by OverviewFX | Aug 24, 2024 | Forex

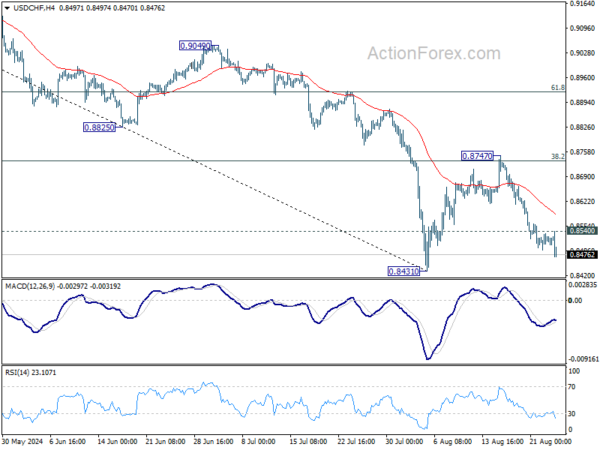

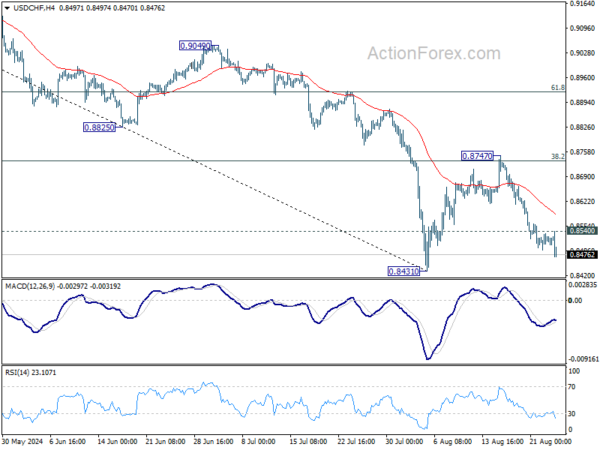

USD/CHF’s extended decline last week suggests that rebound from 0.8431 has completed at 0.8747, after rejection by 38.2% retracement of 0.9223 to 0.8431 at 0.8734. Initial bias is on the downside this week for retesting 0.8431 support first. Firm break there will...

by OverviewFX | Aug 24, 2024 | Forex

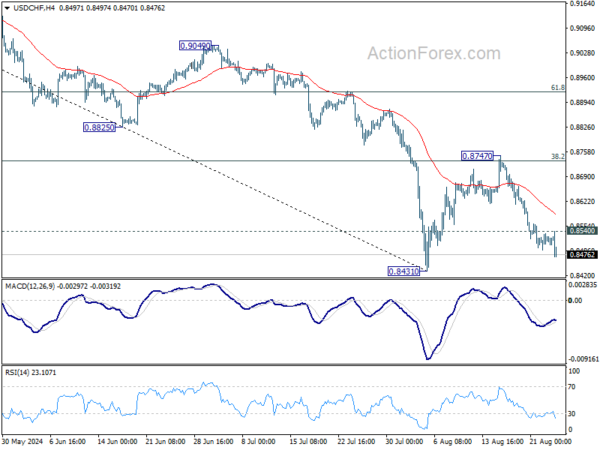

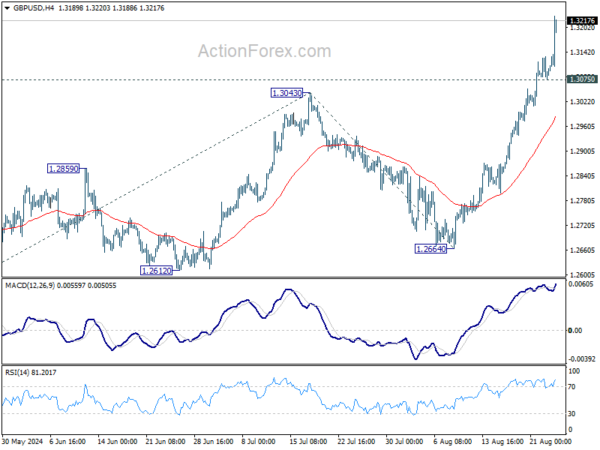

GBP/USD’s rally accelerated higher last week and the break of 1.3141 resistance confirms larger up trend resumption. Initial bias remains on the upside this week for 100% projection of 1.2298 to 1.3043 from 1.2664 at 1.3409. On the downside, below 1.3075 minor support...

by OverviewFX | Aug 24, 2024 | Forex

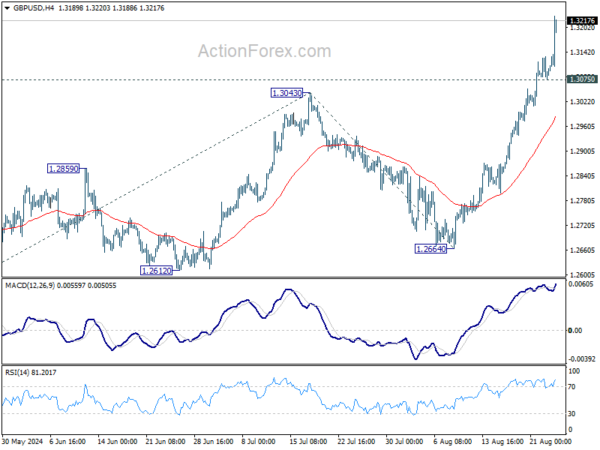

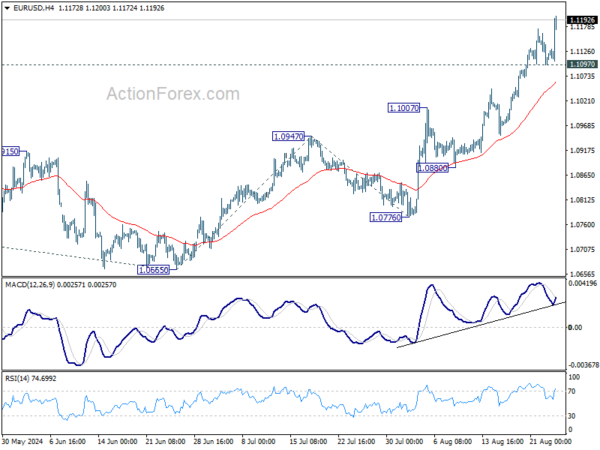

EUR/USD’s rally continued last week and the strong break of 1.1138 resistance argues that larger up trend may be resuming. Initial bias is on the upside this week for t 161.8% projection of 1.0665 to 1.0947 from 1.0776 at 1.1232, and then 1.1274 high. On the downside,...

by OverviewFX | Aug 24, 2024 | Forex

Fed Chair Jerome Powell’s highly anticipated speech at Jackson Hole didn’t disappoint market participants, as he clearly signaled that the time for easing monetary policy has arrived. This declaration provided a notable boost to US stock markets on Friday, with major...

by OverviewFX | Aug 24, 2024 | Forex

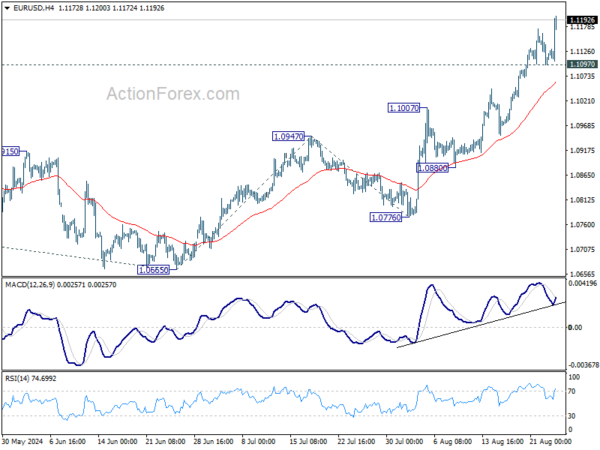

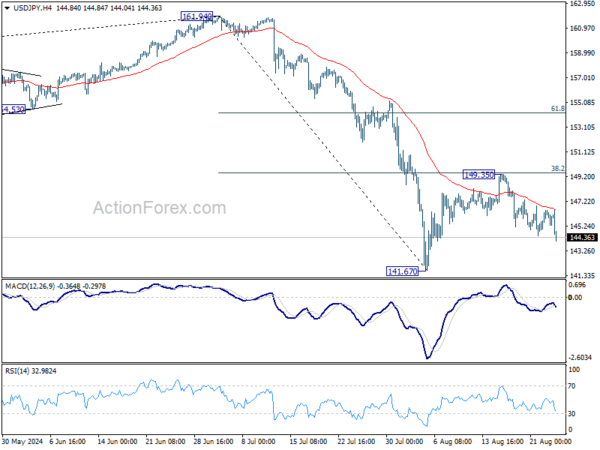

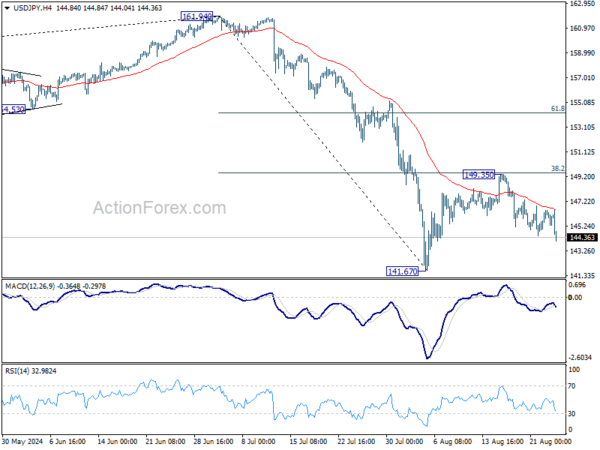

USD/JPY gyrated lower last week even though momentum is a bit unconvincing. Still, the development suggests that rebound from 141.67 has completed at 149.35, after rejection by 38.2% retracement of 161.94 to 141.67 at 149.41. Initial bias is on the downside this week...

by OverviewFX | Aug 24, 2024 | Forex

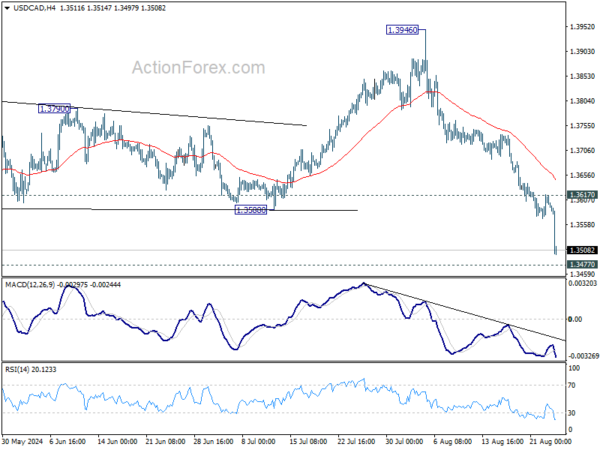

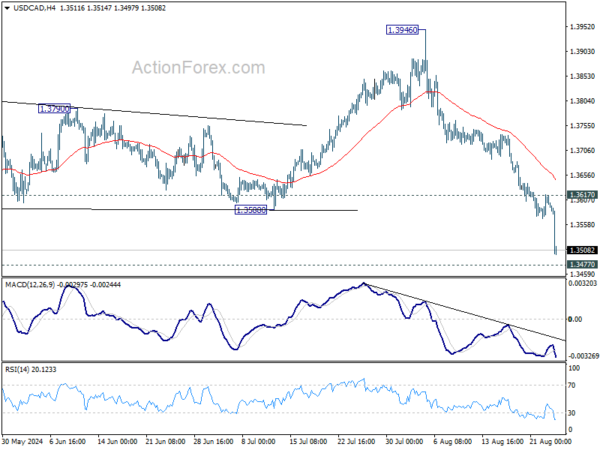

USD/CAD’s steep decline and strong break of 1.3588 support argues that while rise from 1.3176 has completed already. Fall from 1.3946 is seen as another falling leg inside medium term range pattern. Initial bias stays on the downside this week for 1.3477 support. Firm...