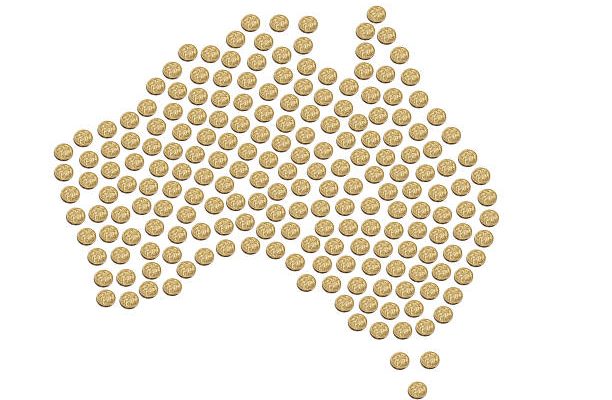

As the market transitions into US session, Australian Dollar maintains its position as the strongest currency of the day. While no significant economic data is expected from the US or Canada, the focus shifts to appearances by SNB Chair Thomas Jordan, as well as Fed officials Thomas Barkin and John Williams. However, traders are expected to look through these events, anticipating insights from the RBA’s decision.

Expectations are widespread that RBA will maintain its policy rate unchanged at 4.35%. Attention will be directed towards the new economic forecasts and the post-meeting press conference. The key question revolves around whether Governor Michele Bullock will shift her stance from a neutral position of “no ruling anything in or out” to a “tightening bias” stance.

Any shift in Bullock’s tone could indicate the central bank’s future direction, whether it’s on track for either a rate cut as some economists expect in November. Or a hike as forecasted by Judo Bank chief economic adviser Warren Hogan, top economic forecaster in the Australian Financial Review’s first annual ranking of economists in 2023.

In the broader currency markets, Sterling and Kiwi are also displaying strength. Yen trails as the weakest currency, followed by Swiss Franc and the Dollar. Euro and the Canadian Dollar occupy middle positions. This picture reflects a prevailing risk-on sentiment mirrored in the rally in major European indexes and US futures.

Technically, a major focus now is on AUD/USD. Current rise from 0.6361 is in progress for 100% projection of 0.6361 to 0.6585 from 0.6464 at 0.6688. Decisive break there could prompt upside acceleration, which would bolster the case that it’s indeed resuming the rally from 0.6269. That would in turn shift favor to the case that whole corrective fall from 0.7156 has completed at 0.6269 already. Let’s see how it goes.

In Europe, at the time of writing, UK is on holiday. DAX is up 0.99%. CAC is up 0.79%. Germany 10-year yield is down -0.0483 at 2.450. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 0.55%. China Shanghai SSE rose 1.16%. Singapore Strait Times rose 0.31%.

Eurozone PPI falls -0.4% mom, -7.8% yoy in Mar

Eurozone PPI fell -0.4% mom, -7.8% yoy in March. For the month, industrial producer prices increased by 0.1% for intermediate goods, 0.1% for capital goods, 0.1% for durable consumer goods, and 0.4% for non-durable consumer goods. Prices decreased by -1.8% for energy.

EU PPI fell -0.5% mom, -7.6% yoy. Among Member States for which data are available, the largest monthly decreases in industrial producer prices were recorded in Bulgaria (-3.4%), Denmark and Greece (both -2.3%) and Spain (-2.2%). Increases were observed in Ireland and Sweden (both +0.9%) as well as in Germany and Croatia (both +0.2%).

Eurozone Sentix rises to -3.6, window for ECB rate cut limited

Eurozone Sentix Investor Confidence rose from -5.9 to -3.6 in May, above expectation of -4.8. This marks the seventh consecutive increase and the highest level since February 2022. Additionally, Current Situation Index climbed from -16.3 to -14.3, marking seven consecutive increases and reaching its highest point since May 2023. Expectations Index also saw growth, rising from 5.0 to 7.8, marking eight consecutive increases and reaching its highest level since February 2022.

Sentix noted that while the data presents an encouraging picture, indicating a gradual recovery from the economic challenges of the past two years, underlying weaknesses in momentum persist. The rise in expectations, though positive, is described as “very sluggish” and has yet to substantially impact the situation values.

As for ECB, Sentix said the window for cutting interest rate “does not appear to be very large”. Despite improvements in the economy, a deteriorating inflation environment adds pressure to bond markets.

Eurozone PMI services finalized at 53.3, highest in 11 months

Eurozone’s PMI services index was finalized at to 53.3 in April, marking a notable improvement from March’s 51.5. PMI Composite was finalized at 51.7, up from the previous month’s 50.3 Both reached the highest levels in 11 months.

Notable country-level performances on PMI Composite include Spain reaching a 12-month high at 55.7, Germany achieving a 10-month high at 50.6, and France hitting an 11-month high at 50.5. However, Italy recorded a two-month low at 52.6, and Ireland saw a six-month low at 50.4.

Chief Economist at Hamburg Commercial Bank, Cyrus de la Rubia, highlighted the positive momentum, noting that service providers have witnessed growth for the third consecutive month, signaling an end to the lackluster performance observed in the latter half of the previous year. He emphasized the uptick in employment, new business, and order book growth, which reached its strongest expansion in eleven months.

However, concerns regarding operating costs persist, with PMI index for operating costs in the service sector continuing to rise rapidly over the past year. De la Rubia cautioned that ECB is likely to adopt a cautious approach regarding potential rate cuts, given this trend. Despite this, service companies have managed to offset some of the cost increases by passing them on to consumers, reflecting improving demand conditions.

China’s Caixin PMI services dips to 52.5, weak expectations a major hurdle

China’s Caixin PMI Services for April, while dipping slightly from 52.7 to 52.5 as expected, maintains a growth streak for the 16th consecutive month. The sector sees robust expansion in new business, marking its fastest pace in nearly a year. Business confidence also reaches its peak for the year so far. PMI Composite, which edged up from 52.7 to 52.8, reached its highest level since May 2023

“The growth in supply and demand in the manufacturing and services sectors picked up pace, with outstanding export growth,” notes Wang Zhe, Senior Economist at Caixin Insight Group. However, Wang cautions, “the pressure on the job market should not be overlooked,” with employment metrics experiencing a sharper decline compared to the previous month.

Furthermore, Wang highlights the persistent challenges in pricing dynamics, stating that “input and output prices remained relatively low, particularly due to the drag from manufacturing factory gate prices.”

Wang noted, “Weak expectations remain one of the major hurdles facing economic development, leading to increasing pressure on employment and a greater risk of deflation.”

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9001; (P) 0.9055; (R1) 0.9104; More….

Outlook in USD/CHF is unchanged and intraday bias stays on the downside. Sustained break of 55 D EMA (now at 0.8993) will bring deeper fall to 38.2% retracement of 0.8332 to 0.9223 at 0.8883. On the upside, above 0.9087 minor resistance will turn intraday bias again first.

In the bigger picture, price actions from 0.8332 medium term bottom are tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Rejection by 0.9243 resistance, followed by sustained break of 38.2% retracement of 0.8332 to 0.9223 at 0.8883 will strengthen this case, and maintain medium term bearishness. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish for 1.0146.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M Apr | 0.10% | 0.10% | ||

| 01:45 | CNY | Caixin Services PMI Apr | 52.5 | 52.5 | 52.7 | |

| 07:45 | EUR | Italy Services PMI Apr | 54.3 | 54.7 | 54.6 | |

| 07:50 | EUR | France Services PMI Apr | 51.3 | 50.5 | 50.5 | |

| 07:55 | EUR | Germany Services PMI Apr F | 53.2 | 53.3 | 53.3 | |

| 08:00 | EUR | Eurozone Services PMI Apr F | 53.3 | 52.9 | 52.9 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence May | -3.6 | -4.8 | -5.9 | |

| 09:00 | EUR | Eurozone PPI M/M Mar | -0.40% | -0.70% | -1.00% | -1.10% |

| 09:00 | EUR | Eurozone PPI Y/Y Mar | -7.8% | -8.30% | -8.50% |