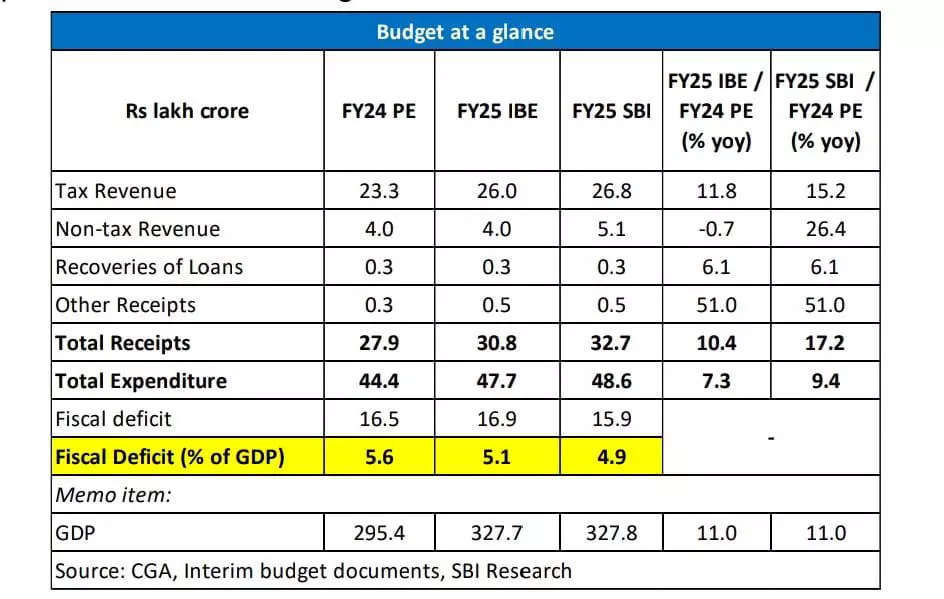

In the Interim Budget, Government has targeted fiscal deficit of 5.1 per cent of GDP for FY25, however on the back of stupendous growth in GST revenues along-with higher dividends from PSUs and RBI, it is believed that the Government may target fiscal deficit of less than 5 per cent of GDP (may be 4.9 per cent) for FY25, revealed a latest report by the State Bank of India.

Further, capital expenditure which was budgeted at Rs 11.1 lakh crore in the interim budget is expected to increase to Rs 11.8 lakh crore in the upcoming budget.

Thus, the total capex of the government (capex through budget & CPSE and Grants for creation of capital assets) is likely to increase to Rs 19.1 lakh crore in FY25 from Rs 18.4 lakh crore earlier.

Nominal GDP is expected to grow at 11 per cent and a tax buoyancy is expected to be between 1.2-1.3 with gross tax revenue growing over 13 per cent, said the report.

The report further asserted that the Government needs to focus on fiscal prudence and continue the fiscal consolidation path, however, it may refrain from obsessing too much over the fiscal stance as it may come in the way of long-term sustainable growth path and strike the right balance by limiting the consolidation to 20 bps (at max) this fiscal when compared to the interim budget.

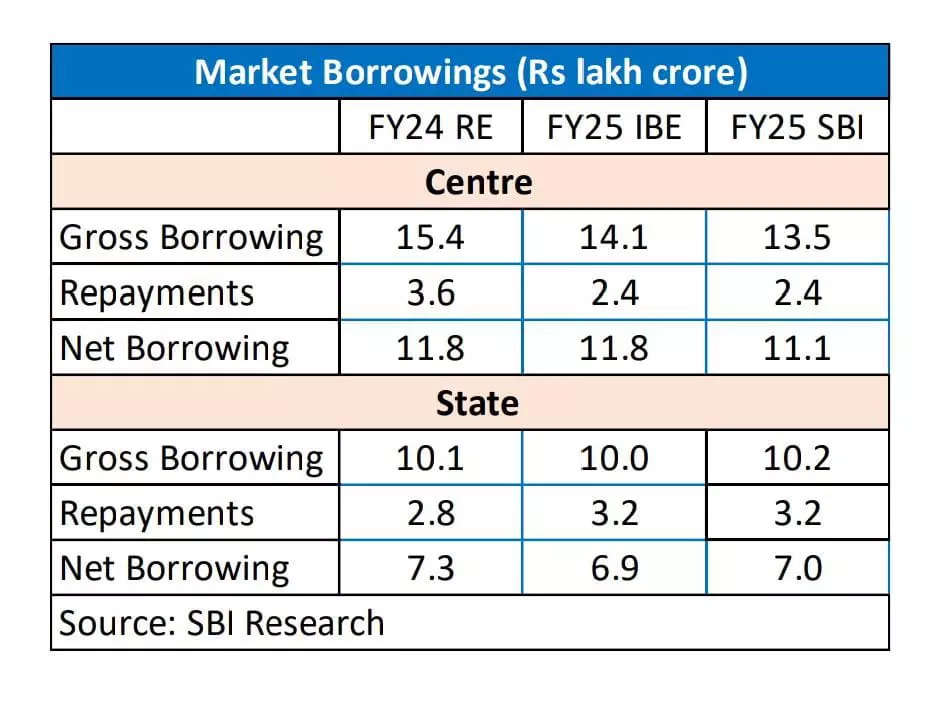

Government borrowing likely to reduce

As the budgeted fiscal deficit gets lowered, gross market borrowing of the government will also reduce to around Rs 13.5 lakh crore in FY25 compared to Rs 14.1 lakh crore in the interim budget.

Further net market borrowing might reduce to Rs 11.1 lakh crore against Rs 11.8 lakh crore earlier. This along with India’s inclusion in Global Bond indices will keep the yield curve movements anchored, said the report.

Tax Revenues

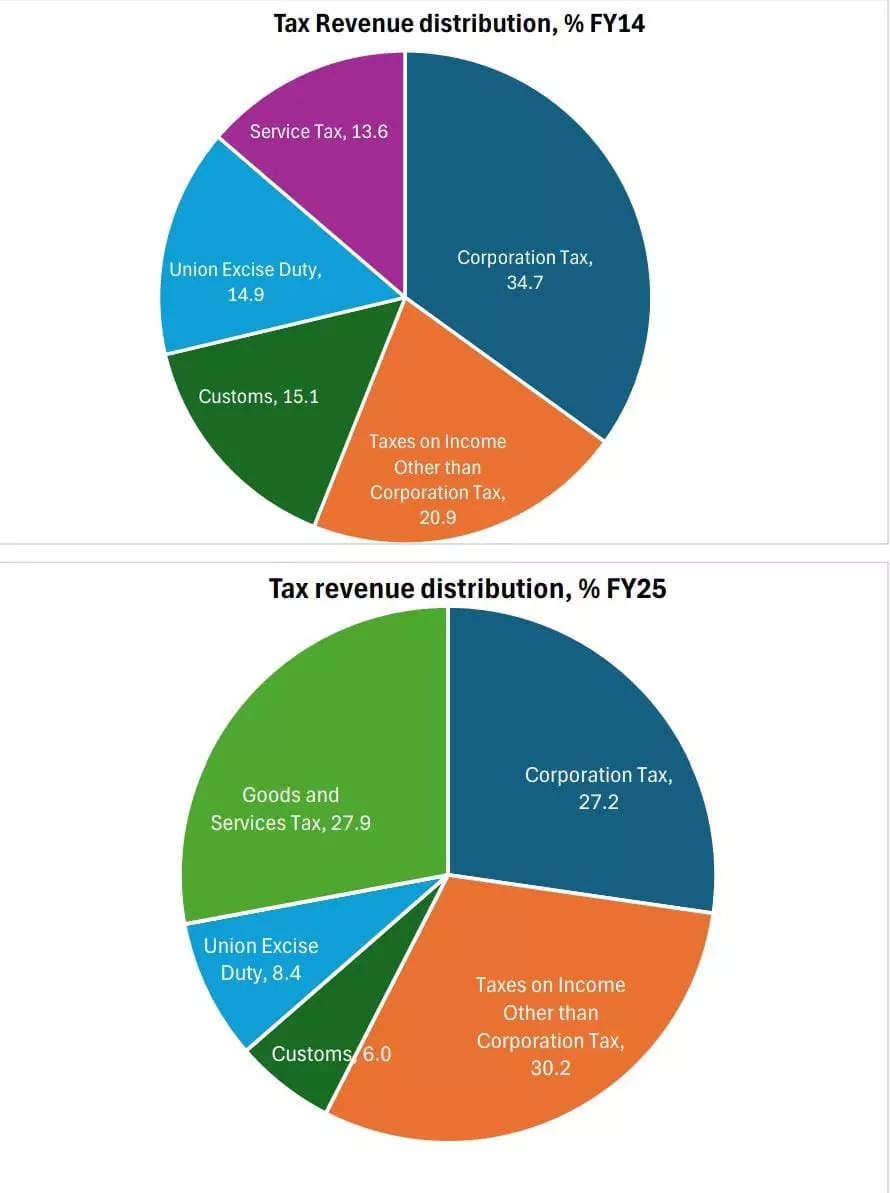

Share of tax non-tax revenue of the Centre has reduced over time. Meanwhile, within tax revenue the share of corporation tax has reduced while the share of income tax has increased during FY14 and FY25, said the report.

Further, there is a tax parity on term deposits in line with other asset classes. The present dispensation for Equity/MF holdings stipulate Short Term Capital Gains tax at a flat rate of 15 per cent while the Long-Term Capital Gains are taxed at a moderate 10 per cent, with exemption allowed till income of LTCG up to one lakh during a given financial year.

Also, the setting-off of loss against profits and carrying over the loss up to next eight years make the opportunity cost of such alternate investments quite lucrative.

It is proposed that the Government should tweak the ‘tax on deposits interest” and make flat tax treatment across maturity ladder, the report by SBI stated.