Technical Analyst Clive Maund shares why he believes American Salars Lithium Inc. (USLI:CSE) is a Strong Buy, including the recent news that it acquired a new project.

American Salars Lithium Inc. (USLI:CSE) is a lithium exploration company whose stock is viewed as a Strong Buy here for both fundamental and technical reasons.

First we will consider the fundamentals of the company before proceeding to review its latest stock chart.

The first point to make is a general one concerning the outlook for lithium itself. As you may recall, after a massive speculative runup in 2020 and especially in 2021, the lithium price fell victim to a severe bear market that ran from mid-2022 through the end of 2023, as we can see on the following 5-year chart. By the end of last year, this bear market had exhausted itself, and a basing process began that has continued up to the present.

The chart implies that perhaps after some further basing action, lithium prices will start higher again in a new bull market.

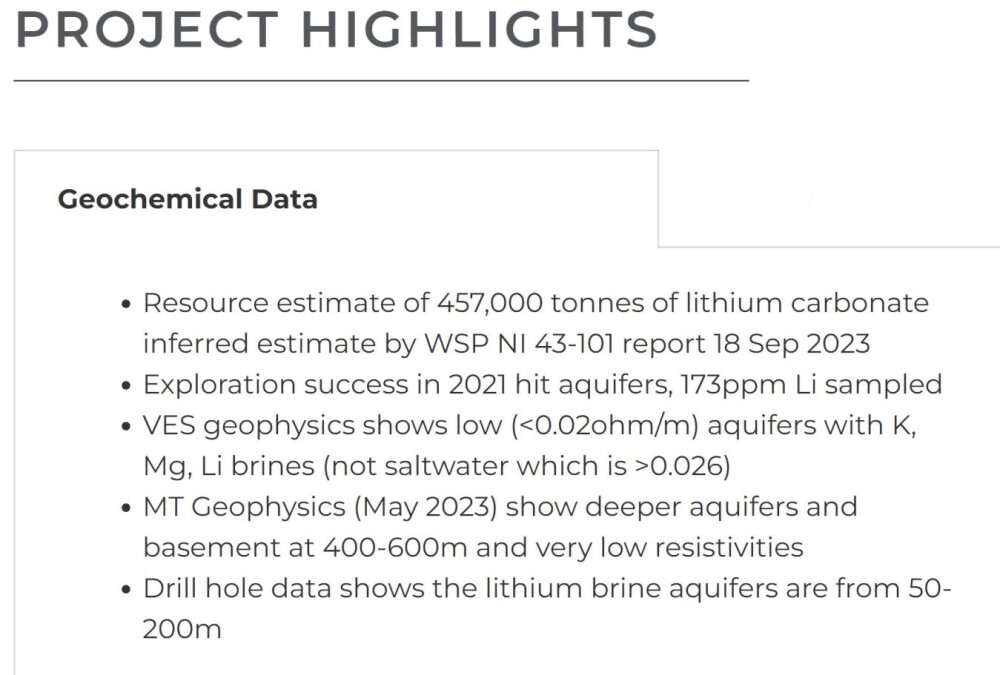

Turning now to the particulars of the company itself, American Salars has a range of projects in Argentina, Canada, and the U.S. Its flagship project is the 3000 Hectare Candela II Salar project in Argentina, which features a National Instrument 43-101 inferred resource of 457,000 tonnes of lithium carbonate that is open for expansion.

Other projects include the Blackrock South lithium brine project in Nevada, located just 72 miles north of the Tesla Gigafactory. The company also has a highly prospective portfolio of projects in British Columbia and Quebec, Canada.

The Incahuasi Salar Project, which is easily accessible by road, is located in the province of Salta in northwestern Argentina, and it supports conditions for quality lithium mines at depth. The region has been substantially explored and it has been found that the lithium brines are close to the surface. The following picture from the company’s website gives some general information about the project.

The following excerpt, also from the company website, sets out some highlights of the project.

This photo shows drilling in progress at the Incahuasi Salar.

Turning now to the company’s other projects, which are all in the exploration stage, we will start by looking briefly at the prospective Black Rock South property in Nevada.

This picture shows the location of the project in NW Nevada and its proximity to the Tesla Gigafactory, an obvious large nearby market for the lithium extracted by the company.

At the Black Rock South property, the recent mineral exploration on the Galt claim group under option to Surge Battery Metals Inc. (NILIF:OTCMKTS;NILI:TSX-V) located 11 Miles to the South includes 51 playa sediment samples collected for chemical analysis at ALS Geochemistry in Vancouver, B.C.

Results of aqua regia leaching of the samples show 68 to 852 parts per million lithium (mean 365 ppm), 5.3 to 201 ppm cesium (mean 72 ppm) and 35 to 377 ppm rubidium (mean 180 ppm). Results from two seven-foot-deep auger holes show lithium, cesium, and rubidium concentrations in the range of 143.5 to 773 ppm Li, 56.8 to 102.5 ppm Cs and 155 to 272 Rb.

The entire San Emidio Desert basin is a highly prospective lithium exploration zone and is about 38 km long and up to 11 km wide at the widest point, with the central playa measuring about 8.5 km north-south and 4.5 km east-west.

A proposed four-hole drill program at the Galt project is pending permitting approval. It is designed to test a tight grouping of highly anomalous surface sediment sampling locations, which returned assay values with a high of 312 ppm lithium and a mean value of 215 ppm lithium.

The following photo gives an idea of the terrain at Black Rock South.

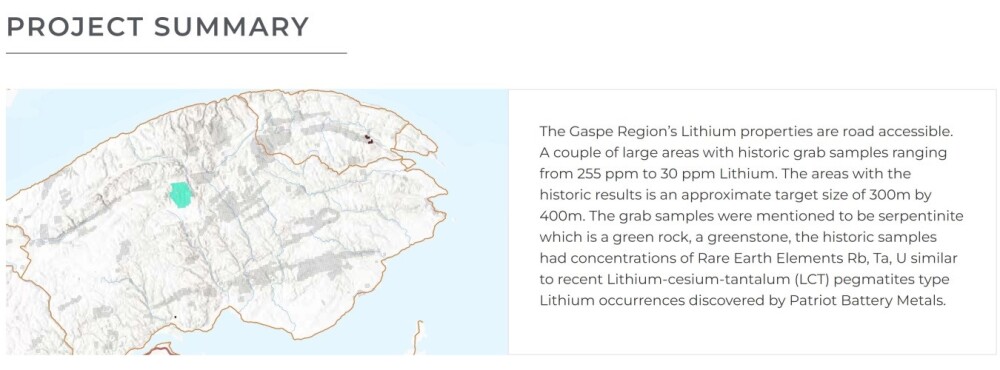

With respect to the company’s Quebec Project, this excerpt from the company website gives some details about it.

Lastly the company’s La Isla property in British Columbia is not lithium but gold with some copper and this excerpt from the company website gives some details about it. Note that this description continues on and the balance of it can be read on the relevant page on the website, the important closing sentence of which reads.

“Results to date from the Isla property demonstrate strong potential for gold and copper bearing mineralization that warrants further geological, geochemical, and geophysical exploration.”

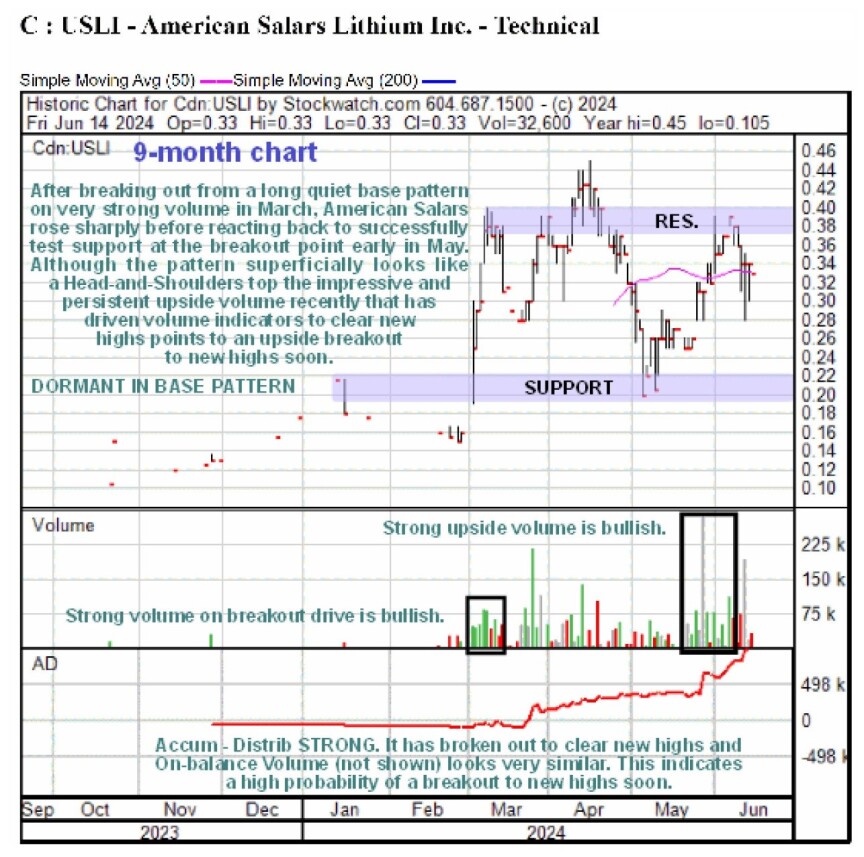

Now we will examine the latest stock chart for the company to see what it portends and we will use a 9-month chart which shows the entire history of the stock from its inception on this market.

As we can see, the stock was “dormant” from September through late February, marking out a low base with almost no trading. Hence the “fly specked” appearance of the chart up to that point, but in March, it suddenly came to life, blasting higher on strong volume to double in price in a matter of a few days. However, since that early March surge, it has meandered around in a rather erratic manner, dropping back hard during the second half of April and early May to successfully test the support shown at the breakout point.

Whilst some might interpret the erratic pattern from the early March surge to be some kind of top area, this is not thought to be the case at all. In the first place, the high volume breakout that we saw in early March has strong bullish implications and should mark the start of a major bull market.

Secondly, the recurrent heavy upside volume since early March is also bullish, especially as it has driven both volume indicators, the Accumulation line and the On-balance Volume line (not shown), to stage breakouts to clear new highs on the high volume advance late in May and early this month. This is a powerful indication that the stock is destined to break out above the resistance to clear new highs soon despite the dip of the past week or so, and with respect to this, we should recall that lithium itself is looking set to break out into a new bull market soon as we saw above.

Last, and certainly not least, there was big news out this morning (June 17) that AMERICAN SALARS ACQUIRES POCITOS LITHIUM SALAR PROJECT WITH INFERRED LITHIUM CARBONATE MINERAL RESOURCE. This is clearly a major positive development for the company because this project has an NI 43-101 Mineral Resource Estimate (“MRE”) prepared in December 2023, consisting of an inferred 760,000-tonne lithium carbonate equivalent (“LCE”).

The conclusion is that American Salars is on course to break out to new highs soon, so anyone holding should stay long, and it is rated a Strong Buy here. Upon breaking out to new highs, a likely initial target for the upleg that follows is the CA$0.60 area.

American Salars’ website.

American Salars Lithium Inc. (USLI:CSE) closed for trading at CA$0.33 on June 14, 2024.

Important Disclosures:

- American Salars Lithium Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Salars Lithium Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.

- Expert Says Lithium-Brine Stock on Course to New Highs Jun 17, 2024

- Oil prices continue to be supported by voluntary cuts by OPEC countries. Hong Kong index fell to a 6-week low Jun 17, 2024

- The New Zealand dollar is falling Jun 17, 2024

- The Japanese yen fell to a six-week low after the Bank of Japan ended its meeting Jun 14, 2024

- Target Thursday: 3 cryptos met expectations, with one surprise winner Jun 13, 2024

- US Dollar declines as Fed signals potential rate cut and inflation eases Jun 13, 2024

- The US Fed has planned only one rate cut this year and four cuts in 2025 Jun 13, 2024

- Euro hits monthly low amid political instability in France Jun 12, 2024

- China’s consumer inflation is on the rise. Today, the focus is on the FOMC meeting Jun 12, 2024

- US500: Braces for mid-week double whammy Jun 12, 2024