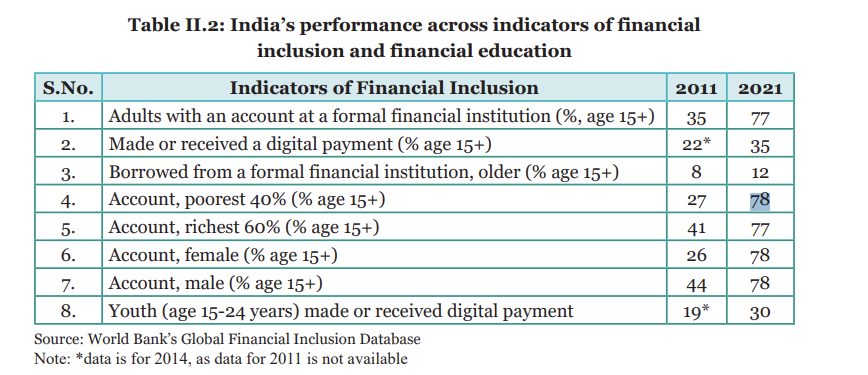

According to the Economic Survey 2024, the percentage of adults with a bank account increased from 35% in 2011 to 77% in 2021.

It also quoted India’s progress in reducing the access gap between the rich and the poor, as well as narrowing the gender divide in financial inclusion, and reducing the access gap between the rich and the poor.

Further, the gender divide in terms of financial inclusion has also narrowed, with both male and female account ownership reaching 78% by 2021, up from 44% and 26% respectively in 2011, highlighted the survey data.

What changed in the approach?

More recently, there has been a shift in focus of the financial inclusion strategy in the country, from ‘every household’ to ‘every adult,’ with added emphasis on the usage of accounts by enhancing direct benefit transfer (DBT) flows through these accounts, promoting digital payments using RuPay cards, UPI etc, as given in the survey report.

The Economic Survey 2024 said, “Based on the bank account data and the relationship with GDP per capita, one rough estimate is that it would have taken 47 years to achieve 80 per cent of adults with a bank account had India solely relied on traditional growth processes.”

Next step is to strengthen Digital Financial Inclusion

Speaking of digital financial inclusion which according to the economic survey 2024 is also the next goal, saw slower growth compared to overall account access. Between 2011 and 2021, the percentage of adults making or receiving digital payments rose from 22% to 35%.

“DFI involves arranging cost-effective digital means to reach currently financially excluded and underserved citizens with a range of formal financial services suited to their needs,” noted the 2024 survey.

The essential components of DFI include the availability of digital transactional platforms to enable customers to make or receive payments and devices to enable such transactions. These retail agents have digital devices and additional financial services via a digital transactional platform, it added.

The Economic Survey 2024 highlights several measures taken by the RBI to promote financial inclusion:

- In March 2022, the RBI launched UPI123Pay for UPI payments on feature phones, and the NPCI introduced UPI Lite, an on-device wallet for low-value transactions up to ₹200 via the BHIM app. These innovations aim to boost digital adoption and create a more inclusive financial ecosystem.

- International collaborations are underway to enhance national and cross-border payment systems. The RBI is working with various countries to link India’s UPI with their Fast Payment Systems for cross-border Person to Person (P2P) and Person to Merchant (P2M) payments. Through Project Nexus, RBI aims to connect the FPSs of Malaysia, Philippines, Singapore, Thailand, and India. An agreement was signed on June 30, 2024, with the platform expected to go live by 2026, making cross-border retail payments more efficient, faster, and cost-effective.

RBI’s Strategy

The RBI’s financial inclusion strategy encompasses a target-based approach, market development, infrastructure strengthening, innovation and technology, last-mile delivery, consumer protection, and financial literacy. Key progress includes:

- Over 1.3 lakh bank branches

- 52.6 crore bank accounts under PMJDY

- 78% account ownership in 2021

- 24.6 ATMs per lakh adults in 2022

- 7.7 crore people with credit cards

- 14.3 commercial banks per lakh adults