Euro dips notably following ECB’s decision to maintain interest rates unchanged, coupled with downward revision in its inflation forecast. Specifically, ECB now anticipates that headline inflation will return to its target by 2025 and drop below 2% in 2026. However, the common currency found some footing during President Christine Lagarde’s press conference. Lagarde highlighted ECB’s growing confidence in controlling inflation, though cautioning that the confidence levels are not yet sufficient for policy adjustments. She hinted at a clearer picture by June rather than April, suggesting that a rate cut might more likely occur in June.

Japanese Yen is currently the day’s runaway standout performer, with traders ramping up bets for a BoJ rate hike on March 19, fueled by unexpectedly robust wage growth data, successful annual spring wage negotiations, and hawkish remarks from a BoJ board member. Reports of governmental support for a near-term rate increase further bolstered these expectations. The focus now shifts to whether Yen can maintain its robust momentum and development in to bullish trend reversal, for the near-term at least.

In other currency market developments, Australian Dollar and New Zealand Dollar trail Yen as today’s strong performers. Swiss Franc, is positioned as the best-performing European major currency for the day, but is trading lower against Yen, Aussie, and Kiwi. Dollar ranks as the second-worst performer, trailing Euro, but holds its position as the weakest currency for the week. With US 10-year yield extending its recent significant drop, possibly testing 4% psychological mark, Dollar may continue to encounter downward pressure.

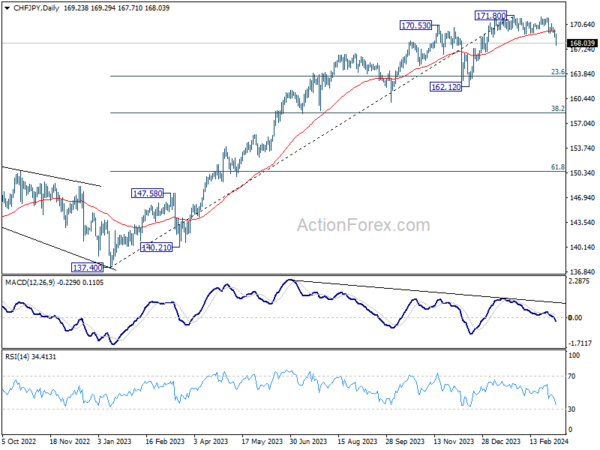

Technically, CHF/JPY’s decline today suggest that a medium term top was already formed at 171.80, on bearish divergence condition in D MACD. Fall from there is tentatively seen as a correction to the five-wave rally from 137.40. Deeper decline would be seen to 23.6% retracement of 137.40 to 171.80 at 163.68 next. Reaction from there could reveal whether the cross is indeed in bearish trend reversal.

In Europe, at the time of writing, FTSE is up 0.13%. DAX is up 0.51%. CAC is up 0.71%. UK 10-year yield is down -0.026 a t 4.056. Germany 10-year yield is down -0.052 at 2.274. Earlier in Asia, Nikkei fell -1.23%. Hong Kong HSI fell -1.27%. China Shanghai SSE fell -0.41%. Singapore Strait Times fell -0.08%. Japan 10-year JGB yield rose 0.0161 to 0.734.

ECB stands pat, downgrades inflation forecasts

ECB keeps interest rates unchanged as widely expected, with main refinancing rate at 4.50%, marginal lending facility rate at 4.75%, and deposit facility rate at 4.00%. The central maintained the language that current inflation will contribute substantially to bring inflation down to target, given that it’s maintained for sufficiently long duration. Future decisions will remain data-dependent.

In the new economic projections, both headline and core inflation forecasts are revised down reflecting lower contribution from energy prices. Inflation is estimated to average 2.3% in 2024, 2.0% in 2025, and 1.9% in 2026. Core inflation is expected to average 2.6% in 2025, 2.1% in 2025, and then 2.0% in 2026.

Growth projection for 2025 was downgraded to 0.6% as economic activity is expected to remain subdued in the near term. Thereafter the economy is expected to pick up and grow at 2.5% in 2025, 1.6% in 2026.

US initial jobless claims unchanged at 217k

US initial jobless claims were unchanged at 217k in the week ending March 1, above expectation of 212k. Four-week moving average of initial claims fell -750 to 212k.

Continuing claims rose 8k to 1906k in the week ending February 24. Four-week moving average of continuing claims rose 10k to 1888k, highest since December 11, 2021.

BoJ’s Nakagawa: Promising cycle of wages and inflation on the horizon

BoJ board member Junko Nakagawa highlighted a promising outlook for wage growth, expressed confidence in the emergence of a positive cycle between inflation and wages, a prerequisite for the central bank to exit negative interest rate.

“We can say that prospects for the economy to achieve a positive cycle of inflation and wages are in sight,” she stated, pointing to a shift in the wage-setting behavior of companies as a sign of economic optimism.

According to Nakagawa, there are “clear signs of change in how companies set wages,” with businesses increasingly inclined to offer annual pay raises in response to the ongoing labor shortages. This adjustment marks a significant departure from previous practices and suggests that companies are prepared to propose wage increases surpassing those of the previous year.

“Japan is moving steadily towards sustainably and stably achieving our 2% inflation target,” she remarked.

Japan’s nominal wage growth hits seven-month high, real wages still in decline

Japan’s nominal wage growth surged by 2.0% yoy in January, surpassing expectations of 1.3%, and marking the most substantial growth since last June. This also represents a notable acceleration from the revised 0.8% increase observed in December.

The surge in wages largely stems from a significant 16.2% yoy advance in special payments, which include winter bonuses. Regular or base salaries maintained steady growth rate of 1.4% yoy, consistent with the previous month’s performance. Meanwhile, overtime pay, a key indicator of labor demand and economic activity, showed slight improvement of 0.4% yoy, recovering from revised decline of -1.2% yoy in the prior period.

Real wages declined by 0.6% yoy, marking a continued decrease in purchasing power for Japanese workers. However, the pace of decline was the joint-slowest since December 2022, indicating stabilization in the erosion of real earnings.

China’s exports jump 7.1% yoy in Jan-Feb, imports rise 3.5% yoy

Title: China’s Trade Performance Surpasses Expectations Amid PBOC’s Supportive Measures

China’s trade figures for the combined period of January and February have remarkably exceeded expectations, with exports rising by 7.1% yoy , surpassing the anticipated 1.9% increase. Imports also showed a robust performance, climbing 3.5% yoy, which beat the forecast of 1.5% growth.

This led to trade surplus of USD 125.2B, not only exceeding the expected USD 110.3B but also marking an increase from last year’s USD 103.8B during the same period.

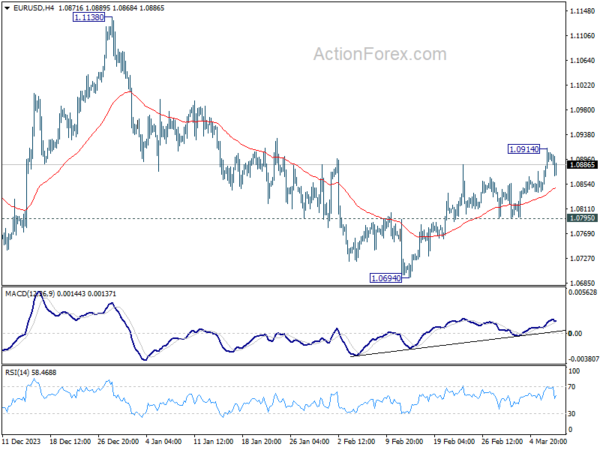

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0856; (P) 1.0885; (R1) 1.0929; More…

Intraday bias in EUR/USD is turned neutral first with current retreat, and some consolidations would be seen below 1.0914 temporary top first. But further rally will remain in favor as long as 1.0795 support holds. Above 1.0914 will resume the rebound from 1.0694 towards 1.1138 resistance next.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q4 | -0.70% | -2.80% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Jan | 2.00% | 1.30% | 1.00% | 0.80% |

| 00:30 | AUD | Trade Balance (AUD) Feb | 11.03B | 11.50B | 10.96B | 10.74B |

| 03:00 | CNY | Trade Balance (USD) Feb | 125.2B | 110.3B | 75.3B | |

| 03:00 | CNY | Trade Balance (CNY) Feb | 891B | 620B | 541B | |

| 06:45 | CHF | Unemployment Rate Feb | 2.20% | 2.20% | 2.20% | |

| 07:00 | EUR | Germany Factory Orders M/M Jan | -11.30% | -6.00% | 8.90% | 12.00% |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 678B | 662B | ||

| 13:15 | EUR | ECB Main Refinancing Rate | 4.50% | 4.50% | 4.50% | |

| 13:30 | CAD | Trade Balance (CAD) Jan | 0.5B | 0.3B | -0.3B | |

| 13:30 | CAD | Building Permits M/M Jan | 13.50% | 2.10% | -14% | -11.50% |

| 13:30 | USD | Initial Jobless Claims (Mar 1) | 217K | 212K | 215K | 217K |

| 13:30 | USD | Trade Balance (USD) Jan | -67.4B | -63.2B | -62.2B | -64.2B |

| 13:30 | USD | Nonfarm Productivity Q4 | 3.20% | 3.20% | 3.20% | |

| 13:30 | USD | Unit Labor Costs Q4 | 0.40% | 0.50% | 0.50% | |

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | Fed’s Chair Powell testifies | ||||

| 15:30 | USD | Natural Gas Storage | -42B | -96B |