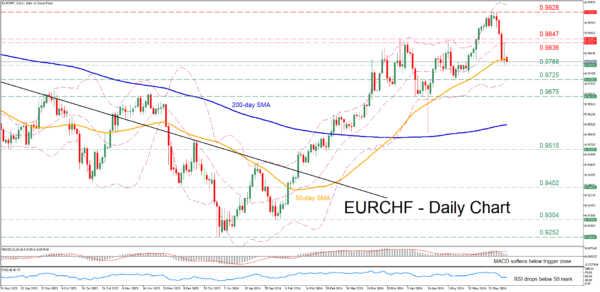

- EURCHF hits a fresh 14-month high of 0.9928

- Before plunging towards the 50-day SMA

- Momentum indicators turn bearish

EURCHF has been in a steady recovery since late December, attempting to erase its massive 2021-2023 downtrend. Last week, the pair surged to a fresh 14-month peak of 0.9928, but quickly retraced lower until the 50-day simple moving average (SMA) curbed its retreat.

If the recent weakness persists, the pair could violate the 50-day SMA and challenge the recent support of 0.9768. Further declines could then come to a halt at the May bottom of 0.9725. Even lower, the April support of 0.9675 might provide downside protection.

Alternatively, should the bulls regain control, immediate resistance could be found at 0.9836, which prevented the bulls from drifting further north on May 1. Higher, the April peak of 0.9847 could prove to be the next barricade for the price to overcome. A violation of that zone may pave the way for the 14-month high of 0.9928.

In brief, EURCHF experienced a strong pullback following its 14-month high of 0.9928, but the 50-day SMA appears to be holding its ground for now. Meanwhile, the pair could exhibit heightened volatility in the upcoming days as markets are bracing for the ECB’s rate decision on Thursday.