By InvestMacro

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday September 10th and shows a quick view of how large market participants (for-profit speculators and commercial traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

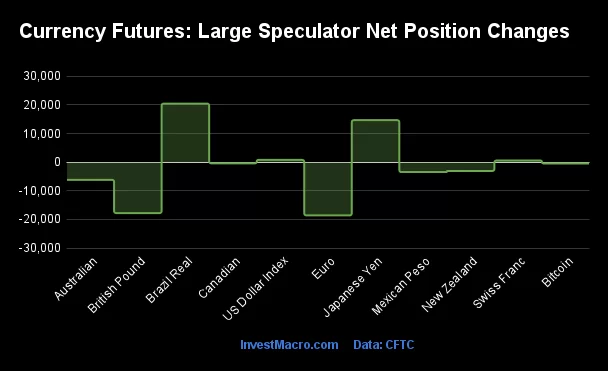

Weekly Speculator Changes led by Brazilian Real & Japanese Yen

The COT currency market speculator bets were overall lower this week as four out of the eleven currency markets we cover had higher positioning while the other seven markets had lower speculator contracts.

Leading the gains for the currency markets was the Brazilian Real (20,447 contracts) with the Japanese Yen (14,654 contracts), the US Dollar Index (781 contracts) and the Swiss Franc (578 contracts) also showing positive weeks.

The currencies seeing declines in speculator bets on the week were the EuroFX (-18,585 contracts), the British Pound (-17,790 contracts), the Australian Dollar (-6,178 contracts), the Mexican Peso (-3,453 contracts), the New Zealand Dollar (-3,077 contracts), Bitcoin (-461 contracts) and with the Canadian Dollar (-409 contracts) also registering lower bets on the week.

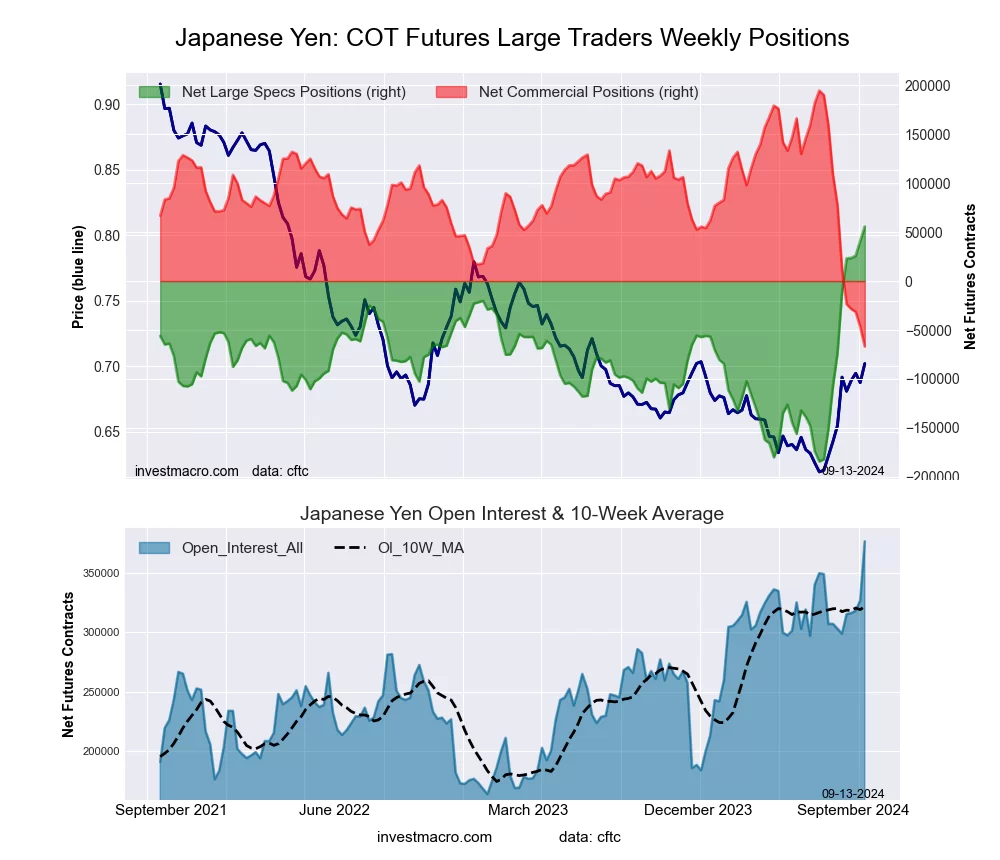

Forex Speculators push Japanese Yen bets higher for record 10-week gain

Highlighting the COT currency’s data this week is the boost in bullish bets for the Japanese yen speculators. Japanese yen bets have continued their remarkable turnaround over the past couple of months with this week marking a tenth consecutive weekly gain.

This week’s increase in the speculator positioning was the second straight weekly rise by over +14,000 contracts and brings the total increase in speculator bets over the past ten weeks to a total of +239,993 contracts — the highest 10-week cumulative change on record. The yen speculator standing has now gone from a total of -184,223 contracts on July 2nd to a total standing this week at +55,770 contracts. This week’s standing also marks the most bullish level since October 4th of 2016.

The yen sentiment has been boosted by the Bank of Japan (BOJ) who is changing their interest rate policy from negative rates previously to a cautious increase of rates beginning with their recent July hike. According to Reuters, analysts are expecting the BOJ to increase their rates again by the end of the year.

The yen exchange rate versus the US dollar has benefited from a change in BOJ policy and has improved by approximately 15 percent from the low-point reached in July, according to this week’s closing prices. The yen rose this week by over 1 percent for a second consecutive weekly gain.

Currencies Net Speculators Leaderboard

Legend: Weekly Speculators Change | Speculators Current Net Position | Speculators Strength Score compared to last 3-Years (0-100 range)

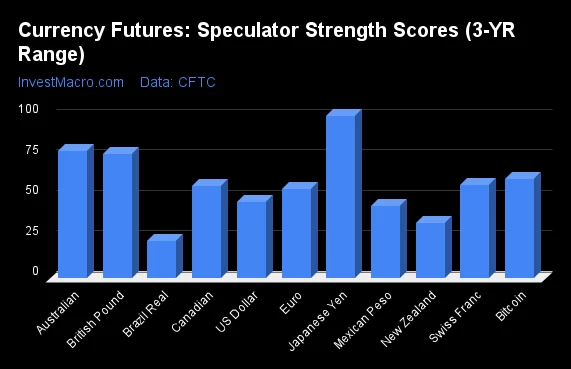

Strength Scores led by Japanese Yen & Australian Dollar

COT Strength Scores (a normalized measure of Speculator positions over a 3-Year range, from 0 to 100 where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the Japanese Yen (100 percent) and the Australian Dollar (79 percent) lead the currency markets this week. The British Pound (77 percent), Bitcoin (61 percent) and the Swiss Franc (58 percent) come in as the next highest in the weekly strength scores.

On the downside, the Brazilian Real (23 percent) and the New Zealand Dollar (35 percent) come in at the lowest strength levels currently. The next lowest strength score is the Mexican Peso (45 percent).

Strength Statistics:

US Dollar Index (47.1 percent) vs US Dollar Index previous week (45.5 percent)

EuroFX (55.0 percent) vs EuroFX previous week (62.9 percent)

British Pound Sterling (76.7 percent) vs British Pound Sterling previous week (84.7 percent)

Japanese Yen (100.0 percent) vs Japanese Yen previous week (93.9 percent)

Swiss Franc (57.7 percent) vs Swiss Franc previous week (56.5 percent)

Canadian Dollar (57.1 percent) vs Canadian Dollar previous week (57.2 percent)

Australian Dollar (78.8 percent) vs Australian Dollar previous week (84.0 percent)

New Zealand Dollar (34.5 percent) vs New Zealand Dollar previous week (40.4 percent)

Mexican Peso (44.7 percent) vs Mexican Peso previous week (46.4 percent)

Brazilian Real (23.3 percent) vs Brazilian Real previous week (3.9 percent)

Bitcoin (61.1 percent) vs Bitcoin previous week (68.0 percent)

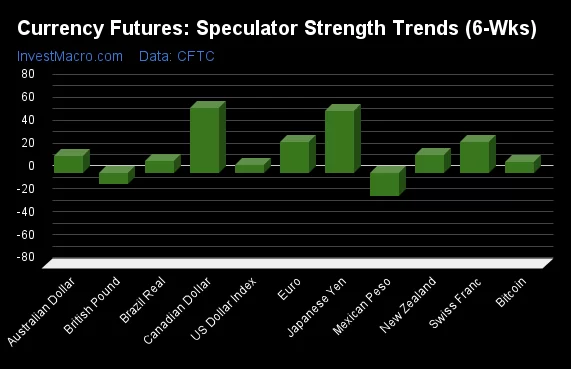

Canadian Dollar & Japanese Yen top the 6-Week Strength Trends

COT Strength Score Trends (or move index, calculates the 6-week changes in strength scores) showed that the Canadian Dollar (57 percent) and the Japanese Yen (54 percent) lead the past six weeks trends for the currencies. The EuroFX (27 percent), the Swiss Franc (27 percent) and the New Zealand Dollar (16 percent) are the next highest positive movers in the latest trends data.

The Mexican Peso (-20 percent) leads the downside trend scores currently with the British Pound (-10 percent) following next with lower trend scores.

Strength Trend Statistics:

US Dollar Index (6.9 percent) vs US Dollar Index previous week (2.6 percent)

EuroFX (27.1 percent) vs EuroFX previous week (27.3 percent)

British Pound Sterling (-9.5 percent) vs British Pound Sterling previous week (-15.3 percent)

Japanese Yen (53.8 percent) vs Japanese Yen previous week (61.8 percent)

Swiss Franc (26.8 percent) vs Swiss Franc previous week (41.2 percent)

Canadian Dollar (57.1 percent) vs Canadian Dollar previous week (41.7 percent)

Australian Dollar (14.6 percent) vs Australian Dollar previous week (0.8 percent)

New Zealand Dollar (15.6 percent) vs New Zealand Dollar previous week (-9.1 percent)

Mexican Peso (-19.9 percent) vs Mexican Peso previous week (-19.1 percent)

Brazilian Real (10.2 percent) vs Brazilian Real previous week (-8.4 percent)

Bitcoin (9.8 percent) vs Bitcoin previous week (11.6 percent)

Individual COT Forex Markets:

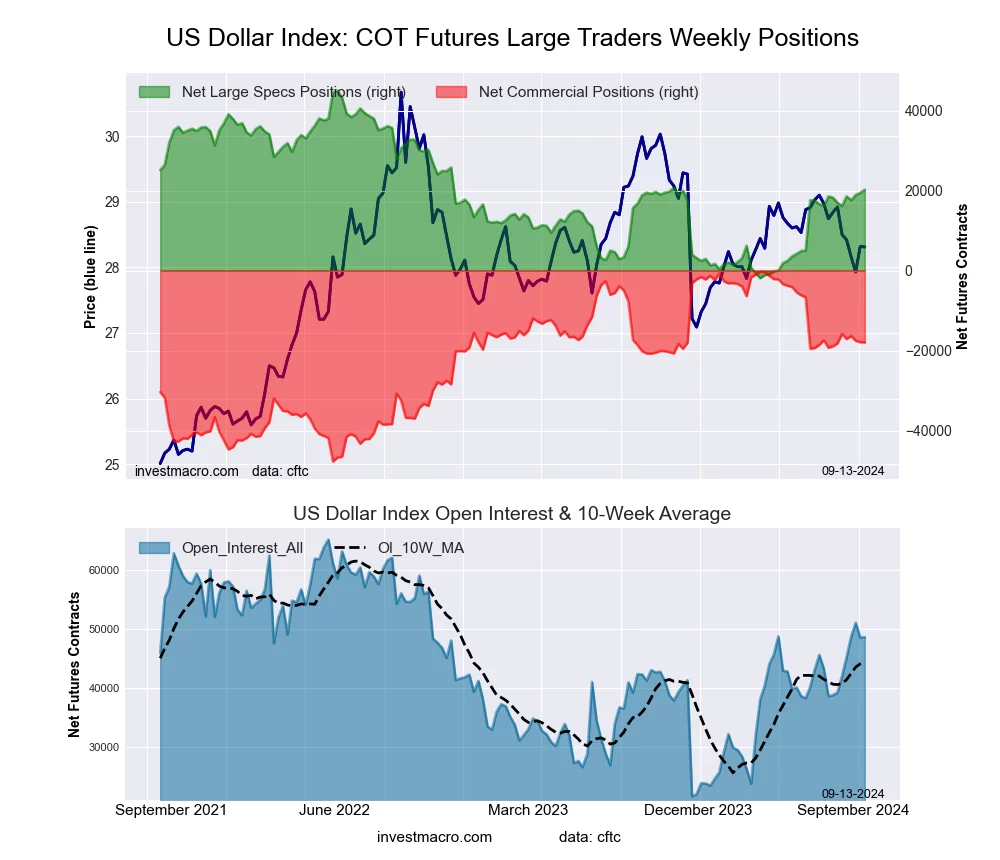

US Dollar Index Futures:

The US Dollar Index large speculator standing this week came in at a net position of 20,210 contracts in the data reported through Tuesday. This was a weekly advance of 781 contracts from the previous week which had a total of 19,429 net contracts.

The US Dollar Index large speculator standing this week came in at a net position of 20,210 contracts in the data reported through Tuesday. This was a weekly advance of 781 contracts from the previous week which had a total of 19,429 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 47.1 percent. The commercials are Bullish with a score of 62.7 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0 percent.

Price Trend-Following Model: Strong Downtrend

Our weekly trend-following model classifies the current market price position as: Strong Downtrend. The current action for the model is considered to be: Hold – Maintain Short Position.

| US DOLLAR INDEX Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 66.0 | 24.6 | 3.9 |

| – Percent of Open Interest Shorts: | 24.5 | 61.5 | 8.5 |

| – Net Position: | 20,210 | -17,979 | -2,231 |

| – Gross Longs: | 32,116 | 11,949 | 1,916 |

| – Gross Shorts: | 11,906 | 29,928 | 4,147 |

| – Long to Short Ratio: | 2.7 to 1 | 0.4 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 47.1 | 62.7 | 0.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 6.9 | 0.5 | -35.3 |

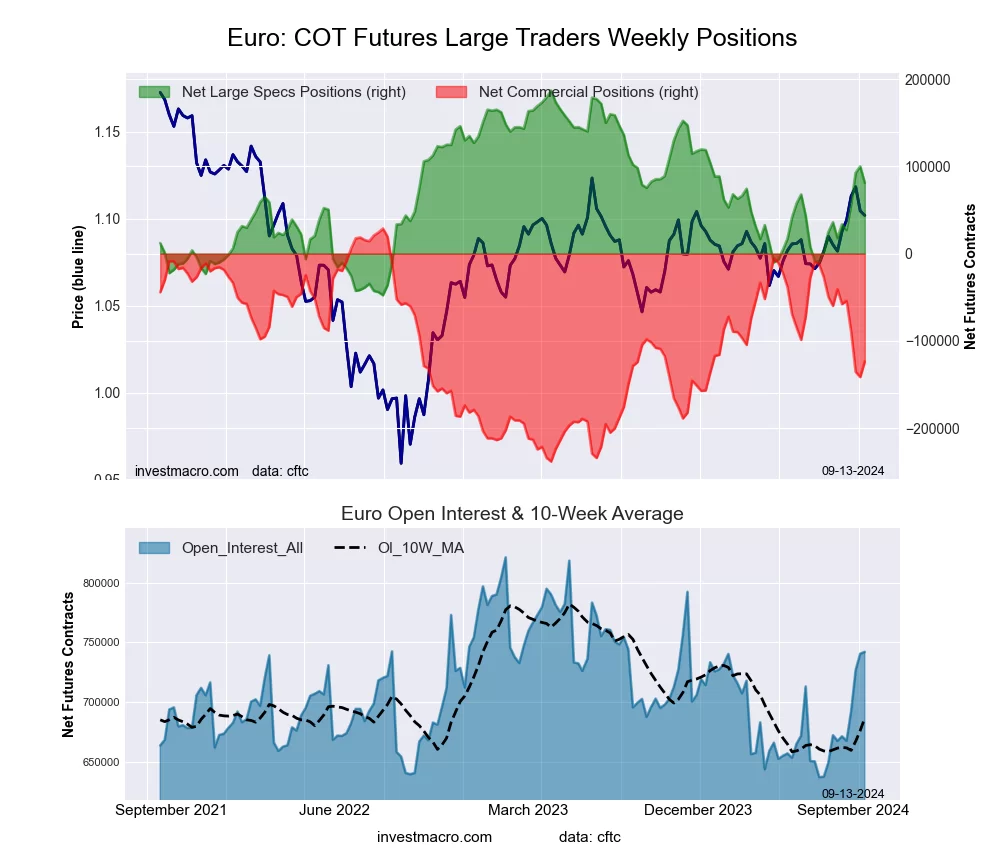

Euro Currency Futures:

The Euro Currency large speculator standing this week came in at a net position of 81,433 contracts in the data reported through Tuesday. This was a weekly decrease of -18,585 contracts from the previous week which had a total of 100,018 net contracts.

The Euro Currency large speculator standing this week came in at a net position of 81,433 contracts in the data reported through Tuesday. This was a weekly decrease of -18,585 contracts from the previous week which had a total of 100,018 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 55.0 percent. The commercials are Bearish with a score of 42.9 percent and the small traders (not shown in chart) are Bullish with a score of 66.6 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| EURO Currency Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.0 | 55.4 | 12.5 |

| – Percent of Open Interest Shorts: | 15.0 | 72.1 | 6.8 |

| – Net Position: | 81,433 | -123,807 | 42,374 |

| – Gross Longs: | 192,821 | 411,082 | 92,555 |

| – Gross Shorts: | 111,388 | 534,889 | 50,181 |

| – Long to Short Ratio: | 1.7 to 1 | 0.8 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 55.0 | 42.9 | 66.6 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 27.1 | -31.1 | 44.1 |

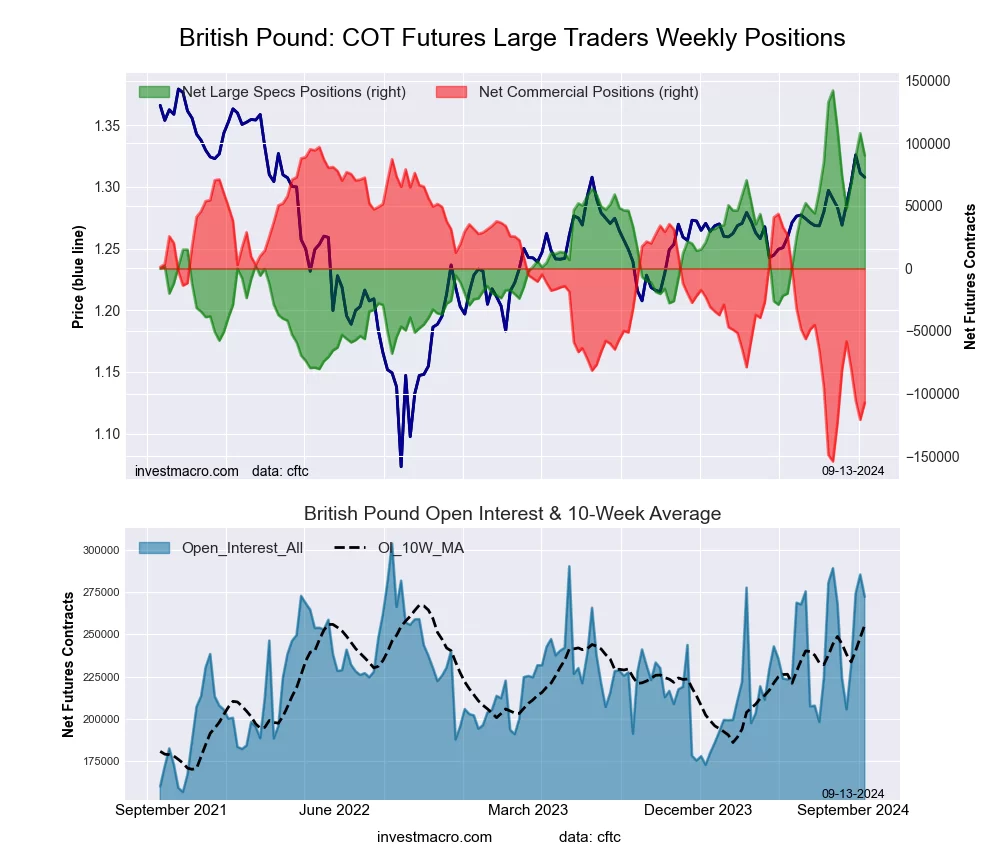

British Pound Sterling Futures:

The British Pound Sterling large speculator standing this week came in at a net position of 90,288 contracts in the data reported through Tuesday. This was a weekly decrease of -17,790 contracts from the previous week which had a total of 108,078 net contracts.

The British Pound Sterling large speculator standing this week came in at a net position of 90,288 contracts in the data reported through Tuesday. This was a weekly decrease of -17,790 contracts from the previous week which had a total of 108,078 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 76.7 percent. The commercials are Bearish-Extreme with a score of 18.7 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 97.9 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| BRITISH POUND Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 52.2 | 25.7 | 15.5 |

| – Percent of Open Interest Shorts: | 19.0 | 65.1 | 9.3 |

| – Net Position: | 90,288 | -107,278 | 16,990 |

| – Gross Longs: | 142,072 | 69,944 | 42,246 |

| – Gross Shorts: | 51,784 | 177,222 | 25,256 |

| – Long to Short Ratio: | 2.7 to 1 | 0.4 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 76.7 | 18.7 | 97.9 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.5 | 6.3 | 11.1 |

Japanese Yen Futures:

The Japanese Yen large speculator standing this week came in at a net position of 55,770 contracts in the data reported through Tuesday. This was a weekly gain of 14,654 contracts from the previous week which had a total of 41,116 net contracts.

The Japanese Yen large speculator standing this week came in at a net position of 55,770 contracts in the data reported through Tuesday. This was a weekly gain of 14,654 contracts from the previous week which had a total of 41,116 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 100.0 percent. The commercials are Bearish-Extreme with a score of 0.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| JAPANESE YEN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 26.3 | 59.4 | 11.3 |

| – Percent of Open Interest Shorts: | 11.5 | 77.1 | 8.4 |

| – Net Position: | 55,770 | -66,719 | 10,949 |

| – Gross Longs: | 98,894 | 223,698 | 42,728 |

| – Gross Shorts: | 43,124 | 290,417 | 31,779 |

| – Long to Short Ratio: | 2.3 to 1 | 0.8 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 100.0 | 0.0 | 100.0 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 53.8 | -55.2 | 40.4 |

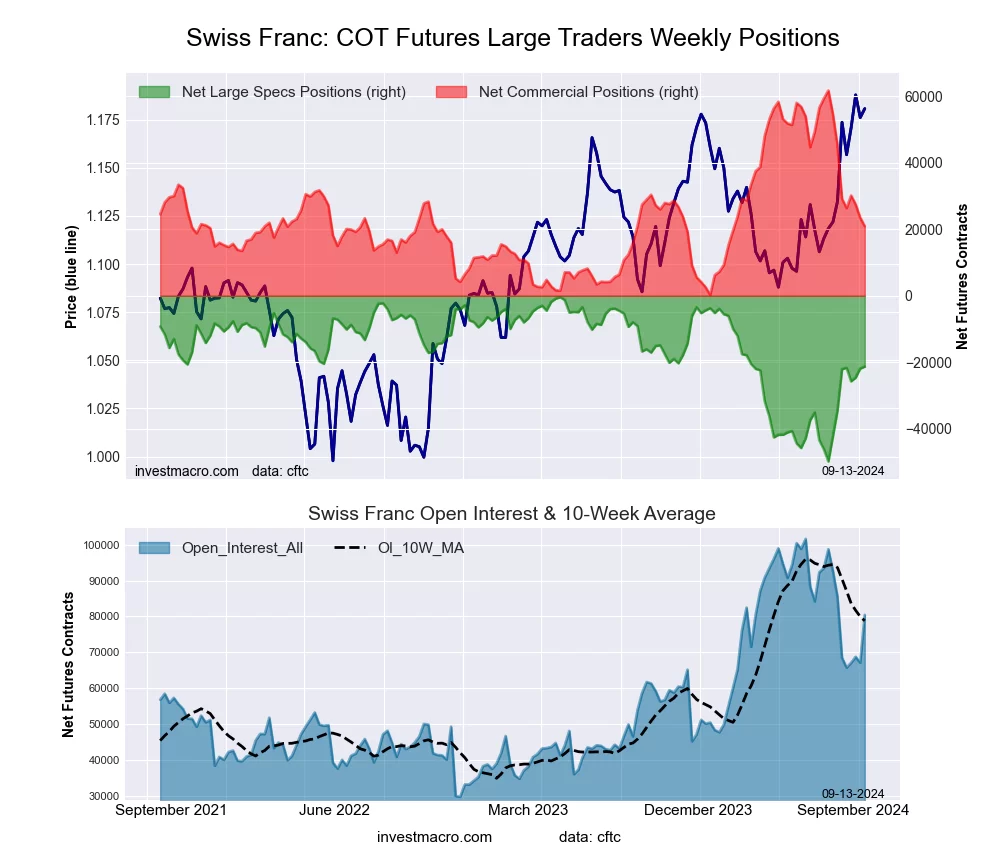

Swiss Franc Futures:

The Swiss Franc large speculator standing this week came in at a net position of -21,304 contracts in the data reported through Tuesday. This was a weekly advance of 578 contracts from the previous week which had a total of -21,882 net contracts.

The Swiss Franc large speculator standing this week came in at a net position of -21,304 contracts in the data reported through Tuesday. This was a weekly advance of 578 contracts from the previous week which had a total of -21,882 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.7 percent. The commercials are Bearish with a score of 33.6 percent and the small traders (not shown in chart) are Bullish with a score of 79.1 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| SWISS FRANC Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 10.0 | 66.7 | 19.5 |

| – Percent of Open Interest Shorts: | 36.5 | 40.7 | 19.0 |

| – Net Position: | -21,304 | 20,885 | 419 |

| – Gross Longs: | 8,082 | 53,642 | 15,706 |

| – Gross Shorts: | 29,386 | 32,757 | 15,287 |

| – Long to Short Ratio: | 0.3 to 1 | 1.6 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 57.7 | 33.6 | 79.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 26.8 | -39.5 | 50.2 |

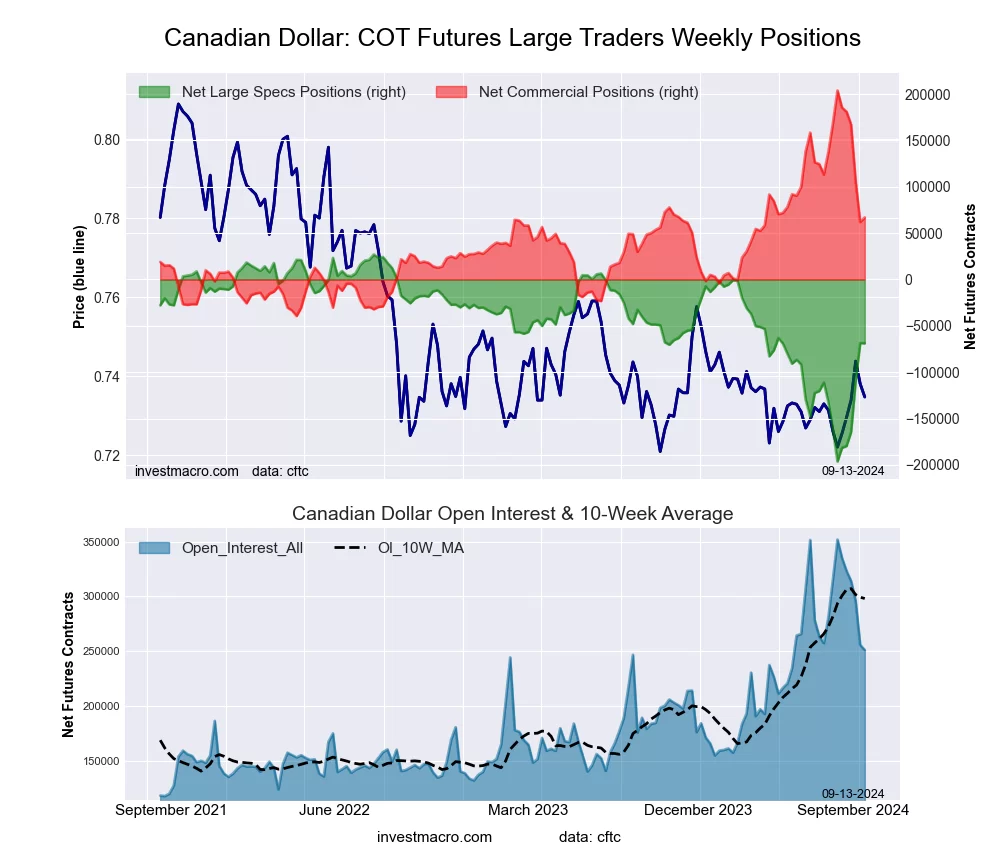

Canadian Dollar Futures:

The Canadian Dollar large speculator standing this week came in at a net position of -68,953 contracts in the data reported through Tuesday. This was a weekly decline of -409 contracts from the previous week which had a total of -68,544 net contracts.

The Canadian Dollar large speculator standing this week came in at a net position of -68,953 contracts in the data reported through Tuesday. This was a weekly decline of -409 contracts from the previous week which had a total of -68,544 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.1 percent. The commercials are Bearish with a score of 43.7 percent and the small traders (not shown in chart) are Bearish with a score of 36.8 percent.

Price Trend-Following Model: Strong Uptrend

Our weekly trend-following model classifies the current market price position as: Strong Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| CANADIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.5 | 70.4 | 12.3 |

| – Percent of Open Interest Shorts: | 36.9 | 43.7 | 11.5 |

| – Net Position: | -68,953 | 66,918 | 2,035 |

| – Gross Longs: | 23,773 | 176,814 | 30,986 |

| – Gross Shorts: | 92,726 | 109,896 | 28,951 |

| – Long to Short Ratio: | 0.3 to 1 | 1.6 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 57.1 | 43.7 | 36.8 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 57.1 | -56.3 | 28.2 |

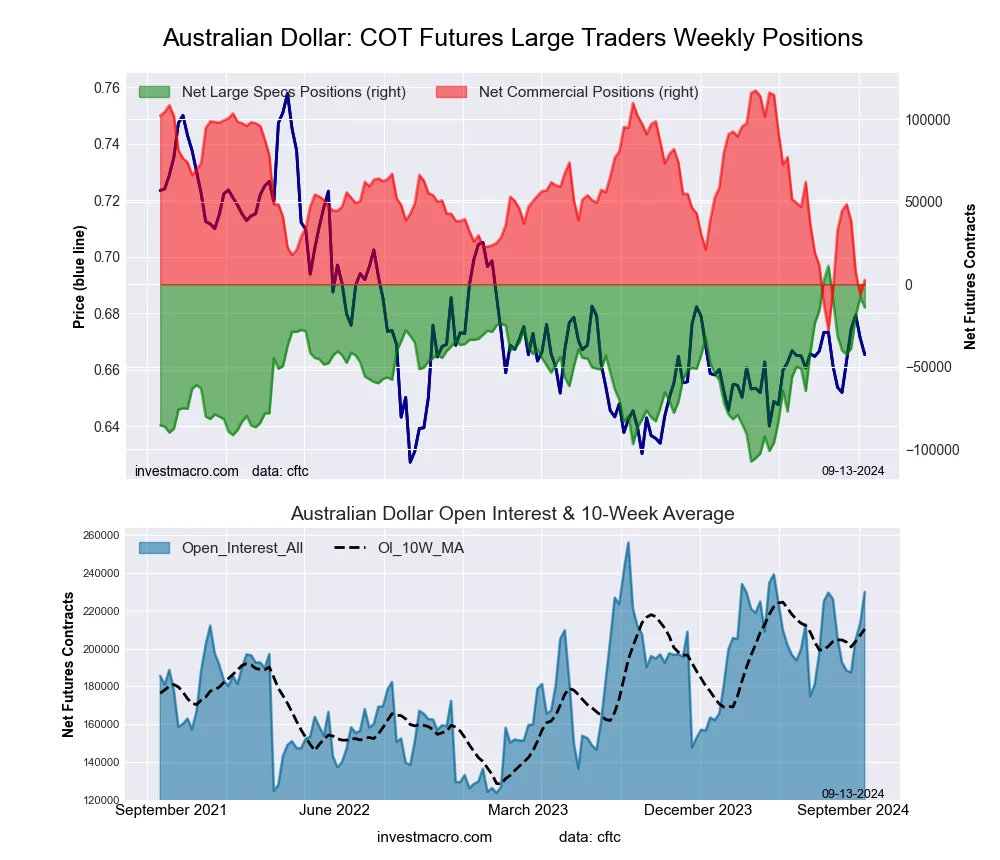

Australian Dollar Futures:

The Australian Dollar large speculator standing this week came in at a net position of -14,042 contracts in the data reported through Tuesday. This was a weekly fall of -6,178 contracts from the previous week which had a total of -7,864 net contracts.

The Australian Dollar large speculator standing this week came in at a net position of -14,042 contracts in the data reported through Tuesday. This was a weekly fall of -6,178 contracts from the previous week which had a total of -7,864 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 78.8 percent. The commercials are Bearish with a score of 21.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 85.3 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| AUSTRALIAN DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.3 | 49.7 | 13.1 |

| – Percent of Open Interest Shorts: | 38.4 | 48.6 | 8.1 |

| – Net Position: | -14,042 | 2,620 | 11,422 |

| – Gross Longs: | 74,259 | 114,426 | 30,094 |

| – Gross Shorts: | 88,301 | 111,806 | 18,672 |

| – Long to Short Ratio: | 0.8 to 1 | 1.0 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 78.8 | 21.0 | 85.3 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.6 | -20.8 | 35.5 |

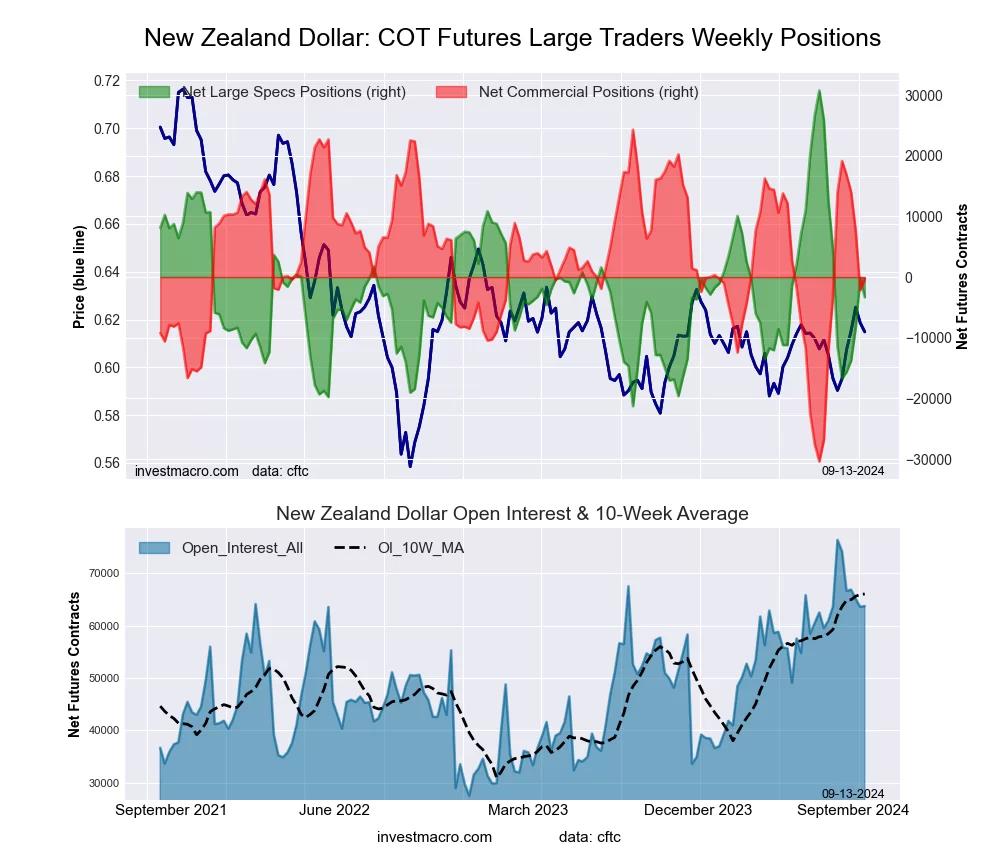

New Zealand Dollar Futures:

The New Zealand Dollar large speculator standing this week came in at a net position of -3,315 contracts in the data reported through Tuesday. This was a weekly fall of -3,077 contracts from the previous week which had a total of -238 net contracts.

The New Zealand Dollar large speculator standing this week came in at a net position of -3,315 contracts in the data reported through Tuesday. This was a weekly fall of -3,077 contracts from the previous week which had a total of -238 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 34.5 percent. The commercials are Bullish with a score of 54.9 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

Price Trend-Following Model: Uptrend

Our weekly trend-following model classifies the current market price position as: Uptrend. The current action for the model is considered to be: Hold – Maintain Long Position.

| NEW ZEALAND DOLLAR Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 33.6 | 49.5 | 10.9 |

| – Percent of Open Interest Shorts: | 38.8 | 50.0 | 5.1 |

| – Net Position: | -3,315 | -347 | 3,662 |

| – Gross Longs: | 21,394 | 31,511 | 6,929 |

| – Gross Shorts: | 24,709 | 31,858 | 3,267 |

| – Long to Short Ratio: | 0.9 to 1 | 1.0 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 34.5 | 54.9 | 100.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 15.6 | -26.2 | 79.1 |

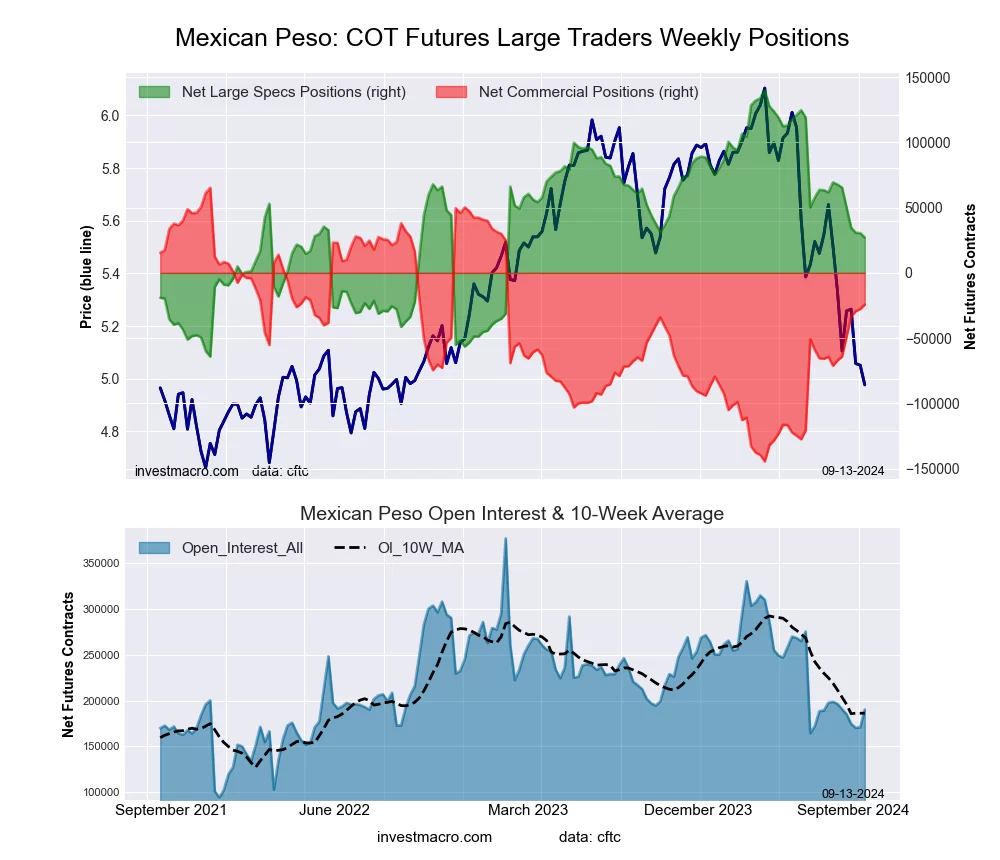

Mexican Peso Futures:

The Mexican Peso large speculator standing this week came in at a net position of 27,026 contracts in the data reported through Tuesday. This was a weekly fall of -3,453 contracts from the previous week which had a total of 30,479 net contracts.

The Mexican Peso large speculator standing this week came in at a net position of 27,026 contracts in the data reported through Tuesday. This was a weekly fall of -3,453 contracts from the previous week which had a total of 30,479 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 44.7 percent. The commercials are Bullish with a score of 57.3 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend. The current action for the model is considered to be: Hold – Maintain Short Position.

| MEXICAN PESO Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.9 | 58.2 | 2.0 |

| – Percent of Open Interest Shorts: | 18.7 | 70.9 | 3.5 |

| – Net Position: | 27,026 | -24,212 | -2,814 |

| – Gross Longs: | 62,614 | 110,666 | 3,879 |

| – Gross Shorts: | 35,588 | 134,878 | 6,693 |

| – Long to Short Ratio: | 1.8 to 1 | 0.8 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 44.7 | 57.3 | 0.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -19.9 | 20.4 | -13.2 |

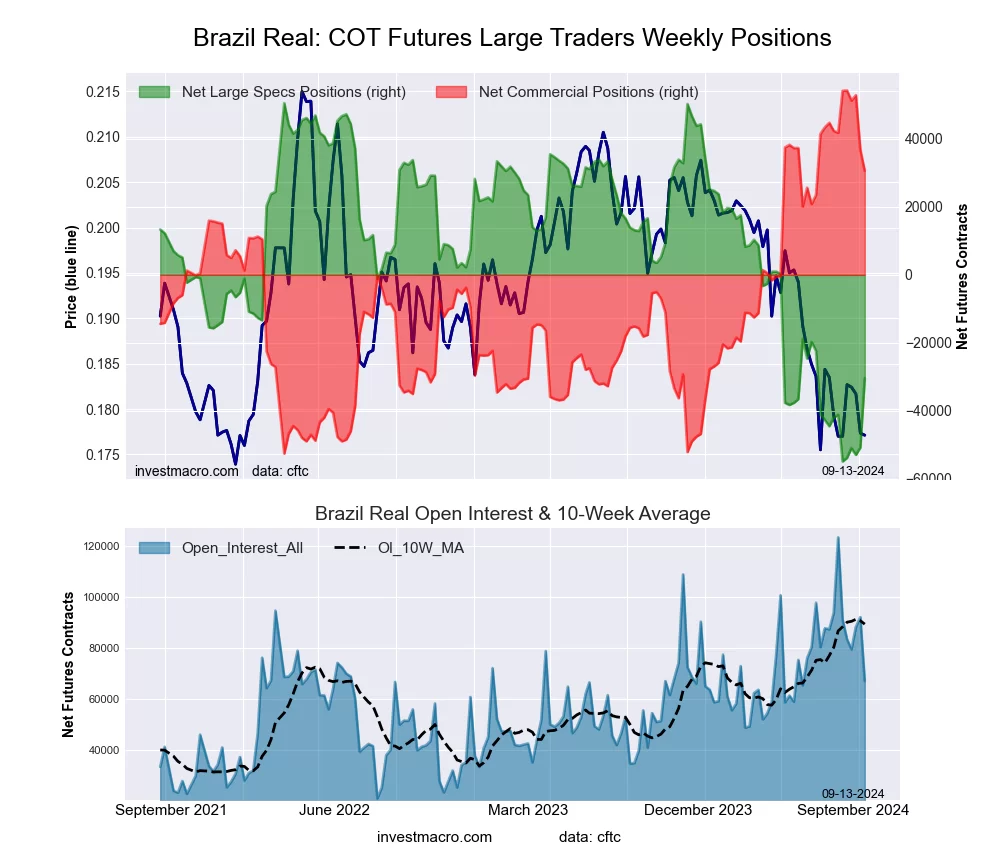

Brazilian Real Futures:

The Brazilian Real large speculator standing this week came in at a net position of -30,364 contracts in the data reported through Tuesday. This was a weekly rise of 20,447 contracts from the previous week which had a total of -50,811 net contracts.

The Brazilian Real large speculator standing this week came in at a net position of -30,364 contracts in the data reported through Tuesday. This was a weekly rise of 20,447 contracts from the previous week which had a total of -50,811 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 23.3 percent. The commercials are Bullish with a score of 77.9 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 19.5 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend. The current action for the model is considered to be: Hold – Maintain Short Position.

| BRAZIL REAL Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 27.0 | 68.6 | 3.9 |

| – Percent of Open Interest Shorts: | 72.3 | 23.0 | 4.3 |

| – Net Position: | -30,364 | 30,599 | -235 |

| – Gross Longs: | 18,115 | 46,011 | 2,631 |

| – Gross Shorts: | 48,479 | 15,412 | 2,866 |

| – Long to Short Ratio: | 0.4 to 1 | 3.0 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 23.3 | 77.9 | 19.5 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 10.2 | -10.5 | 2.2 |

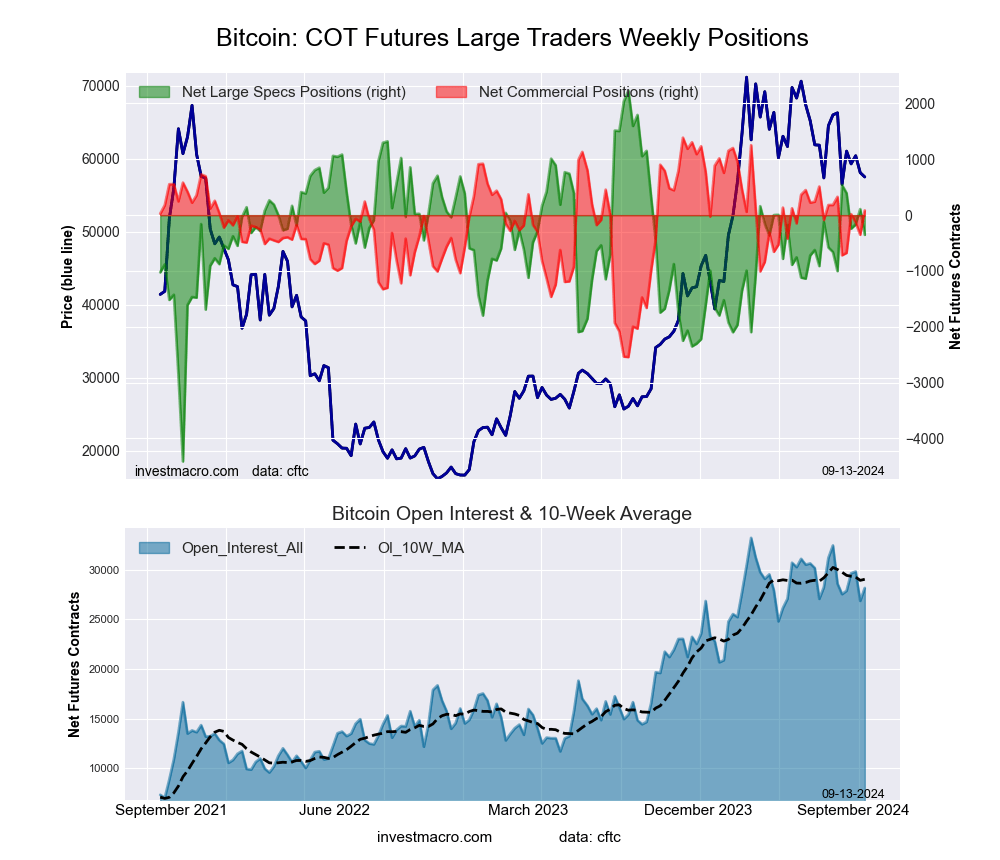

Bitcoin Futures:

The Bitcoin large speculator standing this week came in at a net position of -353 contracts in the data reported through Tuesday. This was a weekly decline of -461 contracts from the previous week which had a total of 108 net contracts.

The Bitcoin large speculator standing this week came in at a net position of -353 contracts in the data reported through Tuesday. This was a weekly decline of -461 contracts from the previous week which had a total of 108 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 61.1 percent. The commercials are Bullish with a score of 66.9 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 19.0 percent.

Price Trend-Following Model: Downtrend

Our weekly trend-following model classifies the current market price position as: Downtrend. The current action for the model is considered to be: Hold – Maintain Short Position.

| BITCOIN Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 81.6 | 3.9 | 4.4 |

| – Percent of Open Interest Shorts: | 82.8 | 3.6 | 3.4 |

| – Net Position: | -353 | 85 | 268 |

| – Gross Longs: | 22,969 | 1,097 | 1,225 |

| – Gross Shorts: | 23,322 | 1,012 | 957 |

| – Long to Short Ratio: | 1.0 to 1 | 1.1 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 61.1 | 66.9 | 19.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.8 | -6.2 | -9.3 |

Article By InvestMacro – Receive our weekly COT Newsletter

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

- COT Metals Charts: Speculator Bets led by Platinum Sep 14, 2024

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & Fed Funds Sep 14, 2024

- COT Stock Market Charts: Weekly Speculator Bets led by VIX & Russell-2000 Sep 14, 2024

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybeans Sep 14, 2024

- Gold sets a new record as prices rise higher Sep 13, 2024

- Weakening US inflation fuels indices and precious metals. ECB cut interest rates as expected Sep 13, 2024

- Why We Tip Our Hat to Warren Buffett Sep 12, 2024

- Timing of the Dollar Meltdown Sep 12, 2024

- NZD/USD is looking for a reason to recover: external background may help Sep 12, 2024

- The ECB will lower interest rates today. The Bank of Japan may raise rates to 1% within a year Sep 12, 2024