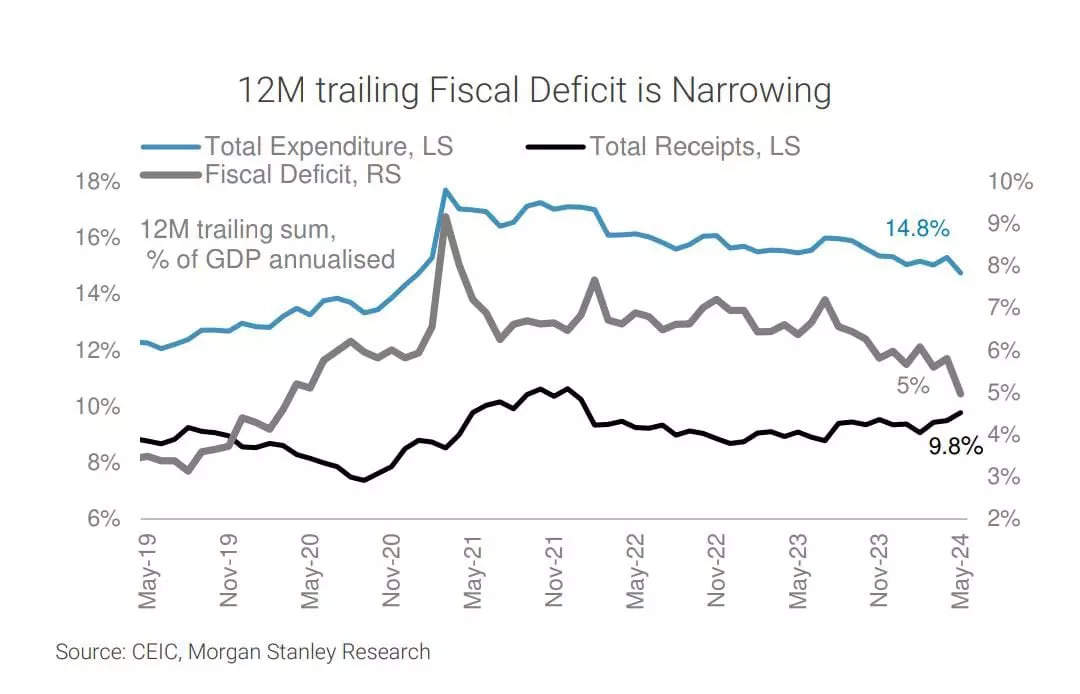

The policy-makers will continue to focus on fiscal prudence, in an attempt to align with the medium-term fiscal deficit target of 4.5 per cent of GDP by FY26, highlighted a latest report by Morgan Stanley.

A narrower-than-expected fiscal deficit for FY24 at 5.6 per cent of GDP is likely to provide a favourable starting point, while the higher-than-expected dividend from the RBI of Rs 2.1tn (0.4% of GDP) is likely to provide additional fiscal space.

The fiscal deficit is expected to consolidate to 5.1 per cent of GDP in FY25, as such the government should continue to maintain its emphasis on capital spending.

Expenditure mix to favour capex

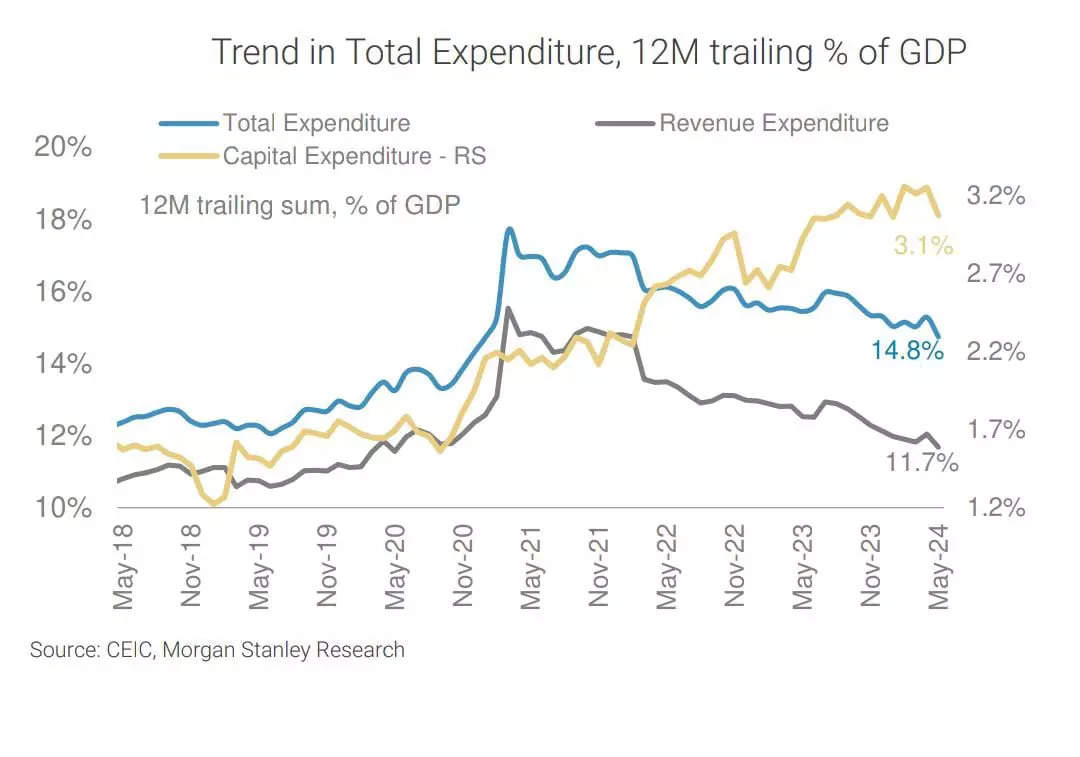

The government’s focus is likely to remain on improving the quality of overall expenditure and therefore the skew towards higher capital spending, relative to revenue expenditure, the report revealed.

The share of capex in GDP is likely to inch up higher (to 3.5 per cent of the GDP in FY25 vs. 3.2 per cent of GDP in FY24), even as the growth rate moderates from last year’s levels, similar to the interim budget forecasts.

In the last four years, capex has grown at a CAGR of 29.6 per cent outpacing revenue expenditure growth of 10.4 per cent. Within capital spending, allocation is expected to improve for infrastructure sectors (railways, roads) and also the focus to remain on infrastructure investments in rural areas, said the report.

This also ties in with the improved growth trend driven by capex and productivity as the benefits of scaling up infrastructure investments seep in.

The centre is likely to continue and even increase the allocation of funds towards 50-year interest-free loans to states, to incentivise state-led spending.

ALSO READ: Fiscal deficit may be budgeted below 5% GDP, borrowing to reduce: SBI Report

In addition, the interim budget included an additional provision worth Rs 750 billion to provide 50-year interest free loans to states, that encouraged growth enabling reforms. The reform momentum is anticipated to continue both at the centre and state level, it further added.

A corpus of Rs 704 billion was allocated to new schemes under the aegis of Ministry of Finance in the interim budget for FY25, this could potentially help private capex.

Path for Viksit Bharat

The budget will also lay the broad contours for the path of the economy to achieve the ‘Viksit Bharat’ goal by 2047, highlighted the Morgan Stanley report.

The core objective of the ‘Viksit Bharat’ vision is to foster inclusive economic participation among all citizens. The vision incorporates different parts of development, including social progress, environmental sustainability, economic growth and good governance, among others.

The budget will likely provide broad policy guidelines on these objectives and this is expected to be followed by more specific ministry level plans, the report said.

In terms of likely reforms, reforms in the arena of executive action is expected such as continued thrust on ease of doing business, scaling up physical infrastructure, improving ease of living, building social infrastructure, integrating with global supply chains, attracting FDI, implementing FTA’s etc, it added.

There is a lower probability to factor market reforms such as land and labour and overhauling the agriculture sector. If the government addresses factor market reforms and also improves agriculture productivity, that could push growth rates toward 8-10 per cent.