Happy Wednesday! Razorpay, Cashfree, PayGlocal and other fintech startups are seeking a licence for facilitating cross-border payments from the RBI. This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ IT hiring mandates jump

■ MeitY bats for startup product validation centres

■ Innoviti Payments, Concerto bag PA licence

Fintech is making global payments its business

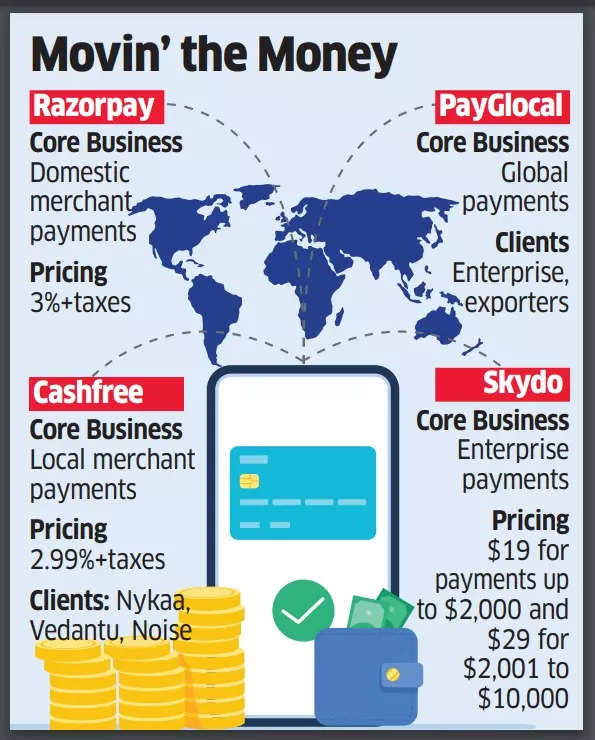

Following the central bank’s move to regulate cross-border transactions by payment aggregators, the likes of Razorpay, Cashfree and new-generation fintechs like PayGlocal and Skydo have either applied or are looking to apply for the licence. Existing players wanting to continue with this business need to inform the regulator by the end of April.What’s happening? The domestic merchant payments space is cluttered with too many players, and there’s a constant squeeze on margins. At the same time, large payment firms see international payments as a major revenue-generating opportunity. For early-stage startups — who may find it tough to tap the domestic market at this stage — international payments is a good place to start.

The big picture: India, being one of the world’s largest economies, has a huge export market. In 2023, the country exported goods and services worth $750 billion, as per the commerce ministry. Small enterprises could have accounted for $250 billion out of this and fintechs for around $10 billion. Fintechs are hoping to chip into the share held by banks.

Also read | NPCI arm, banks and fintechs in talks for net banking synergies

Tell me more: Razorpay and Cashfree are mostly powering Indian ecommerce players to sell outside the country, but industry insiders said they are building solutions for the B2B market as well.

Skydo is chasing small enterprises like software services, legal services, consultancy firms that cater to global clients and need to process international payments.

Also read | On KYC compliance front, payment aggregators may be second to some

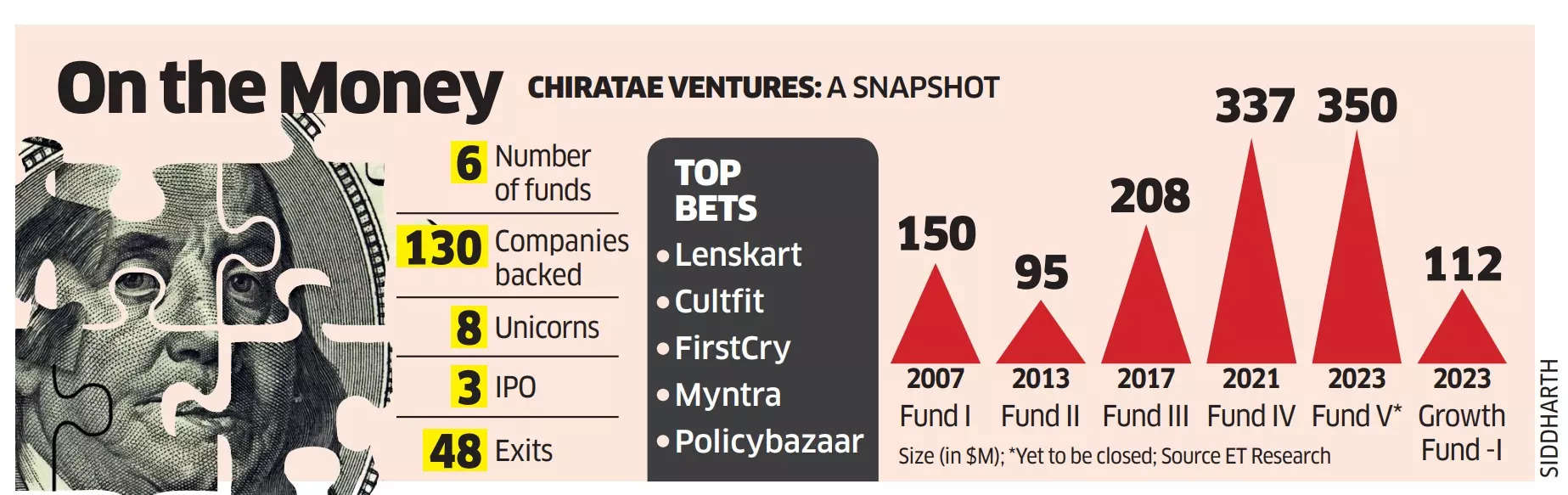

Exclusive: Chiratae bags $70 million via portfolio sale as VC funds push to clock exits

Chiratae Ventures’ founder & chairman Sudhir Sethi (left) and founder & vice chairman TCM SundaramEarly-stage investor Chiratae Ventures (formerly IDG Ventures) has been able to take home around $70 million by offloading stakes in some of its portfolio firms to Madison India Capital, sources told us.

Driving the news: Chiratae’s stake sale to Madison India Capital involved companies from its Fund-II, which was $95 million in size, and Fund-III with $208 million of capital.

The Bengaluru-based fund has sold shares in companies like omnichannel eyewear retailer Lenskart, vendor management startup Bizongo and furniture rental platform Rentomojo, people in the know told us.

Go deeper: Madison Capital is backed by New York-headquartered Lexington Partners, a limited partner (LP) that specialises in secondary transactions.

In 2017, Madison coughed up $180 million to buy stakes in Sequoia Capital India (now Peak XV Partners) portfolio firms like payments platform Pine Labs, health insurer Star Health, India Shelter Finance Corporation, Snapdeal and Micromax.

The bottom line: Chiratae’s bulk secondary deal comes at a time when investment funds are facing pressure from global LPs to show exits and returns from India. The lacklustre performance of most Indian venture capital funds has forced VCs to look for ways to cash out.

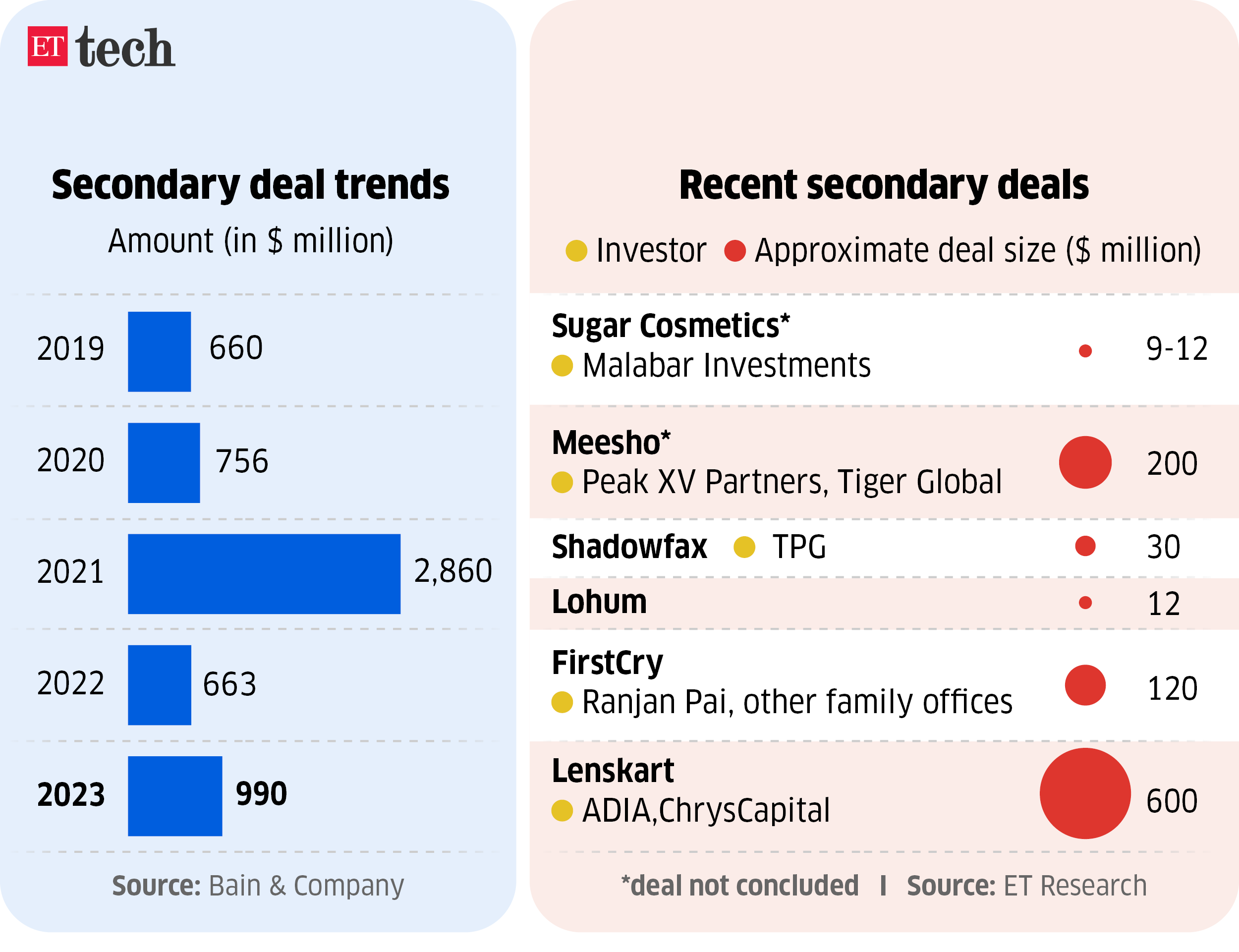

We reported on March 21 that secondaries in late-stage companies have picked up significantly since the last year or so to bring in liquidity.

Also read | Scaled startups could drive venture capital investment activity in 2024: report

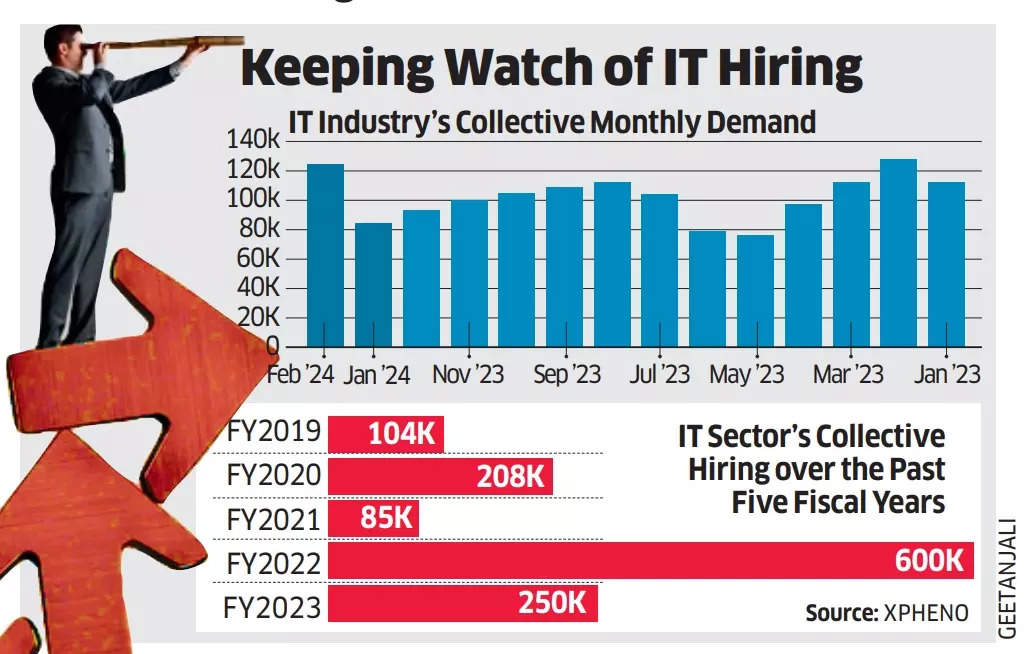

Tide seems to be turning for IT as hiring mandates rise 50% in February

Active demand for technology talent hit a new monthly high for this fiscal year in February, kindling hopes of a recovery in the IT services job market that hit a two-decade-low this fiscal.

Recruiters upbeat: Hiring mandates for IT talent stood at 124,000 last month, a nearly 50% jump from January and 33% higher than in December, data from staffing firm Xpheno shows.

Staffing firms are projecting a hiring increase of 7-8% in the second half of this calendar year, per data gathered by ET from Teamlease and another recruitment firm.

Viewpoint: “Active talent demand in the tech sector is displaying strong signs of positive movement in nearly three quarters,” said Krishna Gautam, business head of direct hiring – IT at Xpheno.

“Talent demand from the tech sector collective of IT services, software products and tech startups had its first growth period this fiscal,” he added. Gautam expects demand for IT talent to improve further to 150,000 in March.

Yes, but: These hiring mandates are based on predictions of future demand, and not all of them may lead to actual hiring. The mandates are given out to create a talent funnel which can be quickly absorbed.

Catch up quick: Last month, we reported that the total fresher hiring for the $250-billion IT sector in the ongoing fiscal year is estimated to drop by 60%-65% on year to 70,000-80,000 — the lowest intake in over two decades.

Teamlease expects the active demand to catalyse a hiring increase of 8.2% in anticipated turnaround from the second half of 2024.

Also read | Upbeat IT CEOs expecting tech spends to rise in 2024

Other Top Stories By Our Reporters

MeitY task force bats for startup product validation and certification centres: A 16-member task force to improve India’s domestic electronics manufacturing capabilities and create a roadmap to make the country a “product nation” is likely to suggest product validation and certification centres for electronics products of startups, and micro, small, and medium enterprises (MSMEs) so that they can be tested against global standards.

Innoviti Payments, Concerto Software get RBI payment aggregator licences: Offline point-of-sales deploying company Innoviti Payments and payment gateway Vegaah, which is run by Concerto Software and Systems, have secured online payment aggregator (PA) licences from the Reserve Bank of India, joining the likes of MSwipe, Razorpay, Cashfree, and Zomato.

Subko secures $10 million in funding led by Zerodha’s Nikhil Kamath: Subko, a speciality coffee roaster and craft bakehouse, has raised $10 million in a funding round led by Zerodha cofounder Nikhil Kamath. A clutch of investors including Blume Founders Fund, The Gauri Khan Family Trust, actor John Abraham, JSW Foundation’s Sangita Jindal, Srinivas and Pallavi Dempo, and The Mehta International Mauritius Ltd Group also participated.

Global Picks We Are Reading

■ Meta kills a crucial transparency tool at the worst possible time (Wired)

■ Law firm conflicts ‘permeated FTX’s bankruptcy’, professors allege (FT)

■ Ghost of Microsoft stalks Apple as DOJ takes its shot (WSJ)