Euro continues to be under significant pressure due to increasing political uncertainty in France. President Emmanuel Macron’s call for a snap election has heightened fiscal consolidation risks, with Moody’s describing this development as “credit negative.” Investor confidence has further eroded following a poll suggesting the National Rally could significantly increase its seats in the upcoming election, though not enough to secure an absolute majority. This political instability is exerting substantial downward pressure on the Euro, which selloff resumes after brief consolidations.

In stark contrast, British Pound is emerging as the strongest currency today, despite mixed employment data. The latest figures showed an unexpected rise in the claimant count and stagnant payrolled employment growth. However, average earnings continued to grow at elevated rate. This data suggests persistent domestic inflationary pressures, contributing to Sterling’s resilience.

Elsewhere in the currency markets, Australian Dollar and Canadian Dollar are among the weakest, following Euro. Meanwhile, Dollar and New Zealand Dollar are performing robustly, just behind the strengthening Sterling. Swiss Franc and Japanese Yen are experiencing less volatility, positioning them in the middle of the pack.

Technically, EUR/CAD is eyeing 55 D EMA (now at 1.4756) with this week’s decline. Sustained break there will argue that corrective rebound from 1.4457 has completed with three waves up to 1.4927, after meeting channel resistance. Deeper fall would then be seen to channel support (now at 1.4648) first. Firm break there will argue that fall from 1.5041 is ready to resume through 1.4457 support.

In Europe, at the time of writing, FTSE is down -0.91%. DAX is down -0.76%. CAC is down -1.18%. UK 10-year yield is down -0.047 at 4.286. Germany 10-year yield is down -0.045 at 2.639. Earlier in Asia, Nikkei rose 0.25%. Hong Kong HSI fell -1.04%. China Shanghai SSE fell -0.76%. Singapore Strait Times fell -0.39%. Japan 10-year JGB yield fell -0.0228 to 1.017.

ECB’s Lane: Not pre-committing to a particular rate path

In a speech today, ECB Chief Economist Philip Lane noted that the central bank’s baseline projections reflect the market yield curve and anticipate “a set of rate cuts” in 2024 and 2025. He noted that with a clearly restrictive deposit facility rate of 3.75%, ECB could address potential “upside shocks to inflation” by adopting a “slower pace of rate reductions.” Conversely, maintaining a policy rate of 3.75% offers “more protection against downside shocks” compared to staying at 4.0%.

Lane emphasized the high level of uncertainty and the persistent price pressures reflected in domestic inflation, services inflation, and wage growth indicators. These factors necessitate a continued restrictive monetary stance, with decisions being made on a data-dependent, meeting-by-meeting basis.

He reaffirmed ECB’s commitment to ensuring that inflation returns to the 2% medium-term target “in a timely manner” and stressed that policy rates will remain “sufficiently restrictive” for as long as necessary to achieve this goal.

Lane emphasized that ECB is “not pre-committing to a particular rate path” and will continue to assess the appropriate level and duration of restriction at each meeting.

ECB’s Villeroy downplays month-to-month inflation noises

ECB Governing Council member Francois Villeroy de Galhau highlighted today at a conference that month-to-month inflation data will be volatile due to base effects, particularly related to energy prices.

He cautioned that this “noise” in the data is not very meaningful, and the ECB remains “outlook driven” and will focus more closely on inflation forecasts.

Villeroy expressed confidence that, barring any external shocks, ECB will bring inflation back to its 2% target by next year, achieving this with a “soft rather than a hard landing.”

He reiterated the need for a gradual approach to future rate adjustments and emphasized that ECB has “significant leeway” to cut rates before monetary policy becomes restrictive.

UK payrolled employment fell -3k in May, unemployment rate rises to 4.4% in Apr

UK payrolled employment fell slightly by -3k in May, following -85k monthly decline in April. Annual growth rate of payrolled employment slowed further from 0.7% yoy to 0.6% yoy. Annual growth in median pay was at 5.2% yoy, down sharply from April’s 6.8% yoy. Claimant count jumped 50.4k, versus expectation of 10.2k.

In the three months to April, unemployment rate rose to 4.4%, above expectation of 4.3%. Average earnings including bonus rose 5.9% yoy, above expectation of 5.7% yoy. Average earnings excluding bonus rose 6.0% yoy, matched expectations.

Australia’s NAB business confidence returns to negative, inflation pressures re-emerge

Australia’s NAB Business Confidence fell from 2 to -3 in May, returning to negative territory. Business conditions also saw a slight decline, dropping from 7 to 6. Specifically, trading conditions decreased from 13 to 10, and profitability conditions fell from 6 to 3. However, employment conditions improved, rising from 2 to 5.

NAB Chief Economist Alan Oster noted pointed out that forward orders are particularly weak in retail, wholesale, and construction sectors, indicating potential challenges ahead. Despite a slowdown in activity, capacity utilization remains above average, suggesting that the “process of bringing supply and demand back into balance remains incomplete”.

Inflationary pressures are re-emerging, with labor cost growth increasing to 2.3% on a quarterly basis, up from 1.5% in April. Purchase cost growth also rose to 1.9%, compared to 1.3% previously. Overall product price growth climbed to 1.1%, up from 0.8%, with retail price growth increasing to 1.6% from 1.0%, and recreation and personal services prices edging up to 1.0% from 0.9%.

Oster concluded that the data presents a “mixed” picture for RBA. There are clear signs of growth challenges, yet inflationary pressures remain a concern. “We expect the RBA to keep rates on hold for some time yet as they navigate through these contrasting risks.”

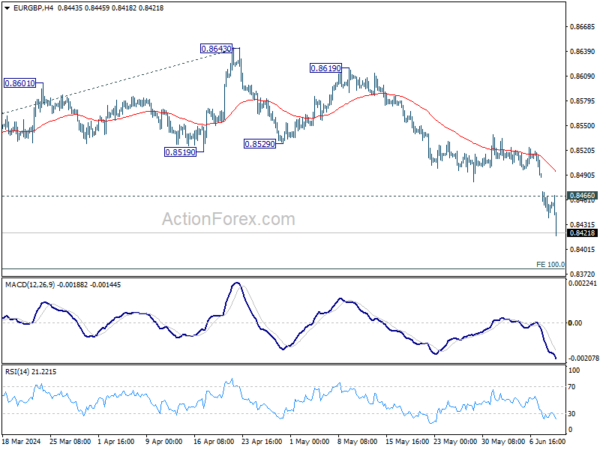

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8440; (P) 0.8456; (R1) 0.8472; More…

EUR/GBP’s decline continues to as low as 0.8418 so far. Intraday bias remains on the downside for 0.8376 projection level next. On the upside, above 0.8446 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

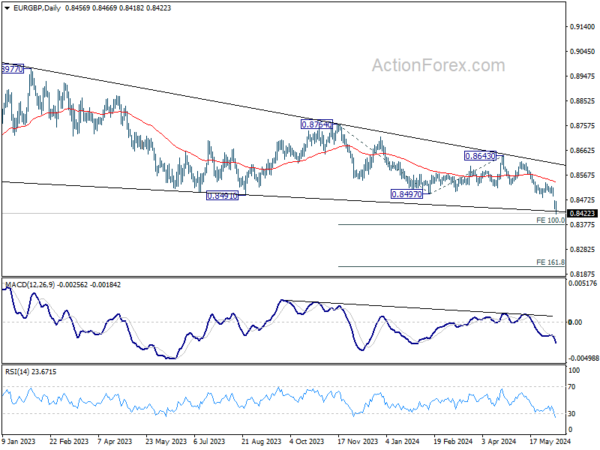

In the bigger picture, down trend from 0.9267 (2022 high) is in progress. Next target is 100% projection of 0.8764 to 0.8497 from 0.8643 at 0.8376. Sustained break there will target 161.8% projection at 0.8211 next. For now, outlook will remain bearish as long as 0.8643 resistance holds, even in case of stronger rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 1.90% | 2.10% | 2.20% | |

| 01:30 | AUD | NAB Business Confidence May | -3 | 1 | ||

| 01:30 | AUD | NAB Business Conditions May | 6 | 7 | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Apr | 4.40% | 4.30% | 4.30% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Apr | 5.90% | 5.70% | 5.70% | 5.90% |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Apr | 6.00% | 6.00% | 6.00% | |

| 06:00 | GBP | Claimant Count Change May | 50.4K | 10.2K | 8.9K | 8.4K |

| 10:00 | USD | NFIB Business Optimism Index May | 90.5 | 89.8 | 89.7 | |

| 12:30 | CAD | Building Permits M/M Apr | 20.50% | 5.20% | -11.70% | -12.30% |