- EURGBP edges higher today ahead of crucial ECB meeting

- Strong downside pressure in place despite UK elections being in the spotlight

- Momentum indicators are mostly mixed at this juncture

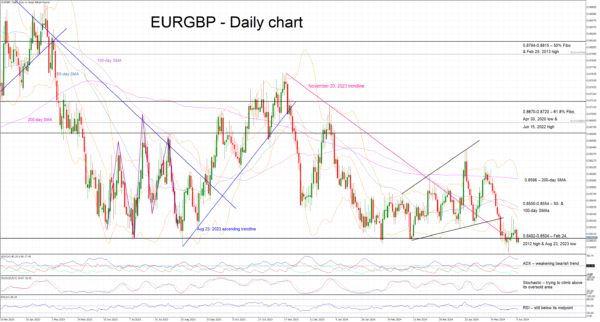

EURGBP is trading higher today, a tad above its lowest level since August 2022, and in an extremely important support area that has repeatedly acted as a floor and put a stop in the bears’ momentum. The market is preparing for the much-awaited ECB meeting that could deliver the first rate from a major central bank later today. The euro has been under severe pressure since mid-April with a slightly odd-shaped double-top structure playing a key role in the current downward trend.

In the meantime, the momentum indicators appear mixed. The Average Directional Movement Index (ADX) remains above its 25-threshold, but it is trading sideways and thus pointing to a weakening bearish trend in EURGBP. Similarly, the RSI is stuck below its 50-midpoint. More importantly, the stochastic oscillator is trying to climb above both its moving average and oversold territory. Should this move take place, it would be seen as a strong bullish signal.

Should the bulls retake control, they could first try to lead EURGBP above the busy 0.8492-0.8504 area, which is defined by the February 24, 2012 high and the August 23, 2023 low. Even higher, the 50- and 100-day simple moving averages (SMAs) at the 0.8550-0.8554 range could prove strong resistance points, with the more important 200-day SMA currently standing a tad higher.

On the flip side, the bears appear determined to keep EURGBP below the 0.8492-0.8504 area and then retest the recent trough at 0.8483. If successful, they could then push EURGBP much lower with the August 4, 2022 low at 0.8339 possibly being the next target.

To sum up, EURGBP remains on the back foot ahead of the ECB with the bears once again trying to decisively break through the strong 0.8492-0.8504 support area.