In its monthly economic review for August published on Friday, the Department of Economic Affairs (DEA) said that the prices of selected food items that drove the inflation rate above 7 per cent in July are on the retreat.

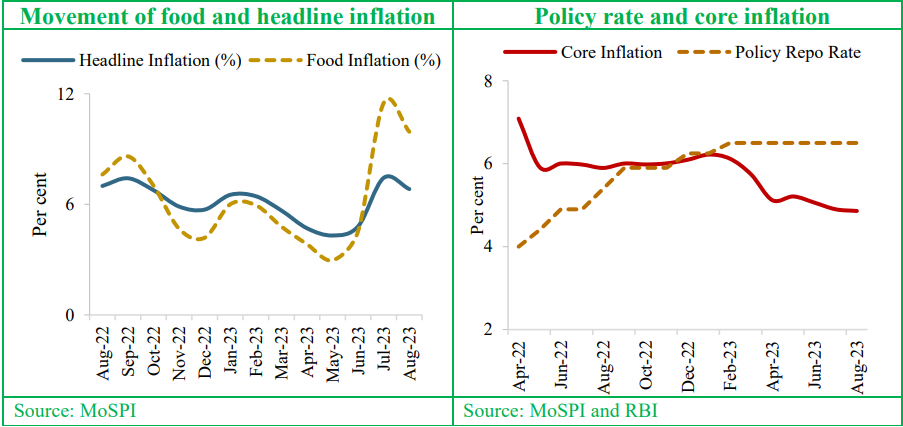

“The calibrated measures taken by the Government, including adjustments in the duties of many critical inputs and monetary policy tightening, helped to reduce core inflation,” the DEA said in its report.

In its report, the department specified that the government’s targeted measures for specific crops, including build-up of buffer, procurement from producing centres and subsidized distribution enabled easing of inflation in the country.

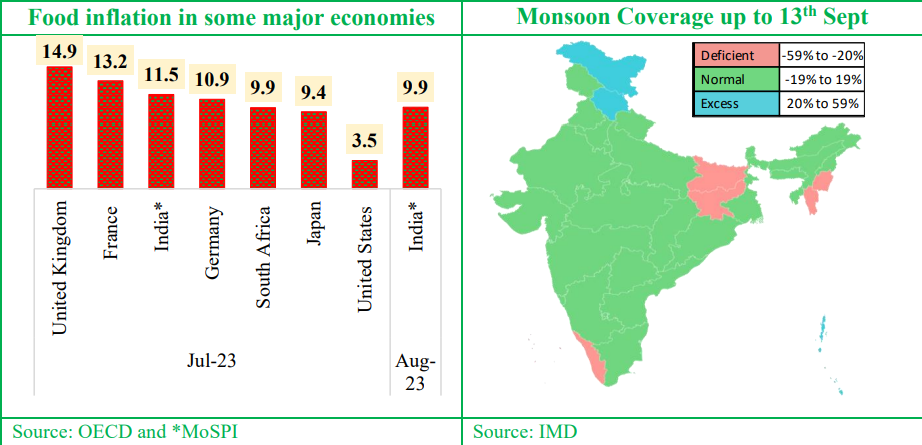

Amid growing food inflation in major economies inter alia France, Germany, Japan, South Africa, and UK, India on the other hand saw a dip in its retail inflation. As of August, consumer food price inflation eased to 9.9 per cent from 11.5 per cent in July.

Vegetable inflation, however, surged in both July and August due to various factors including a sudden price rise in tomatoes and other food items, due to crop specific and weather-related factors like rain deficiency in the country.

Nonetheless, the average inflation during April-August 2023, was 5.6 per cent, which is within the RBI tolerance limit of 2-6 per cent.

Meanwhile, the economy’s outlook report highlighted that the monsoon deficit in August could impact both Kharif and Rabi crops which requires assessment. However, it is a relief that the monsoon deficit of August has been partially plugged in September, the report added.

Despite a 10 per cent deficient monsoon this year, vis-a-vis June-September, The kharif sowing (excluding cotton) is 0.8 per cent higher than the corresponding period last year, as of September 15.

As per the economic review, normal or excess rains were received in around 83 per cent of the country’s area.

While the sown area under pulses and oil seeds remains lower than year ago period, the sowing of kharif rice has emerged as major contributor to the growth with 2.7 per cent higher than 2022.

The DEA’s outlook did mention an emerging concern which is the recent run-up in oil prices. “But, no alarms yet,” it said.

Oil prices hovered near 10-month highs this week, as a bigger-than-expected draw in US oil stockpiles along with weak US shale output reinforcing fears of tight crude supply for the rest of 2023.

Global benchmark Brent crude futures climbed 6 cents, or 0.1%, to $94.40 a barrel on September 20, staying near the highest since November of $95.96 hit on the previous day.

Earlier this week, industry data showed U.S. crude oil stockpiles fell last week by about 5.25 million barrels, Reuters reported.

As per a Bloomberg report, Goldman Sachs Group Inc. rejoined the $100-a-barrel oil club, raising its forecast for crude back to triple digits as worldwide demand hits unprecedented levels and OPEC+ supply curbs continue to tighten the market.

The DEA’s outlook remains bright for FY24 amid continued momentum in economic activity.

“In sum, we remain comfortable with our 6.5 per cent real GDP growth estimate for FY24 with symmetric risks,” it said.