Decentralized exchanges (DEXs) have become a focal point in the cryptocurrency landscape, offering users a platform to trade assets directly without the need for intermediaries. This blog aims to provide a comprehensive overview of DEX development, covering its definition, advantages, key components, development strategies, and security measures. This guide is designed for businesses and potential clients looking to engage with DeFi development companies.

Decentralized Cryptocurrency Exchange explained

A decentralized cryptocurrency exchange is a platform that facilitates peer-to-peer trading of cryptocurrencies without a central authority overseeing transactions. Unlike centralized exchanges that require users to deposit funds into an exchange-controlled wallet, DEXs allow users to maintain control over their assets through personal wallets. Transactions are executed via smart contracts on blockchain technology, ensuring transparency and security.

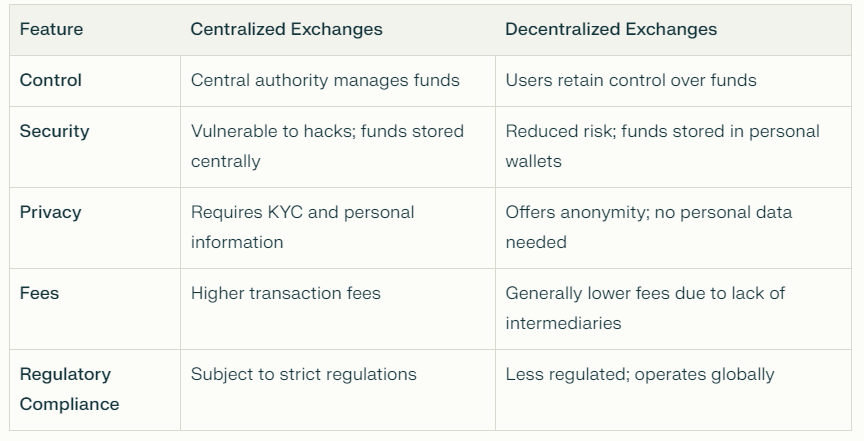

Comparison Between Centralized and Decentralized Exchanges

Understanding the differences between centralized and decentralized exchanges is crucial for potential users and developers alike. Here’s a concise comparison:

Advantages and Benefits of Decentralized Crypto Exchanges

Decentralized exchanges offer several unique benefits that appeal to traders and developers:

Enhanced Security: Users have complete control over their assets, significantly reducing the risk of large-scale thefts.

Greater Privacy: DEXs do not require personal information, allowing users to trade anonymously.

Lower Costs: With no intermediaries involved, transaction fees are often lower compared to centralized platforms.

Censorship Resistance: DEXs operate without central authority oversight, making them less susceptible to government regulations.

User Control: Users can trade directly from their wallets without relying on third-party management.

Accessibility: Anyone with internet access can use DEXs, promoting global participation in cryptocurrency trading.

Transparency: All transactions are recorded on the blockchain, providing an immutable record that enhances trust among users.

Key Components and Features of a Decentralized Crypto Exchange

Several critical components underpin the functionality of a decentralized exchange:

Blockchain Technology: The backbone of DEXs, blockchain ensures secure transaction recording across a distributed network.

Smart Contracts: These self-executing contracts automatically enforce the terms of trading agreements without the need for intermediaries.

Token Standards: Established rules that dictate how tokens are created and managed on the blockchain facilitate interoperability among different platforms.

Wallet Integration: Users must connect their cryptocurrency wallets to the DEX for trading, ensuring they maintain control over their assets.

Planning and Strategy for Decentralized Crypto Exchange Development

Developing a successful DEX requires meticulous planning and strategic foresight. Key steps include:

Market Research and Analysis

Conduct thorough research on current trends in the cryptocurrency market. Understanding user interaction with existing exchanges will help identify desirable features and common pain points.

Identifying Target Audience

Segmenting your audience based on factors such as trading volume and experience level allows you to tailor your platform effectively.

Analyzing Competitors

Perform a SWOT analysis on existing DEXs to identify their strengths and weaknesses. This insight will inform your unique selling propositions (USPs).

Defining Unique Selling Propositions (USPs)

Focus on what makes your DEX stand out. This could be innovative features or enhanced user experiences that competitors lack.

Regulatory Considerations and Compliance

Understanding local regulations is essential. Collaborate with legal experts to navigate requirements like Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Technical Development of a Decentralized Cryptocurrency Exchange

The technical aspects of developing a DEX are complex but vital for its success:

Choosing the Right Blockchain Platform

Selecting an appropriate blockchain is critical. Options include:

Ethereum: Known for robust smart contract capabilities but may face higher transaction costs.

Binance Smart Chain (BSC): Offers faster transactions at lower costs while maintaining compatibility with Ethereum tools.

Solana: Ideal for high-frequency trading due to its ability to handle thousands of transactions per second at low costs.

Smart Contract Development

Smart contracts form the core of DEX functionality. Ensure your contracts are secure by following best practices in coding and regular updates.

Security Best Practices

Implement comprehensive security measures:

– Conduct thorough code reviews to identify vulnerabilities.

– Use multi-signature wallets for fund management.

– Establish bug bounty programs to incentivize community reporting of issues.

Launch and Deployment of a Decentralized Cryptocurrency Exchange

Once development is complete, focus on launching your DEX effectively:

– Conduct extensive testing before launch to ensure all features function as intended.

– Prepare marketing strategies that highlight your platform’s unique features.

– Engage with community members through forums and social media platforms to build awareness and trust.

Conclusion

Decentralized exchanges represent a significant shift in how cryptocurrencies are traded, offering numerous advantages over traditional centralized platforms. For businesses looking to enter this space or enhance their existing offerings, understanding the intricacies of DEX development is essential.

If you are considering building your own decentralized exchange or seeking expert guidance in DeFi development, reach out to Codezeros. Their expertise can help you navigate this dynamic landscape effectively.

Everything You Need to Know About DEX Development was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.