by OverviewFX | Aug 23, 2024 | Forex

Markets remained calm this week with risk sentiment improving further. Stock markets continued to trade higher taking S&P500 back to the recent highs reached in mid-July and cyclical metal prices increased as well. Bond yields drifted moderately lower in the US...

by OverviewFX | Aug 23, 2024 | Forex

In his highly anticipated Jackson Hole speech, Fed Chair Jerome Powell made it clear that “the time has come” for a shift towards monetary easing. Although he did not specify the exact timing or pace of rate cuts, Powell highlighted the increasing need to support the...

by OverviewFX | Aug 23, 2024 | Forex

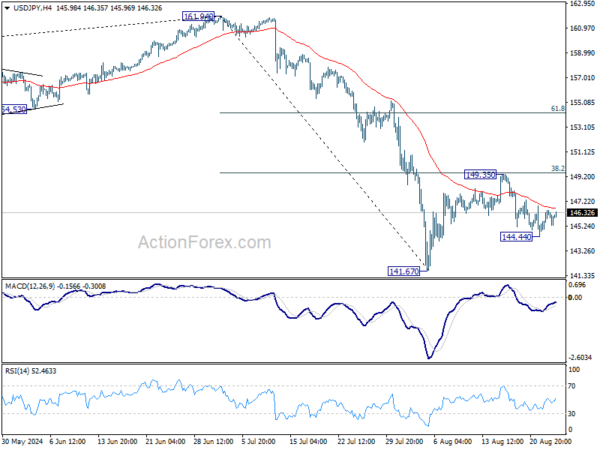

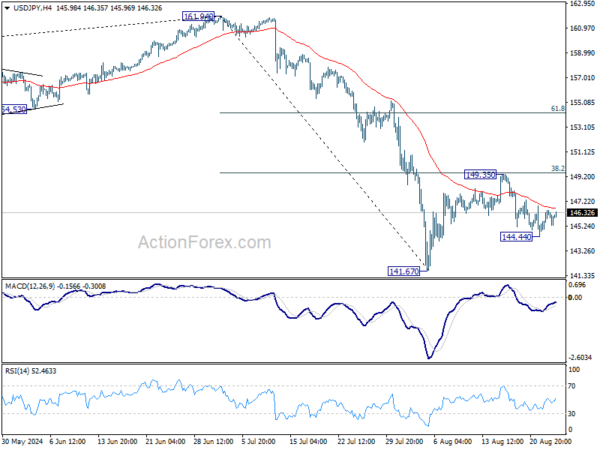

Daily Pivots: (S1) 144.19; (P) 145.55; (R1) 146.63; More… Outlook in USD/JPY is unchanged and intraday bias remains neutral. On the downside, break of 144.44 temporary low will reaffirm the case that rebound form 141.67 has completed, and bring retest of this low. On...

by OverviewFX | Aug 23, 2024 | Forex

Gold prices retest $2500/oz ahead of Fed Chair Powell’s Jackson Hole speech. Gold’s rebound in the European session and technical analysis suggest bullish momentum. September rate cuts likely already priced in. What impact will Powell’s remarks have? Gold prices are...

by OverviewFX | Aug 23, 2024 | Forex

Trading in the forex markets remains muted as investors hold their positions ahead of Fed Chair Jerome Powell’s highly anticipated speech at Jackson Hole. Market participants are keenly focused on any signals regarding the Fed’s plans for monetary policy easing,...

by OverviewFX | Aug 23, 2024 | Forex

The Japanese yen is in positive territory on Friday. In the European session, USD/JPY is trading at 146.06, down 0.14% on the day. The yen has looked sharp this week, gaining 1% against the struggling US dollar. Japan’s Core CPI rises to 2.7% Japan’s core CPI rose...