By RoboForex Analytical Department

EURUSD remains poised around 1.0878 as markets brace for the outcome of the highly anticipated US presidential election. With the world watching, the direction of the major currency pair will hinge significantly on the election results, where a victory for Donald Trump is likely to bolster the USD, potentially leading to a notable increase. Conversely, a win for Kamala Harris could see the USD decline by an average of 1-2%.

The impending volatility is not solely due to the election but amplified by the upcoming Federal Reserve meeting scheduled for Wednesday. The Fed is anticipated to cut interest rates slightly by 25 basis points. Market participants are keenly awaiting any forward guidance from the Fed, particularly with expectations leaning towards another rate reduction in December.

While significant economic data releases are also expected, these pivotal events may overshadow their impact.

Technical analysis of EURUSD

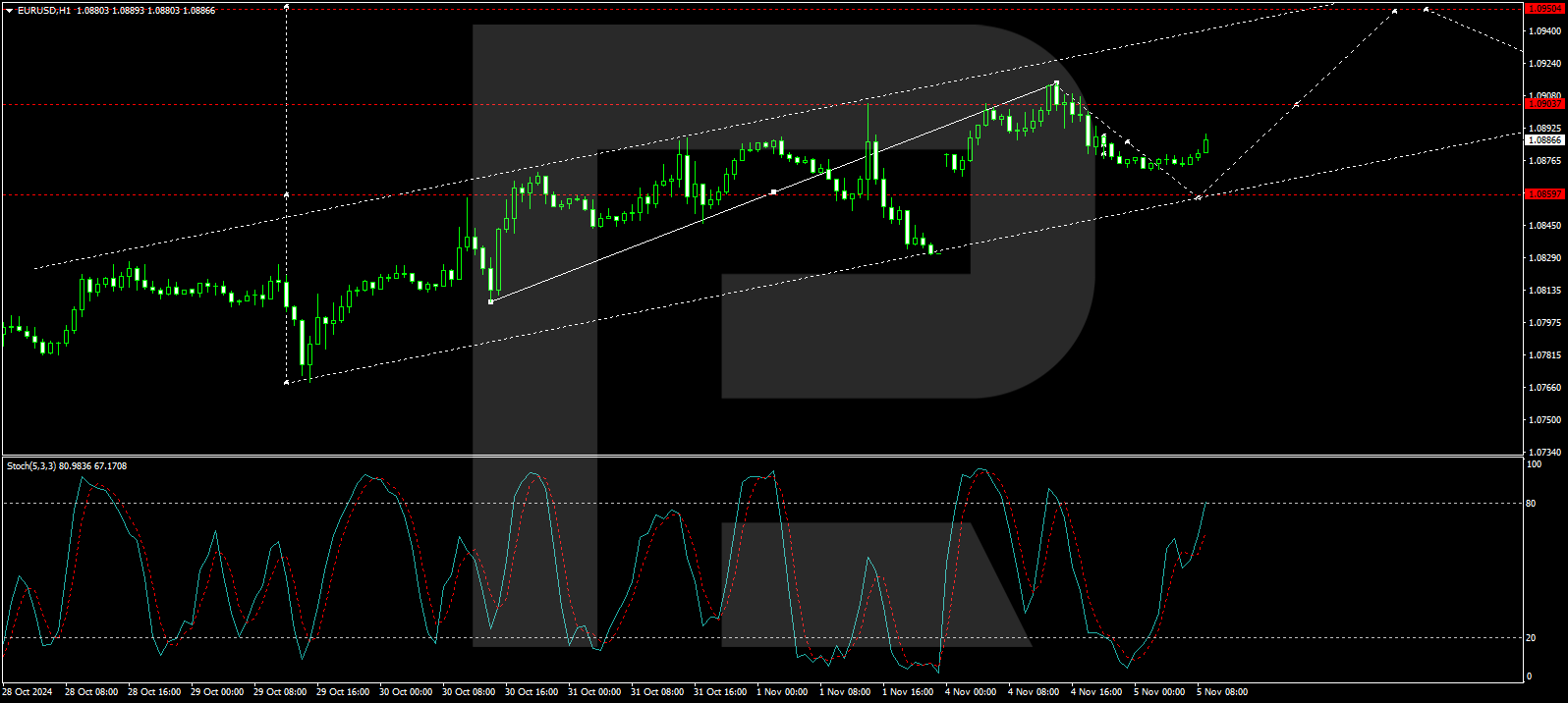

The EURUSD market has completed a growth structure reaching 1.0913, considered part of a third growth wave targeting 1.0950. After this target is achieved, a retraction to 1.0860 is anticipated, potentially forming a broad consolidation range around this level. Technical indicators, such as the MACD, suggest an upward trajectory, reinforcing the possibility of reaching 1.0960 before a corrective pullback to 1.0860.

Support at 1.0872 has spurred the development of a growth impulse towards 1.0900, which is expected to be tested soon. Breaching this level could extend the growth wave towards 1.0950. The Stochastic oscillator supports this short-term forecast, indicating upward momentum with its signal line targeting the upper echelons around 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- EURUSD Stabilises as US Presidential Election Unfolds Nov 5, 2024

- Stock indices rise on weak US labor market report. In Switzerland, there is a further decline in inflation Nov 4, 2024

- US Elections: How might markets react to Harris or Trump win? Nov 4, 2024

- Brent Crude Rises as OPEC+ Delays Production Increase Nov 4, 2024

- COT Metals Charts: Speculator bets led by Palladium & Steel Nov 3, 2024

- COT Bonds Charts: Speculator Bets led by Ultra Treasury Bonds & US Treasury Bonds Nov 3, 2024

- COT Soft Commodities Charts: Speculator Bets led by Corn & Live Cattle Nov 3, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Nasdaq Minis Nov 3, 2024

- Investors’ main focus today is on the NonFarm Payrolls report. Iran is preparing for a new attack on Israel Nov 1, 2024

- AUDUSD holds near August lows: US dollar pressure remains strong Nov 1, 2024