FNG Exclusive… FNG has learned via regulatory filings that AT Global Markets (UK) Limited, the London based, FCA regulated brokerage arm of global online broker ATFX, has posted healthy increases in both Revenue and Net Profit in FY 2023.

AT Global Markets (UK) Limited operates the “ATFX Connect” brand, targeting mainly HNW and institutional clients.

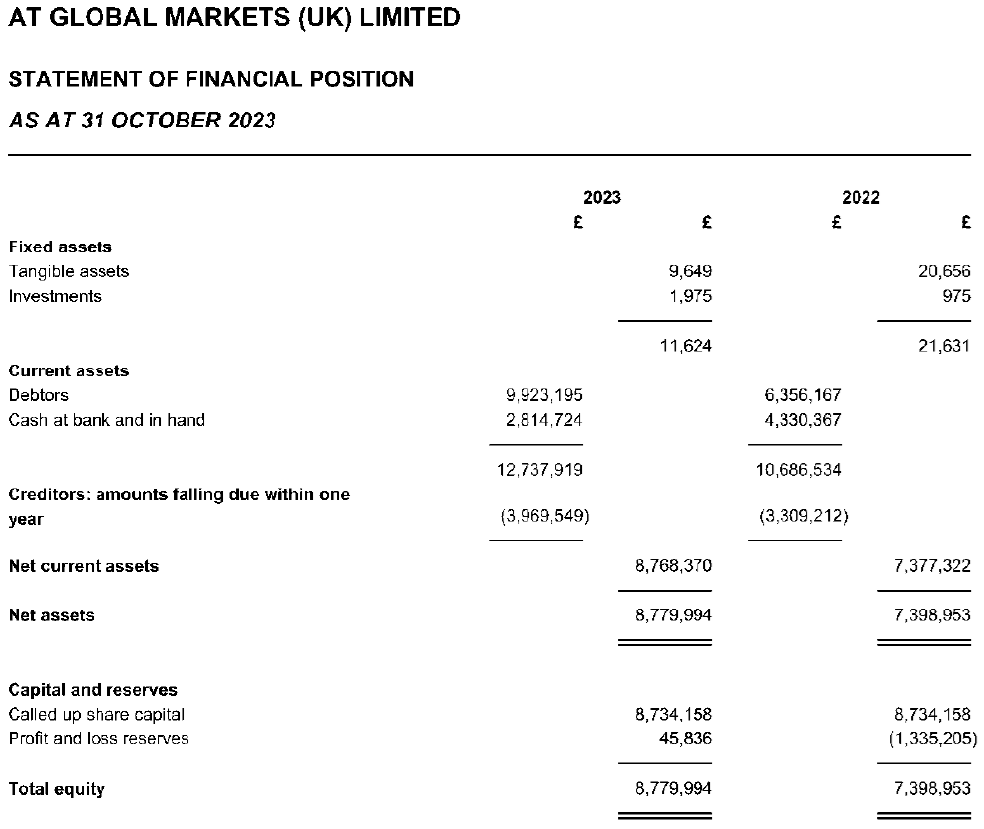

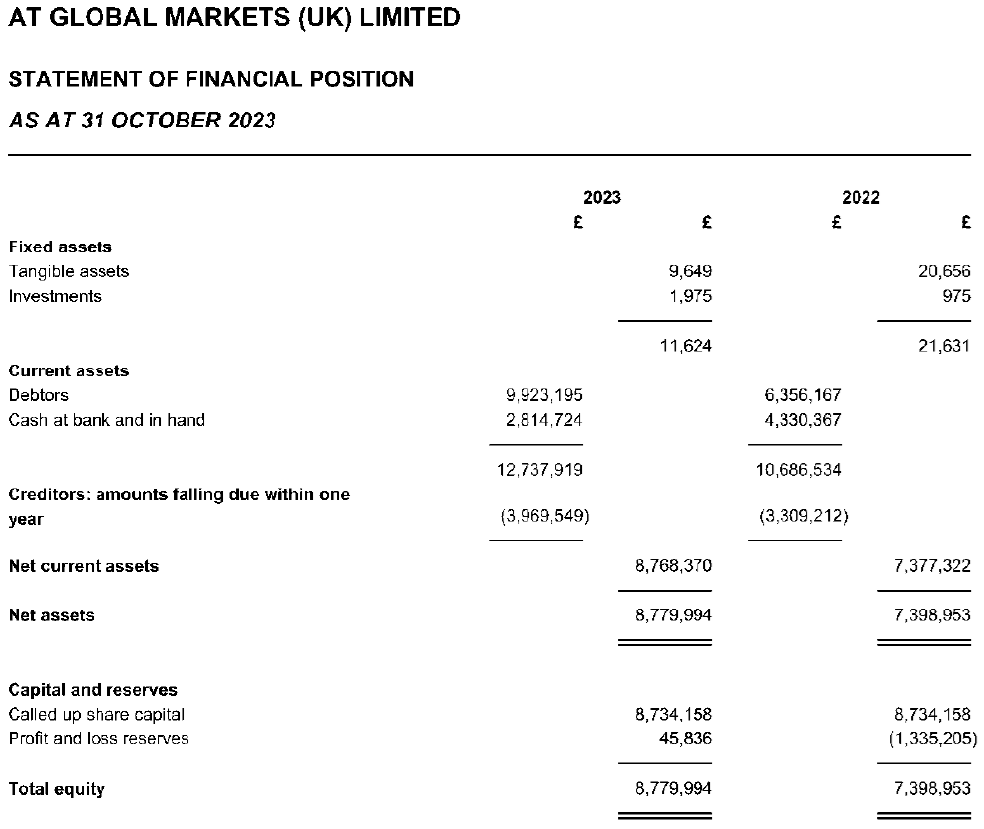

Revenues at ATFX Connect rose by 96% in 2023 (fiscal year end October 31) to £6.2 million, versus £3.2 million in 2022. The company saw a 19% rise in net assets to £8.8 million (2022: £7.4 million), which included £2.8 million of cash balances. Accordingly the company said it has a strong balance sheet and is well placed to achieve its long term strategy.

ATFX Connect made a Net Profit of £1.4 million in 2023, up 65% from £838K the previous year.

The primary focus of the ATFX Connect business is on the foreign exchange markets. The firm also offers contracts based on precious metals, oils, individual stocks and stock indices. The firm will continue to market itself directly to EEA and other international territories, where permitted. The key targets will be the existing high net worth clients, fund managers, brokers and banks who are looking to diversify their portfolio and are comfortable with the risk profile and volatility that investing and trading in derivatives can offer.

ATFX is controlled by Hong Kong based entrepreneur and group Chairman Joe Li. The group has licensed subsidiaries in the UK (FCA), Cyprus (CySEC), Mauritius, the UAE, and Australia following the company’s 2023 acquisition of the ASIC licensed CFDs business of Rakuten Australia.

ATFX Connect’s 2023 income statement and balance sheet follow below.