Trading in the forex markets remains subdued today as investors take a breather from a week of high volatility. Most major currency pairs and crosses are trading within yesterday’s ranges, with little reaction to US PCE inflation data. Annual Core PCE rate was surprisingly unchanged in June, but the slight monthly increase still indicates that disinflation is in progress, keeping investors relatively calm.

In other markets, US futures are trading sharply higher, suggesting that tech shares, in particular, are set to recover some of this week’s steep losses. 10-year Treasury yield is slightly down, continuing its recent range-bound pattern. Gold is attempting to find support at the 55 D EMA to maintain its near-term bullish outlook, while WTI crude oil is struggling to reclaim 80 handle despite recovery yesterday.

In Europe, at the time of writing, FTSE is up 0.88%. DAX is up 0.41%. CAC is up 0.85%. UK 10-year yield is down -0.030 at 4.107. Germany 10-year yield is up 0.013 at 2.435. Earlier in Asia, Nikkei fell -0.53%. Hong Kong HSI rose 0.10%. China Shanghai SSE rose 0.14%. Singapore Strait Times fell -0.12%. Japan 10-year JGB yield fell -0.0128 to 1.062.

US PCE inflation slows to 2.5% in Jun, but core PCE unchanged at 2.6%

US PCE price index rose 0.1% mom in June, matched expectations. Core CPI (excluding food and energy) rose 0.2% mom, matched expectations. Prices for goods decreased -0.2% mom and prices for services increased 0.2% mom. Food prices increased 0.1% mom and energy prices decreased -2.1% mom.

From the same month one year ago, PCE price index growth slowed from 2.6% yoy to 2.5% yoy, matched expectations. However, core PCE price index was unchanged at 2.6% yoy, above expectation of 2.5% yoy. Prices for goods decreased -0.2% yoy and prices for services increased 3.9% yoy. Food prices increased 1.4% yoy and energy prices increased 2.0% yoy.

Personal income rose 0.2% mom or USD 50.4B, below expectation of 0.4% mom. Personal spending rose 0.3% mom or USD 57.6B, matched expectations.

ECB consumer survey: Inflation expectations steady, economic growth outlook deteriorates

The latest ECB Consumer Expectations Survey results revealed stable inflation expectations but a more negative outlook for economic growth.

Median inflation expectations for the next 12 months remained unchanged at 2.8%, holding at their lowest level since September 2021. Similarly, inflation expectations for three years ahead stayed steady at 2.3%.

However, economic growth projections have taken a downturn. Expectations for growth over the next 12 months worsened, with the median forecast dropping to -0.9%, compared to -0.8% in May.

On a positive note, expectations for the unemployment rate in 12 months’ time decreased slightly to 10.6% from 10.7% in May, marking the lowest level since the series began.

Tokyo CPI core rises, but core-core falls; BoJ rate hike uncertainty persists

Japan’s Tokyo CPI core (excluding food) increased from 2.1% yoy to 2.2% yoy in July, aligning with market expectations. This marks the third consecutive month of re-acceleration following a dip to 1.6% yoy in April. The primary driver of this uptick was energy prices, with electricity costs soaring by 19.7% yoy due to the termination of government utility subsidies.

However, other inflation measures showed a slowdown. CPI core-core (excluding food and energy) dropped from 1.8% yoy to 1.5% yoy. Additionally, services inflation decreased from 0.9% yoy to 0.5% yoy, while headline CPI fell slightly from 2.3% yoy to 2.2% yoy.

The increase in core inflation maintains the possibility of a BoJ rate hike next week. However, the current data is not sufficiently conclusive to confirm this outcome. Swap markets indicate a 38% probability of a 15bps hike. A Bloomberg survey reveals that 30% of BoJ watchers anticipate a hike, with 90% viewing it as a potential risk.

USD/JPY Mid-Day Outlook

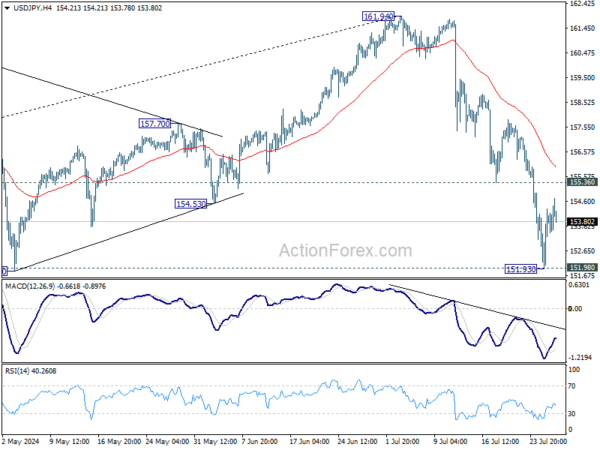

Daily Pivots: (S1) 152.48; (P) 153.40; (R1) 154.86; More…

Intraday bias in USD/JPY remains neutral as consolidations continue above 151.93 temporary low. Risk will stay on the downside as long as 155.36 support turned resistance holds. Decisive break of 151.89 resistance turned support will argue that large scale correction is underway to 148.66 fibonacci level. Nevertheless, break of 155.36 will turn bias back to the upside for stronger rebound.

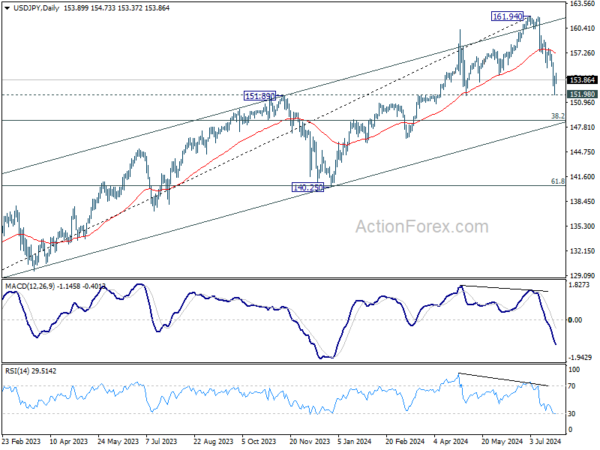

In the bigger picture, considering the depth and momentum of the current decline, 161.94 should be a medium term top already. Fall from there is seen as correcting the whole rise from 127.20 (2023 low) at least. Break of 151.89 will pave the way to 38.2% retracement of 127.20 to 161.94 at 148.66. Risk will now stay on the downside as long as 55 D EMA (now at 157.25) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jul | 2.20% | 2.30% | ||

| 23:30 | JPY | Tokyo CPI Core Y/Y Jul | 2.20% | 2.20% | 2.10% | |

| 23:30 | JPY | Tokyo CPI Core-Core Y/Y Jul | 1.50% | 1.80% | ||

| 12:30 | USD | Personal Income M/M Jun | 0.20% | 0.40% | 0.50% | |

| 12:30 | USD | Personal Spending Jun | 0.30% | 0.30% | 0.20% | |

| 12:30 | USD | PCE Price Index M/M Jun | 0.10% | 0.10% | 0.00% | |

| 12:30 | USD | PCE Price Index Y/Y Jun | 2.50% | 2.50% | 2.60% | |

| 12:30 | USD | Core PCE Price Index M/M Jun | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | Core PCE Price Index Y/Y Jun | 2.60% | 2.50% | 2.60% | |

| 14:00 | USD | Michigan Consumer Sentiment Jul F | 66 | 66 |