Euro weakens broadly following ECB’s decision to maintain interest rates unchanged, coupled with explicit suggestions of a potential rate cut ahead. However, selloff has been relatively mild, primarily because ECB’s statement didn’t serve as a definitive pre-announcement of rate cuts, unlike its 2022 guidance on rate hike. Moreover, the conditional guidance regarding future rate adjustments had been largely anticipated, given previous communications from ECB officials. Still, risk is now mildly on the downside for the common currency, especially in crosses.

Concurrently, Dollar is also paring some of its post CPI strong gain, after PPI data came in lower than market expected. While the PPI report might not significantly hasten a Fed rate cut in June, it at least doesn’t push it further in time. Meanwhile, the greenback’s pullback remains slight. Renewed selloff in US stocks could trigger further gains for Dollar.

So far this week, Dollar remains the strongest currency, followed by New Zealand Dollar and Canadian Dollar. Euro lags as the weakest, trailed by Japanese Yen and Swiss Franc, with Australian Dollar and British Pound positioned in the middle of the pack.

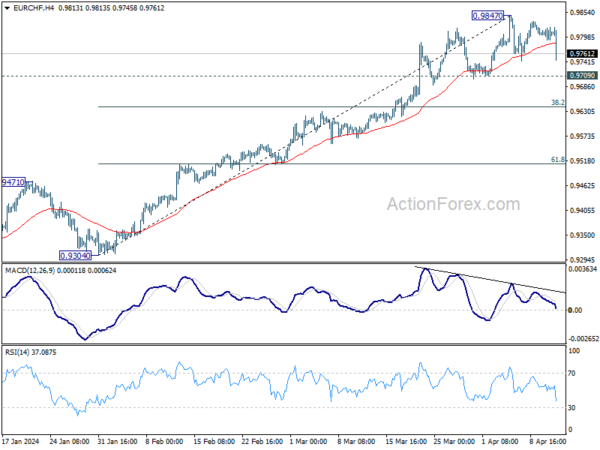

Technically, while EUR/CHF dips notably after ECB, it’s staying well inside familiar range below 0.9847. Near term outlook stays bullish for now, and upside breakout through 0.9847 is expected next. However, firm break of 0.9709 will argue that at least correcting the rise from 0.9304, and target 38.2% retracement of 0.9304 to 0.9847 at 0.9640.

In Europe, at the time of writing, FTSE is down -0.14%. DAX is down -0.37%. CAC is flat. UK 10-year yield is up 0.021 at 4.175. Germany 10-year yield is down -0.0008 at 2.427. Earlier in Asia, Nikkei fell -0.35%. Hong Kong HSI fell -0.26%. China Shanghai SSE rose 0.23%. Singapore Strait Times fell -0.31%. Japan 10-year JGB yield surged 0.0586 to 0.857.

US PPI at 0.2% mom, 2.1% yoy in Mar, below expectations

US PPI for final demand rose 0.2% mom in March, below expectation of 0.3% mom. PPI final demand services rose 0.3% mom while final demand goods fell -0.1% mom.

For the 12-month period, PPI jumped from 1.6% yoy to 2.1% yoy, below expectation of 2.3% yoy. But that was still the highest reading since April 2023.

PPI for final demand less goods, energy, and trade services rose 0.2% mom. For the 12-month period, PPI for final demand less foods, energy and trade services rose 2.8% yoy.

US initial jobless claims falls to 211k

US initial jobless claims fell -11k to 211k in the week ending April 6, below expectation of 215k. Four week moving average of initial claims fell -250 to 214k.

Continuing claims rose 28k to 1817k in the week ending March 30. Four-week moving average of continuing claims rose 3.5k to 1803k.

ECB explicitly opens door to rate cuts

ECB maintained its interest rates as widely expected, holding main refinancing rate and deposit rate at 4.50% and 4.00%. Most importantly, for the first time, the central bank explicitly indicated the possibility for future interest rate cuts, which would be seen as a conditional guidance for a June adjustment.

“If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction,” ECB said. Nevertheless, the decision will still be data depended, and meeting-by meeting.

Current observations have “broadly confirmed” ECB’s medium-term inflation outlook, with continued decline in inflation rates primarily driven by decreases in food and goods price inflation. Most measures of underlying inflation are showing signs of easing, and there is a gradual moderation in wage growth. Additionally, firms seem to be accommodating some of the labor cost increases within their profit margins, which is a positive development for inflationary pressures.

Meanwhile, financing conditions remain restrictive and previous interest rate hikes are still impacting demand, contributing to the downward pressure on inflation. Yet, the persistence of strong domestic price pressures, particularly in the services sector, indicates that services price inflation remains elevated.

BoE’s Greene cautions inflation persistence more pronounced in UK than in US.

In an opinion piece in FT, BoE MPC member Megan Greene explicitly urges market participants to “stop comparing” the monetary policies of the UK and US.

Greene’s commentary comes in the wake of the US March CPI inflation report released yesterday, which surpassed market expectations that “the Bank of England will cut rates earlier and by more than the Federal Reserve this year”.

“The markets are moving rate cut bets in the wrong direction,” Greene asserts, emphasizing that, contrary to market speculation, “rate cuts in the UK should still be a way off as well.”

Highlighting the unique challenges faced by the UK economy, Greene notes the “double whammy” of a tight labor market coupled with a more substantial impact from energy price shocks, which has made “inflation persistence” a more pressing issue for the UK compared to the US and other advanced economies.

Japan’s Suzuki and Kanda: No predetermined Yen levels for currency intervention

Japanese Yen’s steep decline through 152 mark against Dollar overnight has put attention on potential currency intervention. However, responses from key officials today suggest a more measured approach is being considered at this point. In particular, Finance Minister Shunichi Suzuki acknowledged the mixed implications of a weakening Yen, with pros and cons. Its looks like Japan is not gearing up for direct intervention at the current level.

Suzuki highlighted the government is looking at the currency markets “with a high sense of urgency”. But he also emphasized that Japan is “not just looking at levels” such as 152 or 153, but also the underlying factors driving Yen’s depreciation.

Suzuki reiterated the government’s preference for currency stability, emphasizing that exchange rates should reflect economic fundamentals rather than short-term volatilities.

Masato Kanda, Japan’s top currency diplomat, echoed this sentiment by highlighting the recent pace of Yen’s movements as “rapid.” While not dismissing interventions, Kanda pointed out the absence of a fixed level that would trigger such actions. “I don’t have any particular level in mind,” he noted.

China’s CPI falls back to 0.1%, PPI negative for 18th month

China’s CPI slowed significantly from 0.7% yoy to 0.1% yoy in March, coming in below expectation of 0.4% yoy. Core CPI, which strips out food and energy prices, also decelerated from 1.2% yoy to 0.6% yoy. This shift was largely influenced by a notable -2.7% decrease in food prices, while non-food prices edged up rose 0.7%. Month-on-month, CPI declined -1.0% mom.

NBS attributed this March dip in CPI to a “seasonal decline in consumer demand following the holidays and the overall sufficient market supply.”

In parallel, PPI, a measure of factory-gate prices, edged down further to -2.8% yoy from February’s -2.7% yoy, aligning with market expectations. This continuation of downward trend for the 18th consecutive month emphasizes persistent deflationary pressures within the manufacturing sector. On a month-on-month basis, PPI contracted by -0.1%.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0692; (P) 1.0779; (R1) 1.0830; More…

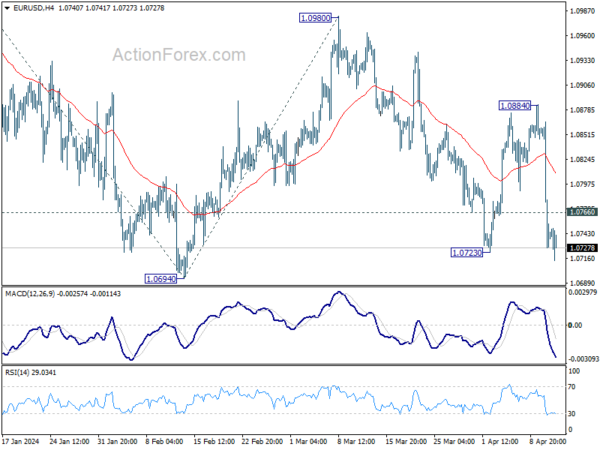

Intraday bias in EUR/USD remains on the downside at this point. Decisive break of 1.0694/0723 support zone will resume whole fall from 1.1138. Next target is 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536. On the upside, above 1.0766 minor resistance will turn intraday bias neutral first. But risk will stay on the downside as long as 1.0884 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Mar | -4% | -6% | -10% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Mar | 2.50% | 2.40% | 2.50% | 2.40% |

| 01:00 | AUD | Consumer Inflation Expectations Apr | 4.60% | 4.30% | ||

| 01:30 | CNY | CPI Y/Y Mar | 0.10% | 0.40% | 0.70% | |

| 01:30 | CNY | PPI Y/Y Mar | -2.80% | -2.80% | -2.70% | |

| 08:00 | EUR | Italy Industrial Output M/M Feb | 0.10% | 0.50% | -1.20% | -1.40% |

| 12:15 | EUR | ECB Main Refinancing Operations Rate | 4.50% | 4.50% | 4.50% | |

| 12:15 | EUR | ECB Rate On Deposit Facility | 4.00% | 4.00% | 4.00% | |

| 12:30 | USD | PPI M/M Mar | 0.20% | 0.30% | 0.60% | |

| 12:30 | USD | PPI Y/Y Mar | 2.10% | 2.30% | 1.60% | |

| 12:30 | USD | PPI Core M/M Mar | 0.20% | 0.20% | 0.30% | |

| 12:30 | USD | PPI Core Y/Y Mar | 2.40% | 2.30% | 2.00% | |

| 12:30 | USD | Initial Jobless Claims (Apr 5) | 211K | 215K | 221K | 222K |

| 12:45 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | 14B | -37B |