When was the last time you used cash to pay for something? If you are like most people in the world, you probably can’t remember. Cash is losing its appeal, as it’s been noted that its share will drop to 10% worldwide by the end of 2025, with North America, Asia-Pacific, and Europe leading the charge away from physical money. (The Covid-19 pandemic has accelerated this trend, as people avoid handling cash and opt for contactless and online payments.)

The decline in cash usage is driven by several factors, such as the availability and adoption of alternative payment methods, the growth of e-commerce and digital platforms, the convenience and security of digital payments, and the changing consumer preferences and behaviors. As a result, more and more people prefer to use digital payments for their everyday transactions. Even banks and financial institutions worldwide are undertaking far more digital transactions than physical ones.

However, digital payments are not without their drawbacks. They depend on the existing financial infrastructure, which can be slow, costly, and inefficient. And they are subject to cyberattacks, fraud, privacy breaches, and regulation.

What if there was a better way to pay digitally? A way that combines the convenience and efficiency of digital payments, with the stability and security of fiat currency. A way that operates on a distributed ledger, such as blockchain, which records and verifies every transaction. A way that is issued and backed by the central bank, and can be used as legal tender for any transaction.

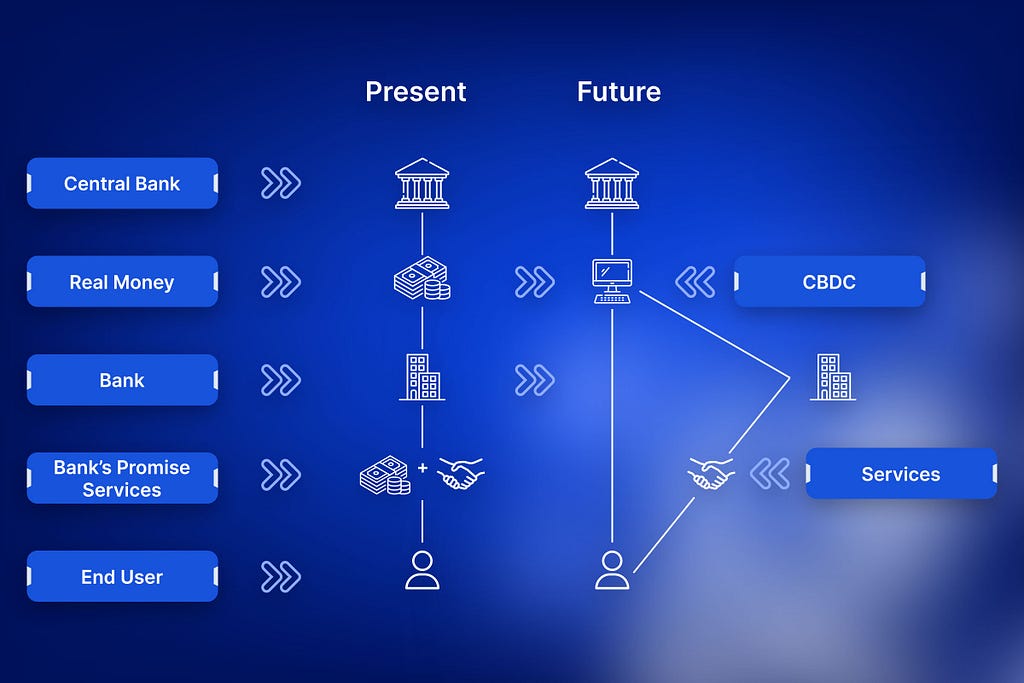

This is the vision of central bank digital currencies (CBDCs), a new form of money that is transforming the future of finance. CBDCs are the digital version of the fiat currency issued by the central bank of a country. They are not a new currency but a new way of using the existing one.

But what are CBDCs exactly, and how do they work? What are the benefits and challenges of CBDCs for users, businesses, and governments? How do CBDCs differ from cryptocurrencies and can they be traded on platforms developed by cryptocurrency exchange development companies, and what are the implications for the global financial system?

These are some of the questions that we will explore in this blog, as we uncover everything you need to know about CBDCs.

What Are CBDCs?

CBDCs, or Central Bank Digital Currencies are a digital form of government-issued currency issued by the central bank of a country, have the same value and legal status as traditional fiat money, and can be transferred electronically. Unlike Stablecoins (a particular type of stabilized cryptocurrency), however, their value is not pegged to another currency, commodity, or financial instrument. Also, unlike cryptocurrencies, which are an outcome of cryptocurrency development services, CBDCs are not decentralized and volatile, but rather backed by the full faith and credit of the government.

Different Types of CBDCs

CBDCs can be classified into different types, depending on who can use them and how they are issued and transferred. The two main types of CBDCs are:

- Wholesale CBDCs:

These are CBDCs that are only accessible to financial institutions, such as banks and are used for interbank payments and settlements. Wholesale CBDCs aim to improve the efficiency, speed, and security of the existing payment systems, such as RTGS (real-time gross settlement) and ACH (automated clearing house). They are not meant to replace cash or bank deposits, but rather to complement them. Wholesale CBDCs are also not very different from the current central bank reserves, except that they use blockchain technology to enable faster and cheaper transactions.

Some examples of wholesale CBDCs are Project Jasper in Canada, Project Stella in the EU, and Project Ubin in Singapore.

- Retail CBDCs:

Retail CBDCs are a type of CBDCs that anyone can use for daily payments, such as shopping, paying bills, or sending money. They are meant to be a digital version of cash, that is easy, accessible, and secure to use. Retail CBDCs can have two different designs: account-based or token-based. Account-based CBDCs need the users to open an account with the central bank or another entity, and the transactions are checked by the users’ identity. Token-based CBDCs do not need an account, and the transactions are checked by the tokens’ validity. Token-based CBDCs are more like cash, as they give more privacy and anonymity, but they also have more problems with security and scalability.

Some examples of retail CBDCs are China’s digital yuan, the Bahamas’ sand dollar, and Sweden’s e-krona.

There are also hybrid CBDCs, which combine elements of both wholesale and retail CBDCs. Hybrid CBDCs allow the public to access CBDCs through intermediaries, such as banks or payment service providers, who act as a bridge between the central bank and the users. Hybrid CBDCs aim to balance the trade-offs between centralization and decentralization and between privacy and regulation. Hybrid CBDCs can also leverage the existing financial infrastructure and network, and reduce the operational and reputational risks for the central bank. An example of a hybrid CBDC is the digital rupee in India, which is being piloted in both wholesale and retail segments.

Potential Benefits of CBDCs

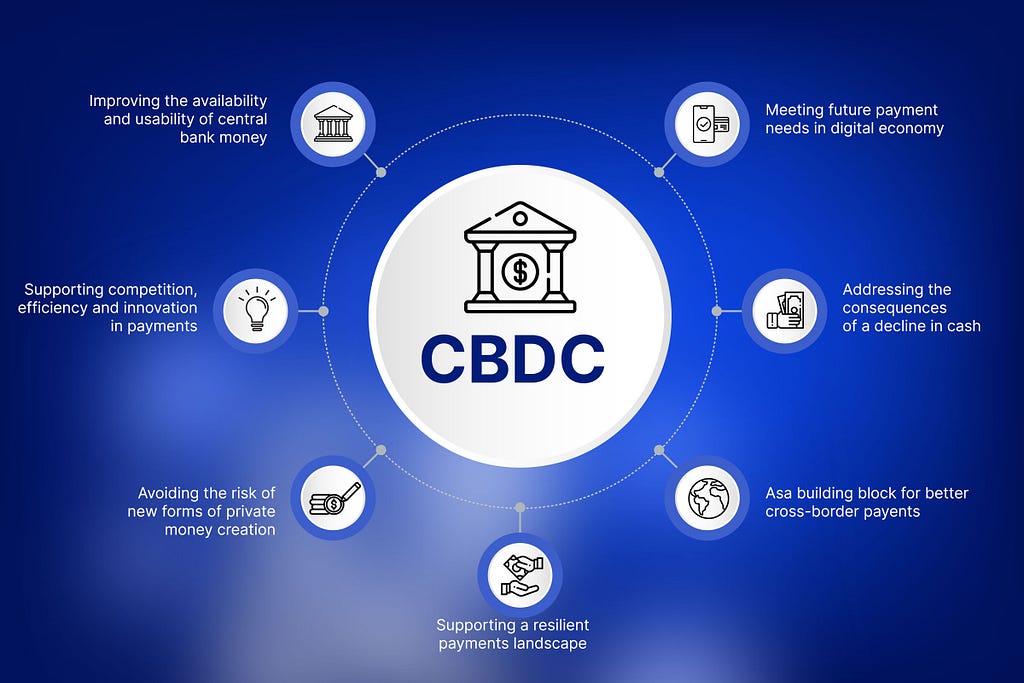

Supporters of digital finance argue that CBDCs and other innovative technologies can solve many problems of payment speed, safety, and inclusion. Some of the benefits of CBDCs are:

Payment Efficiency

CBDCs can significantly improve payment efficiency and accessibility. They offer instant transactions, which can help reduce the time and cost of cross-border payments. They also provide a secure and efficient way for individuals to make transactions without the need for intermediaries such as banks or payment processors.

CBDCs can revolutionize various payment systems, such as online, P2P, and POS payments. They can also improve the efficiency and security of wholesale or large-value payments by enabling faster and longer settlement hours.

CBDCs can even help estimate low-value coins by providing electronic exchange. For instance, the Bank of Korea launched a coinless society pilot in April 2017. The pilot allowed customers to deposit their change in prepaid cards instead of receiving small coins. The pilot saved the country about 36.7 million Euros (the cost of minting coins in 2016).

Financial Inclusion and Accessibility

Financial inclusion is one of the main benefits of CBDCs. They can provide access to digital payments and banking services to millions of people who are currently unbanked or underbanked, especially in developing countries. Many people around the world still face barriers to accessing financial services, such as the lack of bank accounts, the distance from bank branches, or the high costs of transactions.

CBDCs can overcome these barriers, by allowing people to use their smartphones to make transfers and payments, without the need for a bank account or an intermediary by using blockchain technology. CBDCs can thus enable people to access financial services more easily and affordably and improve their economic and social well-being.

Monetary and fiscal policy

CBDCs can enhance the effectiveness and transmission of monetary and fiscal policy, by allowing the central bank to directly influence the interest rates and spending behavior of the public. CBDCs can also facilitate the implementation of negative interest rates, helicopter money, or other unconventional measures in times of crisis. CBDCs can also support the stability and sovereignty of the national currency, by reducing the dependence on foreign currencies or private digital currencies.

Financial stability and security

CBDCs can reduce the risks of bank runs, cyberattacks, fraud, and money laundering, by providing a safe and reliable alternative to cash and private digital currencies. They can also improve the resilience and interoperability of the payment system, and reduce the dependence on intermediaries and foreign platforms. Furthermore, CBDCs can deter criminal activity, by enabling traceability and transparency of transactions and enforcing compliance with anti-money laundering and counter-terrorism financing regulations.

These are some of the benefits of CBDCs that can make them a desirable and viable option for the future of money. However, CBDCs also pose some challenges and trade-offs, such as privacy and data protection, competition and innovation, and technical and operational complexity.

Challenges and Trade-Offs CBDCs Pose

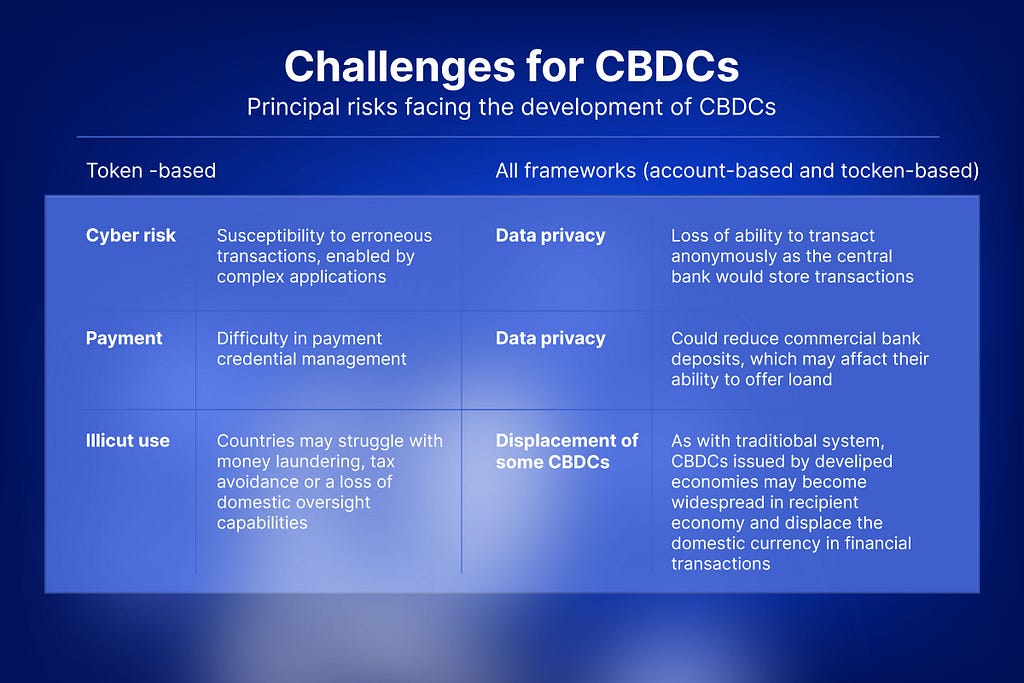

CBDCs pose several trade-offs and challenges that require careful consideration and experimentation by the central banks and other stakeholders.

Privacy and data protection

CBDCs could raise concerns about the privacy and security of the users’ personal and transaction data, especially if the central bank or the government has access to or control over them. They could also create tensions between the competing interests of law enforcement, national security, and civil liberties. For example, CBDCs could enable traceability and transparency of transactions, which could help deter criminal activity, but also expose the users’ financial behavior and preferences to the authorities. CBDCs could also be vulnerable to cyberattacks, data breaches, or identity theft, which could compromise the users’ funds and information. Therefore, CBDCs need to balance the trade-off between privacy and regulation and ensure the protection and confidentiality of the users’ data.

Competition and innovation

CBDCs could affect the profitability and viability of the existing financial institutions and payment service providers, by reducing their market share and intermediation role. They could also stifle the innovation and diversity of the private sector, or create unfair advantages for certain players. For example, CBDCs could reduce the demand for bank deposits, which could lower the banks’ lending capacity and profitability. CBDCs could also compete with or crowd out private digital currencies, such as Stablecoins or cryptocurrencies, which could limit the choice and innovation for the users. Therefore, CBDCs need to find a balance between competition and innovation and ensure cooperation and fairness among the public and private sectors.

Technical and Operational Complexity

CBDCs could require a high level of technical expertise and infrastructure, as well as a robust legal and regulatory framework, to ensure their functionality, scalability, and interoperability. CBDCs could also entail significant operational and reputational risks for the central bank, in case of system failures, cyberattacks, or user errors. For instance, in January 2022, owing to technical glitches, the digital version of Eastern Caribbean DCash went offline for two months.

Moreover, CBDCs could face technical challenges, such as the choice of the underlying technology, the design of the user interface, the integration with the existing payment systems, and the management of the network and security. They could also face legal and regulatory challenges, such as the definition of the legal status and liability of CBDCs, compliance with the anti-money laundering and counter-terrorism financing regulations, and coordination with international standards and frameworks.

Alongside these challenges, some argue that CBDCs are not worth the trouble. They claim that the benefits of CBDCs are too small compared to the costs of building and maintaining the digital currency system. They also doubt that CBDCs can improve the speed of payments, as many advanced countries already have fast and efficient payment systems through legacy infrastructure, without using blockchain technology. Some central banks, like those in Canada and Singapore, have decided that there is no urgent need for CBDCs at the moment.

CBDCs vs Cryptocurrencies: What Are the Differences?

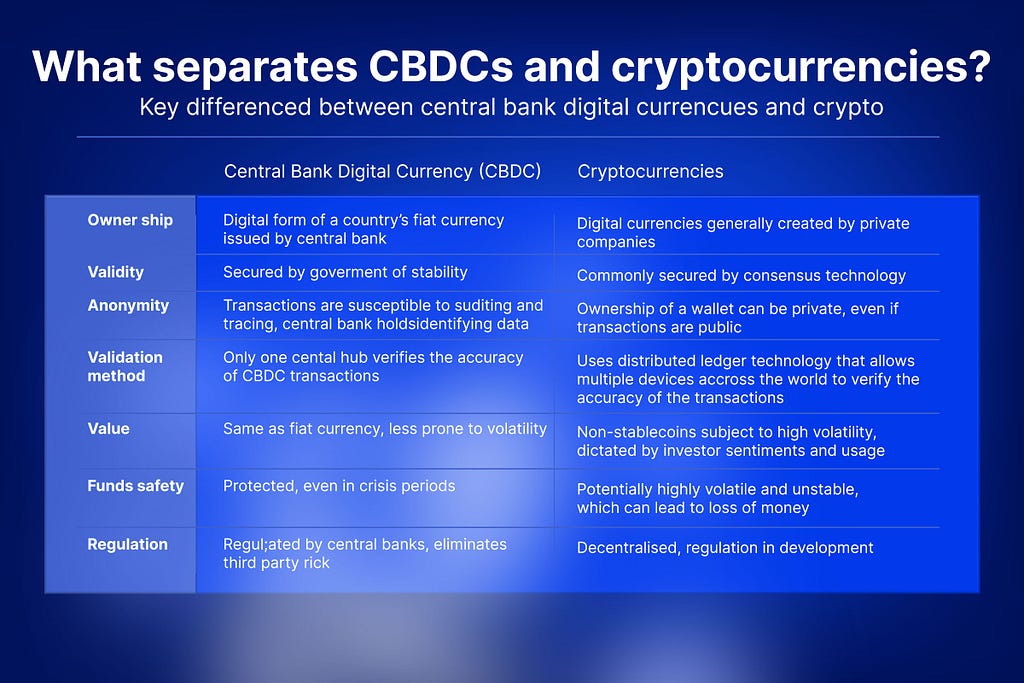

CBDCs and cryptocurrencies are both digital currencies, but they have different features and implications. Here are some of the key differences:

- Legal status and value: CBDCs are legal tender, backed by the government, and have a relatively stable value. They are not traded through crypto exchange development. Cryptocurrencies are not legal tender, backed by the market, and have a volatile value.

- Privacy and transparency: CBDCs are not anonymous, and the transactions are known and verified by the authorities. Cryptocurrencies are pseudonymous, and the transactions are public and visible on the blockchain.

- Security and scalability: CBDCs are secure and scalable, as they are protected and managed by the central bank and the government. Cryptocurrencies are also secure, but they can face scalability issues, as they depend on the network and the consensus algorithms.

- Innovation and diversity: Cryptocurrencies offer more innovation and diversity, as they are the result of the community’s creation and governance. CBDCs, on the other hand, are less innovative and diverse, as they are the product of the central bank and the government’s design and control.

Where Are CBDCs Currently in Use?

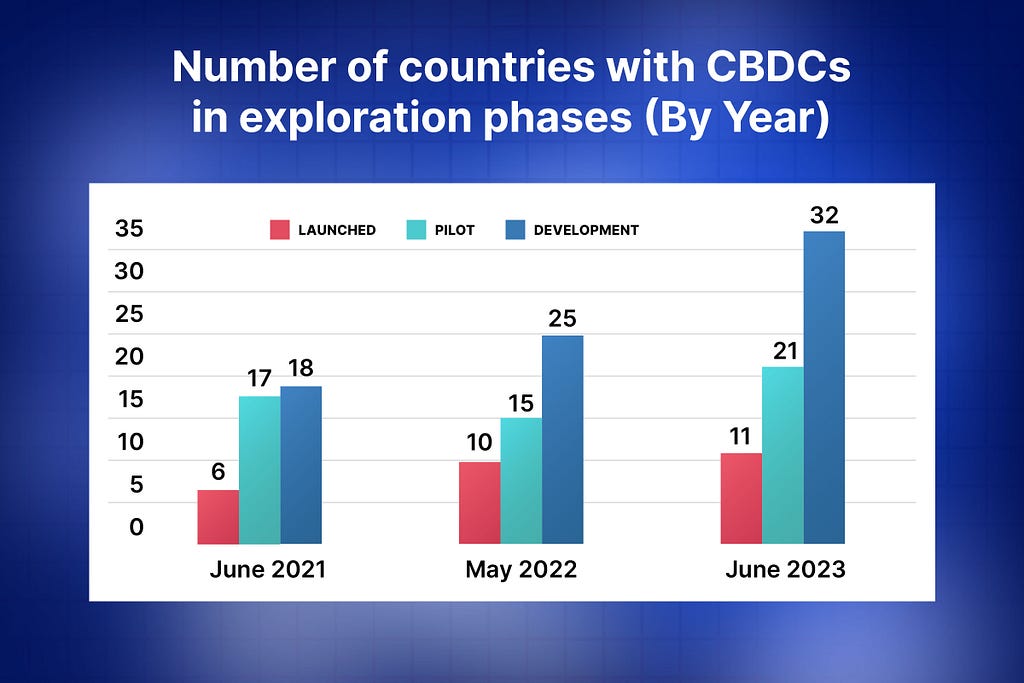

As of March 2023, there were 11 countries and territories with CBDCs123. They are the Bahamas, Antigua and Barbuda, St. Kitts and Nevis, Monserrat, Dominica, Saint Lucia, St. Vincent and the Grenadines, Grenada, and Nigeria. These countries have fully launched their CBDCs, which means that they are available for the general public to use for everyday transactions.

- The Sand Dollar: This is the CBDC of the Bahamas, which was launched in October 2020. The Sand Dollar is the first CBDC in the world to be fully deployed. It is a digital version of the Bahamian dollar, which is pegged to the US dollar. The Sand Dollar aims to improve financial inclusion, reduce transaction costs, and enhance resilience to natural disasters. The Sand Dollar can be accessed through a mobile app and can be used for payments, remittances, and e-commerce.

- DCash: This is the CBDC of the Eastern Caribbean Currency Union (ECCU), which consists of eight countries and territories: Antigua and Barbuda, St. Kitts and Nevis, Monserrat, Dominica, Saint Lucia, St. Vincent and the Grenadines, Grenada, and Anguilla. DCash was launched in March 2021, and it is a digital version of the Eastern Caribbean dollar, which is also pegged to the US dollar. DCash aims to improve payment efficiency, financial inclusion, and regional integration.

- The e-Naira: Launched in October 2021, the e-Naira is a digital version of the Nigerian naira, which is the official currency of Nigeria. The e-Naira aims to enhance monetary policy, financial stability, and economic growth.

These are some of the examples of CBDCs that are currently in use, and they show the diversity and innovation of the digital currency landscape. However, there are many more countries that are in the process of developing, testing, or piloting their own CBDCs, such as China, Sweden, India, and the European Union. For instance, the e-CNY is China’s CBDC project, which uses private banks to manage the digital currency accounts for their clients. The e-CNY was featured at the Beijing 2022 Olympic Games, where it was used by visitors and athletes to buy goods and services in the Olympic Village.

How to Get Ready for CBDCs: A Guide for Different Stakeholders

It is too early to predict what will happen with CBDCs in the future. But central banks can think about these five questions:

- How many people will use CBDCs instead of traditional money?

They should plan based on how the payment system is now, how it will be later, and how many people will want to use CBDCs. - Who will use CBDCs?

They should design CBDCs based on the type of user: regular people, banks, or businesses. They should also get help from experts outside the central bank. - What will the central bank do?

The central bank should use its existing relationships with banks and businesses to make CBDCs popular, whether it is very involved or not. - What will the central bank need?

The central bank will need new ways of making decisions, managing changes, and working with others. - What will the central bank change?

The central bank will need to overcome some problems in rules, business, and taxes to make CBDCs successful. But central banks are not the only ones who care about CBDCs.

Here’s how other people can get ready for CBDCs:

- People who make the payment system should make sure their system can work with digital money.

- Banks, shops, and payment companies should think about how much they need to invest in their system to use CBDCs well, as they also improve their system in other ways.

- People who manage risks and money for banks should watch how digital money will affect their bank’s money and rules.

- People who invest in cryptocurrencies should think about how CBDCs will affect their investments. CBDCs could make cryptocurrencies less popular.

- Banks should learn how to check digital money for fraud and crime. If banks give CBDCs to their customers (and make money from their deposits), they will also have to pay for checking their customers.

Final Takeaway

It is evident that CBDCs can transform the way we pay, save, and invest, enhancing financial stability, monetary policy, and cross-border transactions. However, alongside tackling issues, such as privacy, cybersecurity, financial inclusion, and the impact on the banking system, they are not a one-size-fits-all solution, and different countries may have different approaches and objectives in designing and implementing them.

Essentially, there is still much unknown about the future of CBDCs. So as they evolve and impact the world, we need to keep learning and participating in the discussion about this innovative technology.

Everything You Need to Know About CBDCs was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.