by OverviewFX | Aug 24, 2024 | Forex

EUR/CHF’s retreat from 0.9579 extended lower last week but recovered slightly ahead of 0.9448 support. Initial bias remains neutral this week first, and further rally is in favor. On the upside, sustained break of 55 D EMA (now at 0.9576) will pave the way back to...

by OverviewFX | Aug 24, 2024 | Forex

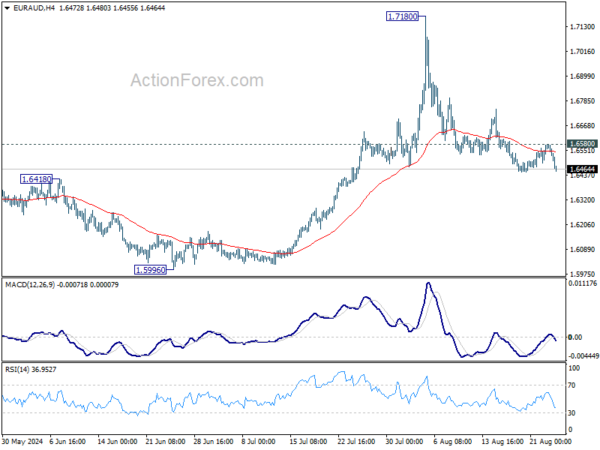

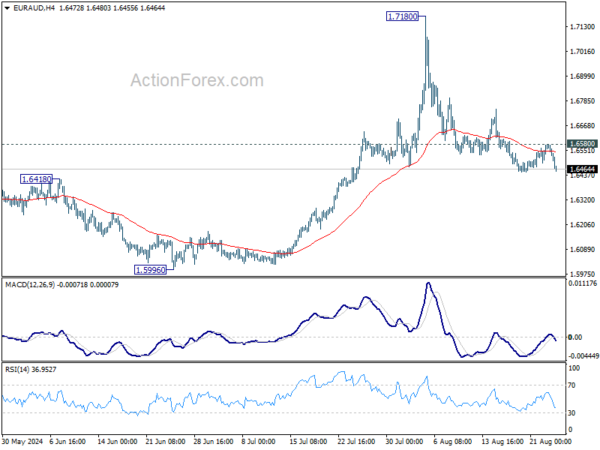

EUR/AUD gyrated lower last week despite weak downside momentum. On the downside, sustained trading below 55 D EMA (now at 1.6432) will argue that rise from 1.5996 has completed. Deeper fall would then be seen back to this support. Nevertheless, strong rebound from...

by OverviewFX | Aug 24, 2024 | Forex

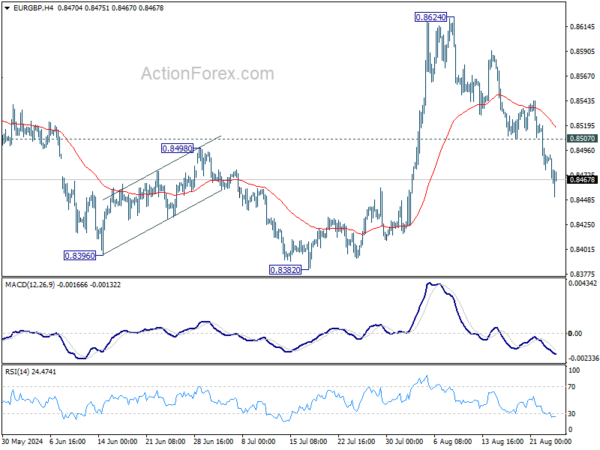

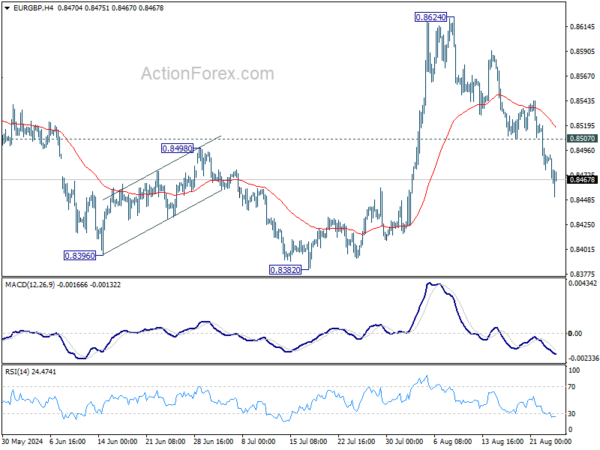

EUR/GBP’s steep decline last week suggest that rebound from 0.8382 has completed 0.8624 already, after rejection by 0.8643 resistance. Initial bias stays on the downside this week for retesting 0.8382 low. Decisive break there will resume larger down trend. On the...

by OverviewFX | Aug 24, 2024 | Forex

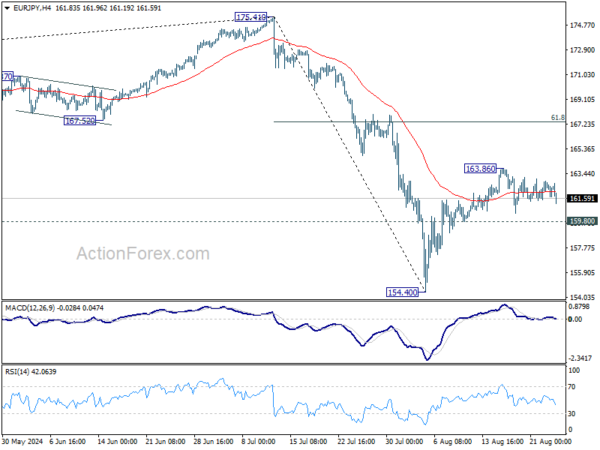

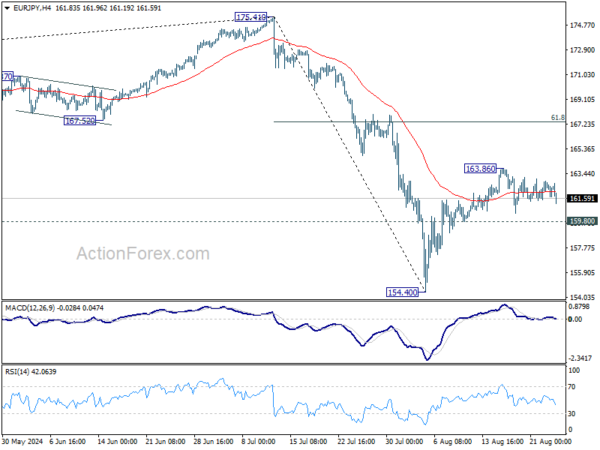

EUR/JPY stayed in sideway trading below 163.86 last week and outlook is unchanged. Initial bias stays neutral this week first. On the upside, break of 163.86 will target 61.8% retracement of 175.41 to 154.40 at 167.38, as the second leg of the corrective pattern from...

by OverviewFX | Aug 24, 2024 | Forex

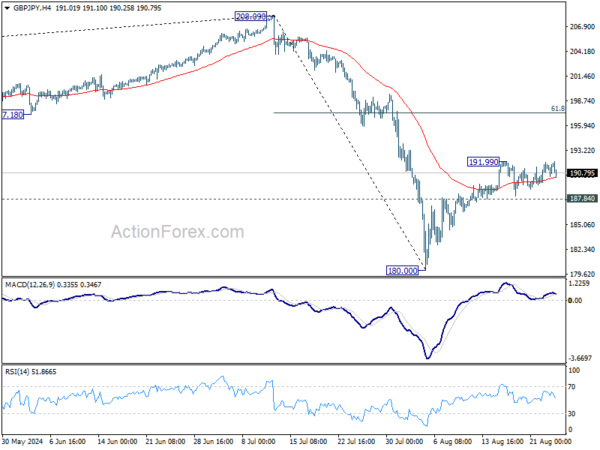

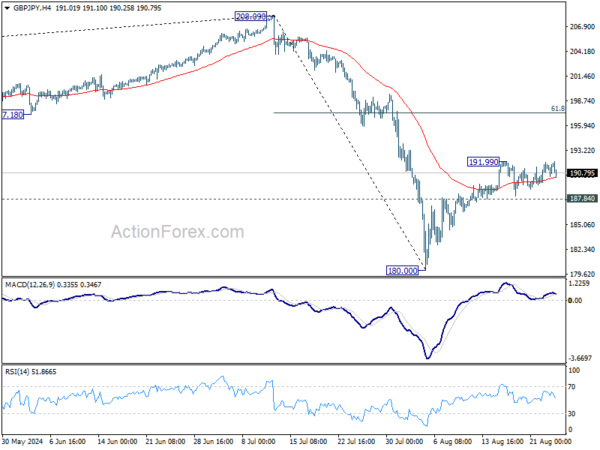

GBP/JPY stayed in sideway trading below 191.99 last week and outlook is unchanged. Initial bias remains neutral this week first. On the upside, above 191.99 will target 61.8% retracement of 208.09 to 180.00 at 197.35, as the second leg of the corrective pattern from...

by OverviewFX | Aug 24, 2024 | Forex

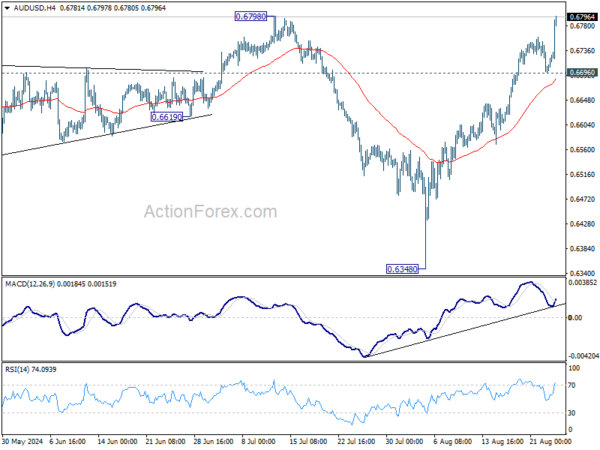

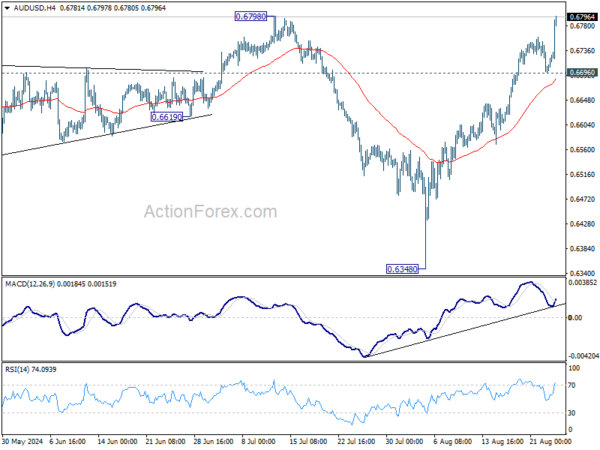

AUD/USD’s rally continued last week despite interim retreat. Initial bias is on the upside this week with focus on 0.6798 resistance. Firm break there will extend the rally from 0.6348 to 0.6870 resistance next. On the downside, below 0.6696 support turn bias to the...