By ForexTime

- EURUSD up over 4% so far in March 2025; set for biggest monthly gain since Nov. 2022

- Apr 1: Eurozone’s March CPI could offer mixed readings for EURUSD

- Apr 2: Trump’s “Liberation Day” tariffs could hurt US economy and USD

- Apr 4: US NFP report, Chair Powell’s speech may offer clues on next Fed rate cut

- Bloomberg FX model: 73.7% chance EURUSD trades between 1.0650 – 1.0934 next week

The world’s most-traded FX pair is set for its biggest monthly gain in over 2 years!

At the time of writing, EURUSD is up about 4.08% so far in March 2025.

If it holds around these levels, that would the EURUSD’s biggest 1-month gain since the 5.3% advance in November 2022.

Why did EURUSD rise in March 2025?

Two main reasons:

1) Weaker USD: Markets are worried that President Trump’s tariffs would actually hurt US economic growth.

Against such a dimmer outlook, the US dollar has weakened against almost all of its G10 peers (except against the Japanese Yen) in March 2025.

2) Historic change to Germany government spending: Earlier this month, Europe’s largest economy amended its constitution to get rid of its so-called “debt brake”.

This “historic” decision is set to unleash hundreds of billions of euros on defense and infrastructure spending.

With more government spending for Europe’s largest economy, that has sweetened the Eurozone’s economic outlook, hence the strengthening euro.

NOTE: The euro has also strengthened against almost all its G10 peers (except the Swedish Krona and the Norwegian Krone) so far in March 2025.

Imagen

With all that in mind …

Can EURUSD extend its month-to-date (March 2025) gains into Q2 2025?

This question will be especially pertinent as we enter a week filled with these major events on the global economic calendar:

Sunday, March 30

- Europe, UK goes into Daylight Savings Time

Monday, March 31

- JPY: Japan February industrial production, retail sales

- AU200 index: March Melbourne institute inflation

- CNH: China March PMIs

- THB: Thailand February external trade

- GER40 index: Germany March CPI; February retail sales

Tuesday, April 1

- JP225 index: Japan February jobless rate; 1Q Tankan index

- AUD: RBA rate decision; February retail sales

- CN50 index: China March manufacturing PMI

- EUR: Eurozone March CPI; February unemployment

- US30 index: US March ISM manufacturing

Wednesday, April 2

- USDInd: Trump’s “Liberation Day” – more US tariffs incoming?

Thursday, April 3

- AUD: Australia February trade balance

- CN50 index: China March services PMI

- EU50 index: Eurozone February PPI; ECB meeting minutes

- RUS2000 index: US initial weekly jobless claims; ISM services index; speech by Fed Vice Chair Philip Jefferson

- US500 index: 25% US tariffs on auto imports kick in

Friday, April 4

- SG20 index: Singapore February retail sales

- GER40 index: Germany March construction PMI; February factory orders

- CAD: Canada March unemployment rate

- US500 index: US March nonfarm payrolls

- USDInd: Speech by Fed Chair Jerome Powell

From the list above, we highlight 4 specific events that could trigger massive reactions in the world’s most-traded FX pair:

-

Tuesday, April 1st: Eurozone March consumer price index (CPI)

Here’s what economists predict for this important set of inflation data:

- Headline CPI year-on-year (March 2025 vs. March 2024): 2.3%

If so, this would match February’s 2.3% year-on-year figure. - Headline CPI month-on-month (March 2025 vs. February 2025): 0.6%

If so, this would be notably higher than February’s 0.4% month-on-month figure. - Core CPI (excluding food and energy prices) year-on-year: 2.5%

If so, this would be a slight easing from February’s 2.6% core year-on-year figure.

Lower-than-expected CPI prints which encourages more rate cuts by the European Central Bank (ECB) could weaken EURUSD.

-

Wednesday, April 2nd: “Liberation Day” – more US tariffs?

April 2nd is the deadline for when US President Donald Trump intends to roll out “reciprocal” tariffs, which suggests an “eye-for-an-eye” approach.

This essentially points to the raising of US tariffs to fix trade imbalances against its major trading partners, including the Eurozone.

Markets initially believed that these “reciprocal tariffs” would actually slow down US economic growth, hence the US dollar’s steep drop in early March.

More recently, markets hope that Trump’s next tariff salvo may not be as damaging as initially feared. Hence, the euro has weakened against the US dollar in 7 out of the past 8 daily trading sessions.

There is still much uncertainty about what this major tariff announcement will look like, with markets largely adopting a “wait and see mode”.

Ultimately, if the market’s worst-case-scenario is confirmed, that could further dent the US dollar while adding to EURUSD’s gains from March 2025.

-

Friday, April 4th: US March nonfarm payrolls (NFP)

Here’s what economists predict for this closely-watched jobs report:

- Headline NFP figure: 135,000 (new jobs added to US labour market)

If so, this would be lower than February’s 151,000 headline NFP figure.

If so, this would match February’s unemployment rate

- Average hourly earnings month-on-month (March 2025 vs. Feb 2025): 0.3%

If so, this would match February’s figure.

Stronger-than-expected US jobs data, which points to resilience in the world’s largest economy, should bolster the US dollar and drag EURUSD lower.

-

Friday, April 4th: Speech by Fed Chair Jerome Powell

Just 3 hours after the US jobs report’s release, the Chair of the Federal Reserve – the US central bak – is set to share his economic outlook.

Markets will be eager to find out his take not just on the latest NFP numbers, but also what President Trump’s tariff announcements earlier in the week would mean for the resilience of the US economy.

A weakening US jobs market that faces more damage from tariffs could prompt the Fed to cut rates sooner than expected – a weaker USD scenario.

At the time of writing, markets are forecasting a:

- 54% chance (almost evenly split) that the Fed will cut its benchmark rates by another 75-basis points (3 more rate cuts, 25-bps per FOMC meeting) by end-2025.

- 70% chance that the next Fed rate cut will happen at the June FOMC meeting.

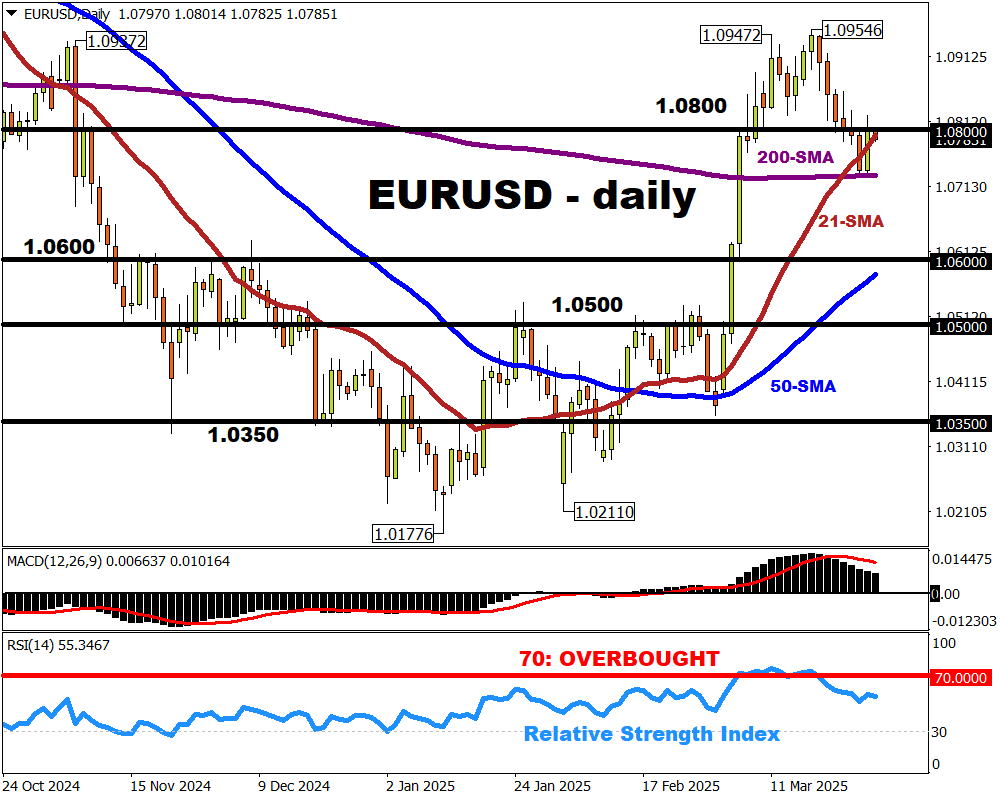

Looking at the charts …

At the time of writing, EURUSD is trading just below the big, round 1.08000 number, around its 21-day simple moving average (SMA).

Note also that EURUSD earlier this week found crucial support at its 200-day SMA.

Imagen

Bloomberg’s FX model currently predicts a 74% chance that EURUSD will trade between 1.0650 – 1.0934 over the coming week.

Potential Scenarios:

- EURUSD could weaken below its 200-day SMA and towards 1.0650 if we see:

– weaker-than-expected Eurozone CPI which paves way for ECB rate cuts

– more US trade tariffs on EU, but not as damaging on the US economy

– stronger-than-expected US jobs report and a hawkish Chair Powell that pushes back on the next Fed rate cut

- EURUSD could revisit its latest cycle high around 1.094 or above if we see:

– stronger-than-expected Eurozone CPI which delays ECB rate cuts

– reciprocal US trade tariffs that confirm market’s worst-case fears by hurting the US economy and dollar

– weaker-than-expected US jobs report and a dovish Chair Powell that opens the door for a sooner-than-June Fed rate cut

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The Pound Stands Strong Amid Global Trade Tensions Mar 28, 2025

- Uncertainty over the scope and impact of tariffs increased market volatility Mar 27, 2025

- EUR/USD Faces Further Decline Amid Market Jitters and Trump’s Tariff Threat Mar 27, 2025

- Australia’s inflation rate is at a 3-month low. Oil prices are approaching $70 again Mar 26, 2025

- USD/JPY Rises Again: Yen Lacks Support as Bulls Take Control Mar 26, 2025

- Oil prices rise amid a new OPEC+ plan to cut production. Inflation in Singapore continues to weaken. Mar 24, 2025

- SNB cut the interest rate to 0.25%. Inflationary pressures are easing in Hong Kong and Malaysia Mar 21, 2025

- Week Ahead: GBPUSD set for end March mayhem? Mar 21, 2025

- EURUSD Loses Momentum as Fed Bolsters the US Dollar Mar 21, 2025

- Pound Hits 4.5-Month High: New Peaks on the Horizon Mar 20, 2025