Euro’s forward drive this week faced a halt as subpar PMI readings painted a concerning picture for the Eurozone economy. The data fuels concerns that the Eurozone economy might be heading into deeper waters. At the same time, British Pound is weighed down by slowing wages growth and weak PMIs too. Swiss Franc is also on a similar downward slide following the European counterparts.

On the other hand, the Dollar is putting up a valiant effort to stabilize, though it’s currently overshadowed by the Australian and New Zealand Dollars. Notably, Australian Dollar is drawing strength from comments by RBA Governor. The remarks underscored that potential rate hike remains on the table, depending largely on inflationary outlook. On the other hand, Japanese Yen and Canadian Dollar currently demonstrate a neutral stance without clear directional cues.

Shifting the spotlight to other markets, Gold witnesses a moderate dip, continuing its consolidation phase after last week’s unsuccessful attempt on 2000 level. Concurrently, WTI crude oil displays a slight weakening sentiment as the market remains cautious, awaiting any escalations or de-escalations concerning Middle East tensions. Bitcoin, after a robust surge earlier, seems to be pausing for breath, steadying below the 35k mark. US 10-year yields exhibit a modest recovery, potentially laying the groundwork for another attempt to hit 5% level.

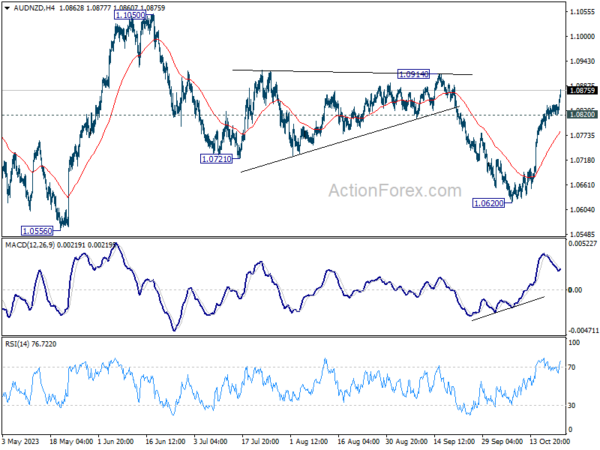

On a technical note, AUD/NZD is extending the rise from 1.0620, and further rally is expected as long as 1.0820 minor support holds. The corrective decline from 1.1050 should have completed with three waves down to 1.0620. Firm break of 1.0914 resistance would set the stage for stronger rise back to 1.1050 resistance. The next move will depend on tomorrow’s Australia CPI and the implication for RBA meeting on November 7.

In Europe, at the time of writing, FTSE is down -0.09%. DAX is up 0.19%. CAC is up 0.51%. Germany 10-year yield is down -0.046 at 2.828. Earlier in Asia,Nikkei rose 0.20%. Hong Kong HSI dropped -1.05%. China Shanghai SSE rose 0.78%. Singapore Strait Times rose 1.00%. Japan 10-year JGB yield dropped -0.0201 to 0.854.

Eurozone PMI composite fell to 35-month low, moving from bad to worse

Eurozone economy appears to be on shaky ground, with the latest PMI figures showing continued deterioration. October saw Manufacturing PMI slide to 43.0 from 43.4, while Services PMI dropped to a concerning 32-month low of 47.8, down from 48.7. Composite PMI wasn’t left behind, recording a 35-month low at 46.5, down from 47.2.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, stated, “In the Eurozone, things are moving from bad to worse.” He highlighted that manufacturing has been grappling with a slump for over a year now. When examining the top Eurozone players, France and Germany, de la Rubia noted that their manufacturing downturns are almost on par.

However, it’s not all gloom for France in the services sector. Despite a lower activity index compared to Germany, France showcases some resilience with new businesses not declining as rapidly. Moreover, companies in France are steadily adding jobs rather than eliminating them.

Another noteworthy aspect is the persistent price increases within the services sector. Comparing it to prior economic downturns, inflation for both input prices and prices charged has only marginally slowed down. This trend might be challenging for ECB. As de la Rubia points out, “these figures reinforce the case of a pause in the interest rate cycle instead of thinking aloud about loosening monetary policy.”

Germany PMI Manufacturing rose from 39.6 to 40.7 in October, a 5-month high. PMI Services fell from 50.3 to 48.0. PMI Composite fell from 46.4 to 45.8.

France PMI Manufacturing fell from 44.2 to 42.6 in October, hitting a 41-month low. PMI Services improved from 44.4 to 46.1, a 3-month high. PMI Composite rose from 44.1 to 45.3, a 2-month high.

Germany’s Gfk consumer sentiment fell to -28.1, hope of recovery this year laid to rest

Germany’s Gfk consumer sentiment for November fell from -26.7 to -28.1. In October, economic expectations improved slightly from -3.4 to -2.4. Income expectations fell form -11.3 to -15.3. Propensity to buy ticked up from -16.4 to -16.3. Propensity to save rose from 8.0 to 8.5.

“With the third decline in a row, hopes of a recovery in consumer sentiment this year must finally be laid to rest,” explains Rolf Bürkl, consumer expert at NIM.

“Above all, high prices for food are weakening the purchasing power of private households in Germany, so private consumption will not be able to support the economy this year.”

UK PMI composite ticks up to 48.6, recession cannot be ruled out

UK PMI Manufacturing saw a modest uptick, moving from 44.3 to 45.2 in October. In contrast, Services sector edged downwards, marking a 9-month low, albeit by a marginal decrement from 49.3 to 49.2. Composite PMI slightly climbed, positioning at 48.6 from a previous 48.5.

According to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, the UK is treading dangerously close to recessionary waters. Williamson highlighted the combined impacts of the rising cost of living, soaring interest rates, and dwindling exports as the chief culprits behind a third consecutive month of diminishing output.

While the rate of economic decline is currently moderate, with predictions hinting at just a -0.1% quarterly GDP drop, the darkening cloud of economic uncertainty suggests tougher times might be ahead. “A recession, albeit only mild at present, cannot be ruled out,” he added.

On a brighter note, the cost pressures evident earlier have started to soften, partly attributed to diminishing wage inflation and decline in prices set by manufacturers. Nonetheless, service sector continues to grapple with inflation, which even saw a slight bump. This indicates that headline inflation might persistently hover around the 4% range as we transition into early next year.

This poses a dilemma for policymakers, especially when factoring in potential inflationary pressures from surging oil prices. “It would be unlikely for policymakers to rule out the possibility of rates rising again later in the year,” he said.

UK payrolled employment fell -11k in Sep, pay growth slowed to 5.7% yoy

In September, UK payrolled employment fell -11k. Median monthly pay rose 5.7% yoy, slowed notably from August’s 7.7% yoy. Annual growth in median pay was highest in the transportation and storage sector, with an increase of 13.5%, and lowest in the health and social work sector, with a decrease of -0.3%.

In the three months to August, unemployment rate fell from 4.3% to 4.2%, below expectation of 4.3%.

RBA Bullock signals readiness to hike again if inflation outlook revised up

RBA Governor Michelle Bullock emphasized the central bank’s ongoing commitment to stabilizing inflation and promoting job growth in her speech today. While the Governor acknowledged the possibility of maintaining the current cash rate level to achieve these objectives, she did not shy away from highlighting potential challenges. “There are risks that could see inflation return to target more slowly than currently forecast,” she noted.

In response to the potential of inflationary pressures, Bullock assured that the Board remains vigilant: “The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.”

As the Board gears up for its subsequent gathering, Bullock emphasized the significance of upcoming data. She mentioned, “The Board will receive several pieces of information before its next meeting that will be important for this assessment.”

She elaborated on the forthcoming procedures, revealing, “This includes a full update of the staff’s forecasts. We will reconsider the outlook for the economy in light of incoming information and will have opportunities to explain our assessment in the media release and Statement on Monetary Policy that will follow the November meeting.”

Australia’s PMI composite dives to 47.3, slowdown amid sticky inflation

Australia’s economic indicators from October paint a worrisome picture, as PMI Manufacturing dipped to a six-month low at 48.0, down from 48.7. More significantly, PMI Services plunged to a 10-month trough, dropping from 51.8 to 47.6. PMI Composite, which combines both manufacturing and services, dropped to a concerning 21-month low of 47.3 from 51.5.

Weighing in on these figures, Warren Hogan, Chief Economic Advisor at Judo Bank, mentioned PMI output index reverting to cyclical lows around 47 after a brief rise above the neutral 50 mark in September. These PMI indicators resonate with the ongoing narrative that Australia’s economic momentum has decelerated in 2023, aligning with the anticipated gentle slowdown most economists had projected.

A silver lining, however, emerges from the employment index, which remains steadfastly above the 50-mark. Hogan interprets this as a sign that the deceleration in business activities hasn’t notably dampened hiring trends.

However, a significant area of concern highlighted by Hogan is the enduring nature of inflation pressures, which he refers to as “stickiness”. Both input and output price indexes remain elevated, not hinting at an imminent return of inflation to RBA’s target.

As RBA prepares for its board meeting, set to coincide with Melbourne Cup day, the latest PMI readings, especially concerning inflation, are unlikely to drastically influence the interest rate decision. Hogan articulated, “A strong case exists for a further modest upward adjustment to the Australian cash rate target, to ensure the economy remains on the so-called ‘narrow path’. If we are to avoid recession, Australia will need an extended period of below-trend growth to ensure inflation returns to target by 2025.”

Japan’s PMI manufacturing unchanged at 48.5, worst slump in eight months

October saw Japan’s PMI Manufacturing remain unchanged at 48.5, missing expectations of 48.9 and marking the fifth consecutive month showing deteriorating operating conditions. Additionally, PMI Services and PMI Composite displayed downturns, with the former dropping from 53.8 to 51.1 and the latter declining from 52.1 to a sub-50 figure of 49.9.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that this is the first instance of a decline in business activity for the private sector since December 2022. The drop, albeit marginal, was primarily due to a more pronounced decrease in manufacturing output – the fastest rate seen in eight months. On the other hand, services activity did continue its expansion, albeit at its slowest pace for the year.

The overall sentiment among firms was not particularly encouraging either. They expressed the least optimism since the beginning of the year concerning future output, suggesting a tempered outlook for the immediate future. However, a silver lining in the employment sector, which saw a resurgence, particularly in the service sector.

On the pricing front, both manufacturing and service sectors experienced diminished cost pressures. This deceleration resulted in output prices within the private sector rising at their most muted pace since February 2022.

EUR/USD Mid-Day Outlook

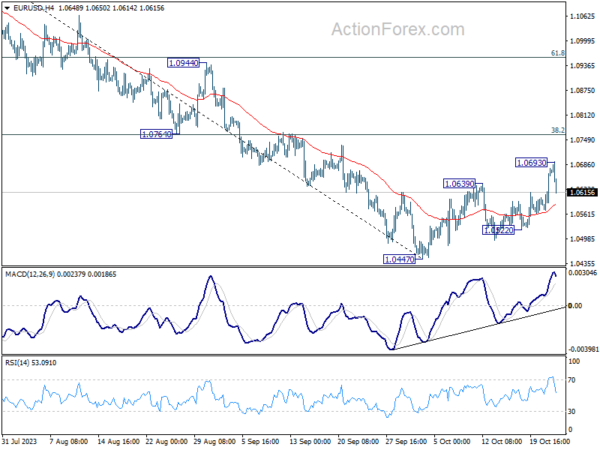

Daily Pivots: (S1) 1.0601; (P) 1.0640; (R1) 1.0707; More…

Intraday bias in EUR/USD is turned neutral again as it retreated notably today after hitting 55 D EMA (now at 1.0684). On the upside, above 1.0693 will resume the rebound to 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). On the downside, break of 1.0522 support will retain near term bearishness for resuming the whole decline from 1.1274 through 1.0447 next.

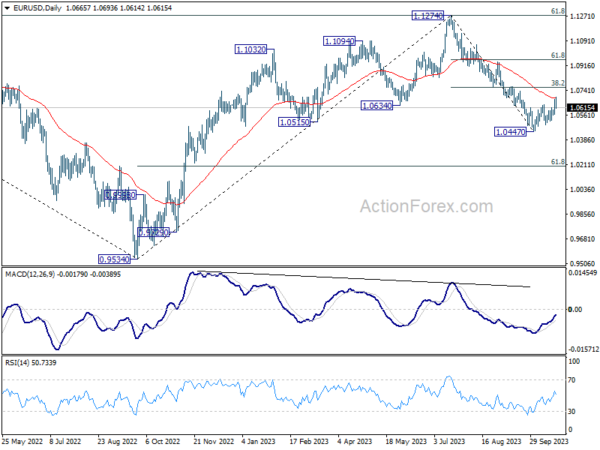

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0684) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Oct P | 48 | 48.7 | ||

| 22:00 | AUD | Services PMI Oct P | 47.6 | 51.8 | ||

| 00:30 | JPY | Manufacturing PMI Oct P | 48.5 | 48.9 | 48.5 | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Nov | -28.1 | -27.3 | -26.5 | -26.7 |

| 06:00 | GBP | Claimant Count Change Sep | 20.4K | 2.3K | 0.9K | -9.0K |

| 06:00 | GBP | ILO Unemployment Rate 3M Aug | 4.20% | 4.30% | 4.30% | |

| 07:15 | EUR | France Manufacturing PMI Oct P | 42.6 | 44.8 | 44.2 | |

| 07:15 | EUR | France Services PMI Oct P | 46.1 | 44.6 | 44.4 | |

| 07:30 | EUR | Germany Manufacturing PMI Oct P | 40.7 | 40.1 | 39.6 | |

| 07:30 | EUR | Germany Services PMI Oct P | 48 | 50.1 | 50.3 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Oct P | 43 | 43.7 | 43.4 | |

| 08:00 | EUR | Eurozone Services PMI Oct P | 47.8 | 48.7 | 48.7 | |

| 08:30 | GBP | Manufacturing PMI Oct P | 45.2 | 45.2 | 44.3 | |

| 08:30 | GBP | Services PMI Oct P | 49.2 | 49.5 | 49.3 | |

| 12:30 | CAD | New Housing Price Index M/M Sep | 0.10% | 0.10% | ||

| 13:45 | USD | Manufacturing PMI Oct P | 49.5 | 49.8 | ||

| 13:45 | USD | Services PMI Oct P | 49.9 | 50.1 |