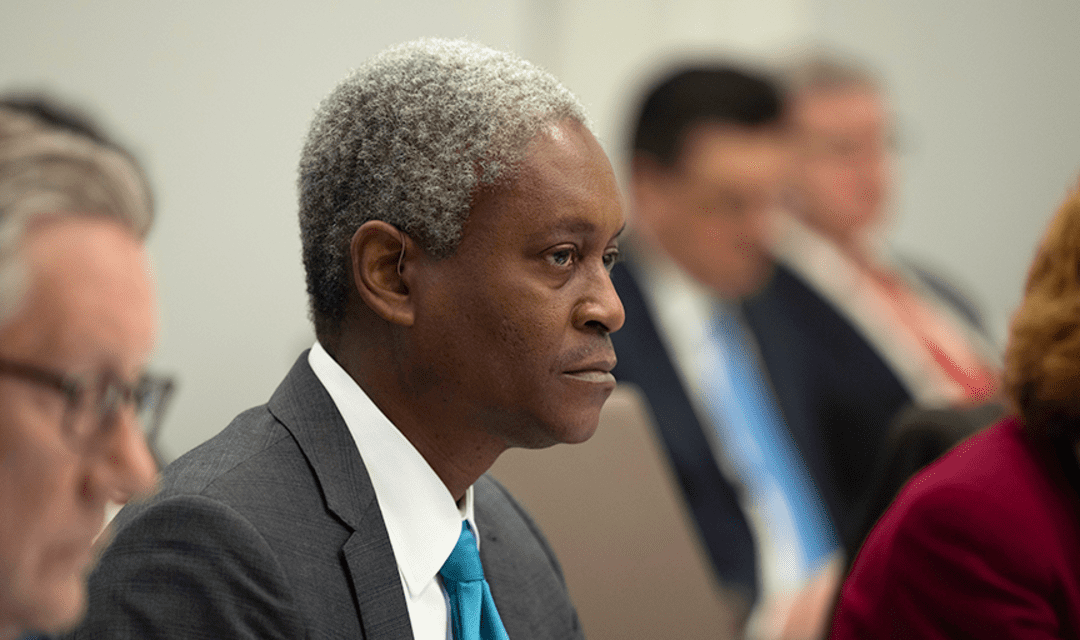

With the labor market strong and growth above trend, there isn’t pressure on the U.S. central bank to cut interest rates, Atlanta Fed President Raphael Bostic said Monday.

“The good news is the labor market and economy are prospering, furnishing the FOMC the luxury of making policy without the

pressure of urgency,” Bostic said in a new essay posted on his regional bank’s website.

The Atlanta Fed president, who is a voting member of the Fed’s interest-rate committee, quickly added that this could change.

One concern about cutting interest rates is that businesses seem to be poised to ”pounce” on the first hint of a move, and quickly boost spending and hiring, Bostic said.

This fresh burst of demand could lead to higher inflation.

“This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months,” he said.

Bostic’s call for caution fits in the mainstream of Fed thinking over the past few weeks. While the Fed has penciled in three rate cuts for this year, some economists are starting to think the central bank might actually cut fewer times this year, if at all.

Even noted pessimist Nouriel Roubini said in an interview earlier Monday was upbeat about the U.S. economy.

Fed Chairman Jerome Powell will testify to Congress on Wednesday and Thursday. That is likely to be the final word from the chairman ahead of the central bank’s next policy meeting on March 19-20.

Stocks

DJIA

SPX

were lower in late morning trading on Monday. The 10-year Treasury note yield

BX:TMUBMUSD10Y

inched up to 4.22%. It has been in a narrow trading range since mid-February.