Yen continues to dominate the forex markets today, with speculation heating up ahead of next week’s BoJ meeting. According to a Reuters report, unnamed sources have confirmed that a rate hike will be debated at the meeting. However, the decision is expected to be a “close call,” described as a “judgment call” on whether to “act now or later this year.” It is also believed that BoJ will unveil a plan to roughly halve its bond purchases in the coming years, continuing its steady withdrawal from massive monetary stimulus.

Meanwhile, Euro is under pressure following disappointing PMI data, which showed significant deterioration in the manufacturing sector while services growth remained moderate only. This data should justify a September ECB rate cut, although inflation data might complicate further cuts beyond that. On the other hand, Sterling is supported by solid PMI figures, bolstering the stance of BoE hawks against a rate cut in August.

Overall in the currency markets, Swiss Franc is the second strongest for the day, trailing the Yen, with support from buying against Euro. Sterling follows as the third strongest. New Zealand Dollar is currently the worst performer, followed closely by Australian Dollar and then Euro. Dollar and Canadian Dollar are positioned in the middle, with the latter awaiting BoC rate cut later in the session.

Technically, the medium term bearish case for Nikkei continues to build up with today’s break of 55 D EMA, as well as trend line support. A medium term top is likely in place at 42426.77 on bearish divergence condition in D MACD. Fall from there could be correcting the whole five-wave rally from 25661.89. Deeper decline would be seen to 37950.19 support first, and firm break there will solidify this case. Next medium term target would be 38.2% retracement of 25661.89 to 42426.77 at 36022.58. The depth of Nikkei correction could be used to verify the depth of USD/JPY’s based on their close correlation.

In Europe, at the time of writing, FTSE is down -0.08%. DAX is down -0.75%. CAC is down -1.03%. UK 10-year yield is up 0.013 at 4.141. Germany 10-year yield is down -0.004 at 2.439. Earlier in Asia, Nikkei fell -1.11%. Hong Kong HSI fell -0.91%. China Shanghai SSE fell -0.46%. Singapore Strait Times fell -0.01%. Japan 10-year JGB yield rose 0.0144 to 1.078.

US goods exports rises 5.7% yoy, imports rises 6.9% yoy

US goods exports rose 5.7% yoy to 172.32B in June. Goods imports rose 6.9% yoy to USD 269.16B. Trade balance reported USD -96.84B, versus expectation of USD -98.0B.

Wholesale inventories rose 0.2% mom to USD 903.3B. Retail inventories rose 0.7% mom to USD 802.1B.

UK manufacturing PMI hits 24-month high, encouraging start to H2

UK PMI data for July reveals a promising start to the second half of the year. PMI Manufacturing rose to 51.8, exceeding expectations of 51.1 and marking a 24-month high. PMI Services also increased slightly from 52.1 to 52.4, though just below the forecast of 52.5. The overall PMI Composite index improved from 52.3 to 52.7.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, noted, “The flash PMI survey data for July signal an ‘encouraging start’ to the second half of the year, with output, order books, and employment all growing at faster rates amid rebounding business confidence, while price pressures moderated.”

Post-election business sentiment has surged, with increased demand and hiring in both manufacturing and services sectors. Despite the slowest price rise in three and a half years, suggesting potential for a summer rate cut, caution remains.

“Policymakers will likely take a cautious approach to loosening policy amid signs of inflationary pressures pivoting away from services towards manufacturing, where Red Sea shipping delays and higher freight prices are adding to costs again,” Williamson added. The renewed hiring trend could also sustain wage pressures, keeping inflation somewhat persistent.

Eurozone PMI composite hits 5-month low at 50.1, ECB’s post-September rate cut path uncertain

Economic activity in Eurozone weakened in July, with PMI Manufacturing dipping from 45.8 to 45.6, a seven-month low, and missing expectations of 46.3. PMI Services also declined from 52.8 to 51.9, below the anticipated 52.9, marking a four-month low. Consequently, PMI Composite fell from 50.9 to 50.1, a five-month low.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that the Eurozone economy “barely moved” in July. He highlighted that the manufacturing sector “deteriorated significantly,” offsetting “moderate growth” in the services sector.

While current growth data might justify a September rate cut by ECB, inflation data complicates this decision. De la Rubia noted that input prices in the services sector rose faster, and selling prices remained steady. Manufacturing input prices, which had fallen for over a year, have increased for two consecutive months. Output prices only marginally decreased.

De la Rubia added “Our conclusion is that while a September rate cut will most probably be exercised, it will be much trickier to follow this path in the months thereafter, unless the downturn morphs into a deep recession.”

German Gfk consumer sentiment improves to -18.4, driven by income expectations

Germany’s Gfk Consumer Sentiment for August rose to -18.4, surpassing expectations of -21.1, and marking an improvement from July’s -21.6.

In July, economic expectations jumped from 2.5 to 9.8, and income expectations surged from 8.2 to 19.7, reaching their highest level since October 2021. Willingness to buy also improved, rising from -13.0 to -8.4, while willingness to save slightly decreased from 8.2 to 8.0.

Rolf Buerkl, consumer expert at NIM, attributed this upswing primarily to Germans’ increased income expectations. He also noted that the euphoria from the European Football Championship likely contributed to the positive sentiment.

However, Buerkl cautioned that it remains to be seen whether this effect is sustainable or just a “short-term flare-up.” He warned that if this good mood fades quickly, the path out of low consumption could be “long and demanding.”

Australia’s PMI composite dips to 50.8, no major slowdown with continued inflation pressures

Australia’s PMI Manufacturing saw a marginal improvement in July, rising slightly from 47.2 to 47.4. Conversely, PMI Services dropped to a six-month low, moving from 51.2 to 50.8. PMI Composite also decreased from 50.7 to 50.2, the lowest in six months.

Warren Hogan, Chief Economic Advisor at Judo Bank, highlighted that despite a further moderation in the composite output index, “there are no signs of a significant slowdown in Australian business activity in 2024.” He noted that while manufacturing continues to struggle, services sector is still experiencing better activity compared to the end of 2023.

Hogan also mentioned that the impact of recent tax cuts and cost-of-living support measures has yet to fully manifest in the business conditions and should positively affect consumer spending in future months. Insights from the upcoming final PMIs for July and the reports for August are expected to provide a clearer picture of these effects.

Despite softer activity levels, inflation pressures have not eased significantly. The services sector saw a notable increase in input costs, which rose four points to 63.3—the highest since November 2023. In contrast, manufacturing input costs rose only slightly and are near their lowest in four years. The composite output price index nudged up to 54.1 in July, indicating a small increase but suggesting that inflation is likely stabilizing around an annualized rate of 4% as of mid-2024.

Japan’s PMI services surges to 53.9 while manufacturing back in contraction

Japan’s PMI Manufacturing declined from 50.0 to 49.2, underperforming against expectations of 50.5, indicating contraction. In contrast, PMI Services experienced a robust increase, rising sharply from 49.4 to 53.9, signaling a strong expansion and the highest activity level in three months. PMI Composite also rose from 49.7 to 52.6.

Usama Bhatti, Economist at S&P Global Market Intelligence, stating the reading was “indicative of solid growth,” driven primarily by the services sector. Manufacturing saw a “renewed reduction in output,” though the decline was marginal.

Additionally, the PMI report highlighted increasing operational challenges, with a “renewed increase in capacity pressures” across the private sector. For the first time in three months, there was a rise in the level of outstanding business, suggesting that firms are facing more backlog in their operations.

The report also underscored persistent cost pressures, particularly in manufacturing, where input prices rose sharply, marking the steepest increase since April 2023.

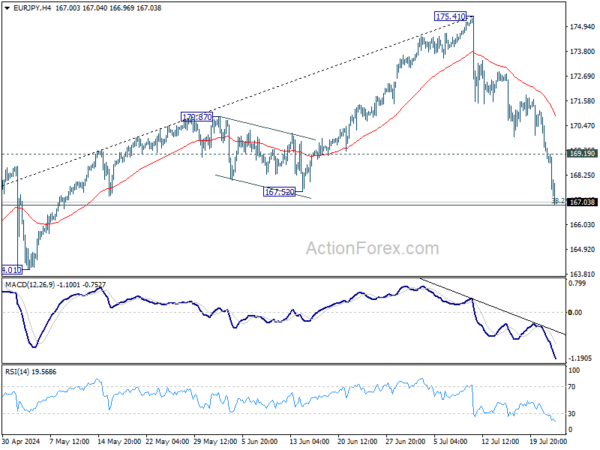

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 168.13; (P) 169.61; (R1) 170.38; More…

EUR/JPY’s fall from 175.41 accelerates lower today and it’s now pressing 38.2% retracement of 153.15 to 175.41 at 166.90. Some support could be seen from this fibonacci level, and break of 169.19 minor resistance will turn intraday bias neutral first. However, decisive break of 166.90 will pave the way to medium term channel support (now at 165.46).

In the bigger picture, medium term outlook will stay bullish as long as 164.29 resistance turned support holds. Long term up trend is still in favor to continue through 175.41 at a later stage. However, firm break of 164.29 will be a strong sign of bearish trend reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Jul P | 47.4 | 47.2 | ||

| 23:00 | AUD | Services PMI Jul P | 50.8 | 51.2 | ||

| 00:30 | JPY | Manufacturing PMI Jul P | 49.2 | 50.5 | 50 | |

| 00:30 | JPY | Services PMI Jul P | 53.9 | 49.4 | ||

| 06:00 | EUR | Germany GfK Consumer Confidence Aug | -18.4 | -21.1 | -21.8 | -21.6 |

| 07:15 | EUR | France Manufacturing PMI Jul P | 44.1 | 45.9 | 45.4 | |

| 07:15 | EUR | France Services PMI Jul P | 50.7 | 49.7 | 49.6 | |

| 07:30 | EUR | Germany Manufacturing PMI Jul P | 42.6 | 44.5 | 43.5 | |

| 07:30 | EUR | Germany Services PMI Jul P | 52 | 53.5 | 53.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jul P | 45.6 | 46.3 | 45.8 | |

| 08:00 | EUR | Eurozone Services PMI Jul P | 51.9 | 52.9 | 52.8 | |

| 08:30 | GBP | Manufacturing PMI Jul P | 51.8 | 51.1 | 50.9 | |

| 08:30 | GBP | Services PMI Jul P | 52.4 | 52.5 | 52.1 | |

| 12:30 | CAD | New Housing Price Index M/M Jun | -0.20% | 0.10% | 0.20% | |

| 12:30 | USD | Goods Trade Balance (USD) Jun P | -96.8B | -98.0B | -99.4B | -99.4B |

| 12:30 | USD | Wholesale Inventories Jun P | 0.20% | 0.50% | 0.60% | |

| 13:45 | CAD | BoC Interest Rate Decision | 4.50% | 4.75% | ||

| 13:45 | USD | Manufacturing PMI Jul P | 51.5 | 51.6 | ||

| 13:45 | USD | Services PMI Jul P | 54.5 | 55.3 | ||

| 14:00 | USD | New Home Sales M/M Jun | 643K | 619K | ||

| 14:30 | CAD | BoC Press Conference | ||||

| 14:30 | USD | Crude Oil Inventories | -2.6M | -4.9M |