and weaker than anticipated, suggesting a potential slowdown in the construction sector and broader economic support.

Market participants are now turning their attention to an upcoming speech by Jerome Powell, Chair of the Federal Reserve, for further clues on the direction of U.S. monetary policy.

Technical analysis of EUR/USD

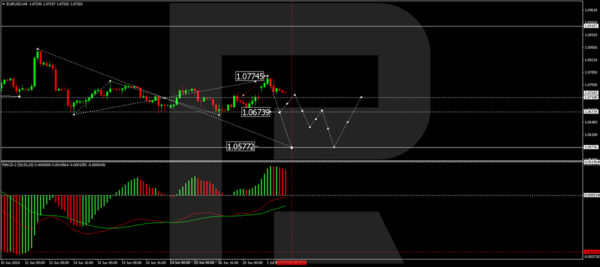

The EUR/USD pair completed a correction to 1.0774 but is now forming a declining wave towards 1.0675. Should this level be reached, a minor correction to 1.0714 may occur before a potential further drop to 1.0630, and potentially extending down to 1.0573. The MACD indicator underlines this bearish outlook with its signal line positioned below zero and histograms trending downwards.

On the hourly chart, the pair is currently crafting a declining structure with an initial target at 1.0675. Following this, a correction towards 1.0714 is plausible, before a continuation of the downtrend to 1.0640. The Stochastic oscillator corroborates this view, with its signal line approaching the 20 level, indicating a potential for further declines before a rebound towards 50 might occur.

Market outlook

Investors will continue to assess the blend of economic data and central bank signals, particularly from the Fed, to gauge the potential trajectory of interest rates and their impact on currency valuations. Today’s speech by Jerome Powell could be particularly pivotal in setting market expectations moving forward.