By RoboForex Analytical Department

The EUR/USD pair declined to 1.0740 on Wednesday, nearing the month’s low. This downward movement is primarily driven by the political instability in France following the significant developments in the European Parliament elections.

French President Emmanuel Macron has called for early legislative elections after the far-right party’s strong showing. While Macron retains the presidency and maintains control over foreign policy and defence, the election results could hinder his ability to implement new domestic policies and appoint ministers. There are growing concerns about Macron’s potential loss in the forthcoming elections, adding to worries about France’s financial stability.

The European Central Bank (ECB) met last week and decided to lower interest rates for the first time in five years. Despite this, the ECB adopted a cautious approach towards further monetary easing, contributing to the current economic outlook.

Attention is also focused on the ongoing US Federal Reserve meeting. While no changes in interest rates are expected, the market is eagerly awaiting the Fed’s latest economic assessment and guidance. If signalled, the timing of potential interest rate cuts could substantially impact market movements.

EUR/USD technical analysis

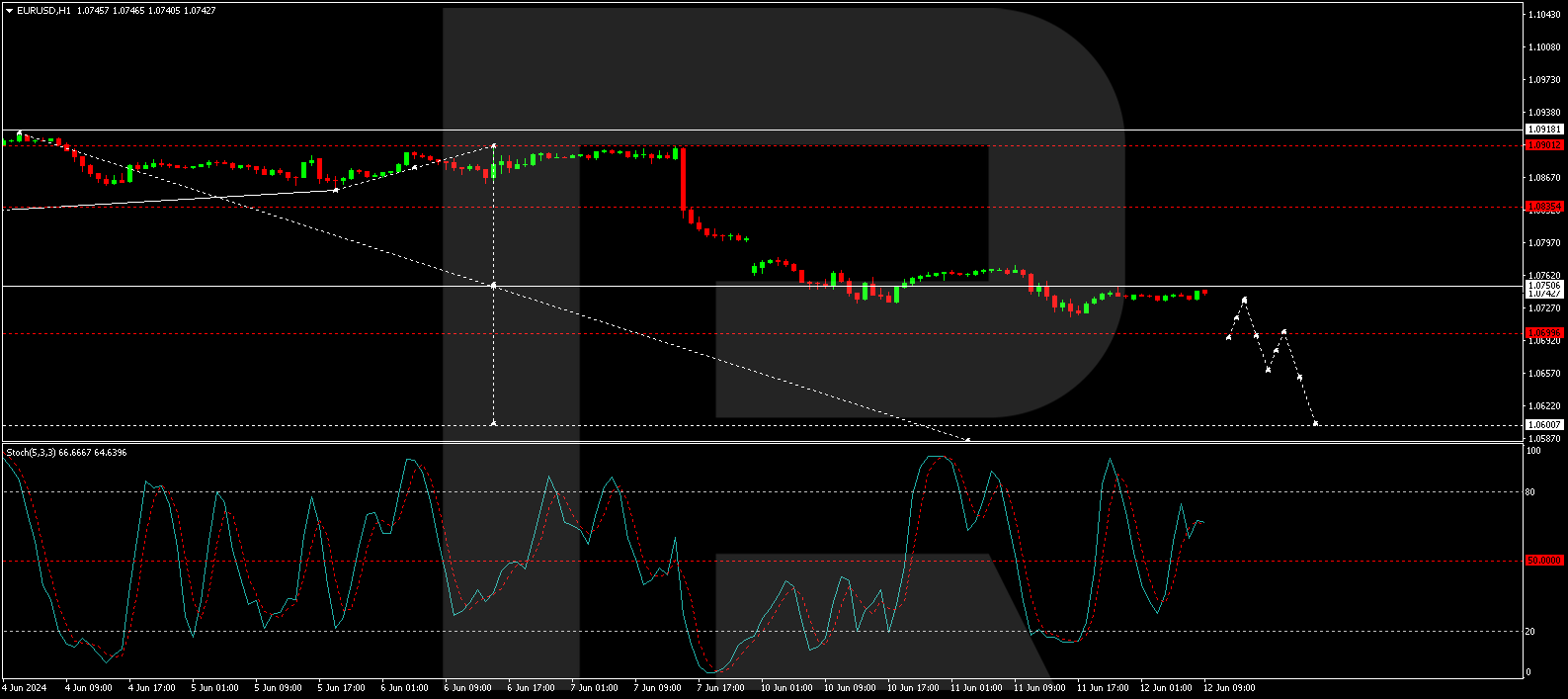

On the H4 chart, the EUR/USD is forming a consolidation range around the 1.0750 level. A potential decline to 1.0700 is considered, after which a rebound to 1.0750 may occur, a test from below. Further declines could target the 1.0660 level, possibly continuing to 1.0600. The MACD indicator supports this bearish outlook, with its signal line below zero and directed downwards.

On the H1 chart, the consolidation range has expanded between 1.0773 and 1.0717. A movement towards 1.0750 is anticipated, with a forming trend continuation pattern suggesting a further drop. Exiting this range on the downside could initiate a movement towards 1.0600. The Stochastic oscillator, currently below 80, is expected to fall to 20, aligning with the potential for further declines.

Market outlook

Investors are advised to watch monetary policy developments in Europe and the US. Additionally, political events in France, which could significantly impact the EUR/USD trajectory in the near term, should be monitored closely.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Euro hits monthly low amid political instability in France Jun 12, 2024

- China’s consumer inflation is on the rise. Today, the focus is on the FOMC meeting Jun 12, 2024

- US500: Braces for mid-week double whammy Jun 12, 2024

- Which cryptos could see biggest moves after US CPI/Fed meeting? Jun 11, 2024

- Brent Crude Oil stabilises around 81.50 USD amid demand optimism Jun 11, 2024

- Euro falls to four-week low: politicians to blame Jun 10, 2024

- Trade of the Week: EURGBP bears ready pounce? Jun 10, 2024

- Traders further lowered their expectations for a Fed interest rate cut this year Jun 10, 2024

- COT Metals Charts: Speculator Bets led lower by Platinum & Copper Jun 8, 2024

- COT Bonds Charts: Speculator Bets led lower by 5-Year Bonds Jun 8, 2024