by OverviewFX | Aug 20, 2024 | Forex

Oil prices have decreased lately as a result of various crucial factors Technical Outlook confirms bearish structure Global economic concerns The global economy is encountering substantial difficulties, especially in prominent economies such as China and Europe....

by OverviewFX | Aug 20, 2024 | Forex

Euro/dollar maintains its position close to a seven-month peak, trading at 1.1077 on Tuesday. The US dollar’s weakening continues, largely driven by market expectations of an imminent interest rate cut by the US Federal Reserve next month. Attention is also geared...

by OverviewFX | Aug 20, 2024 | Forex

Canada’s CPI slowed to 2.5% yoy in July, down from 2.7% yoy in June, aligning with market expectations. This marks the slowest pace of inflation since March 2021. According to Statistics Canada, the deceleration in headline inflation was broad-based, with lower prices...

by OverviewFX | Aug 20, 2024 | Forex

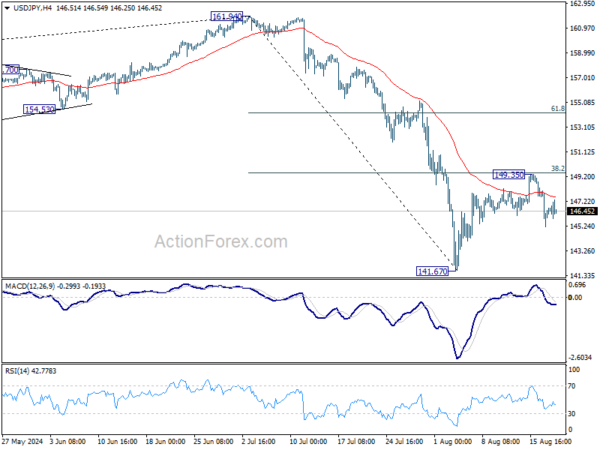

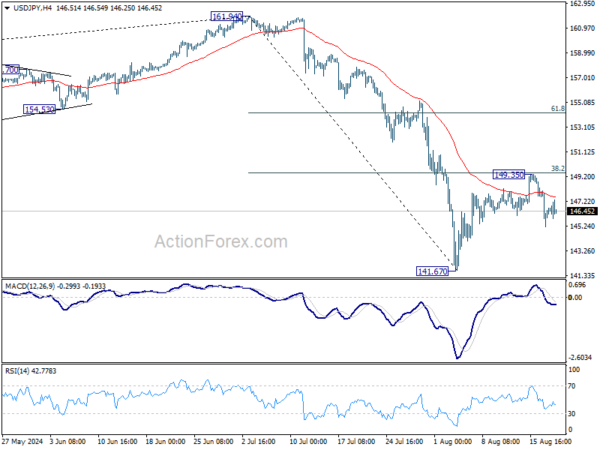

Daily Pivots: (S1) 145.17; (P) 146.62; (R1) 148.04; More… As noted before, USD/JPY’s rebound from 141.67 could have completed at 149.35 after rejection by 38.2% retracement of 161.94 to 141.67 at 149.41. Intraday bias stays mildly on the downside for retesting 141.67...

by OverviewFX | Aug 20, 2024 | Forex

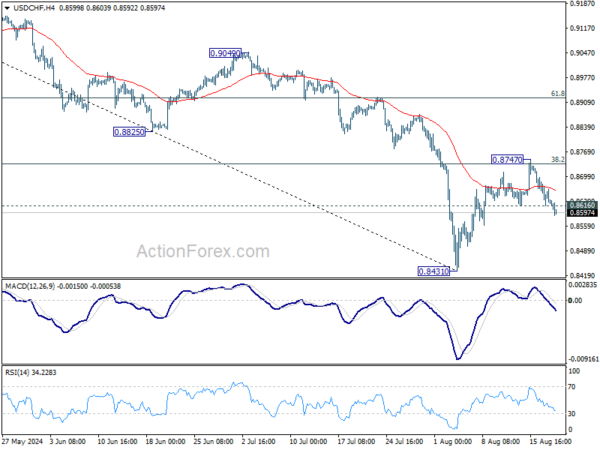

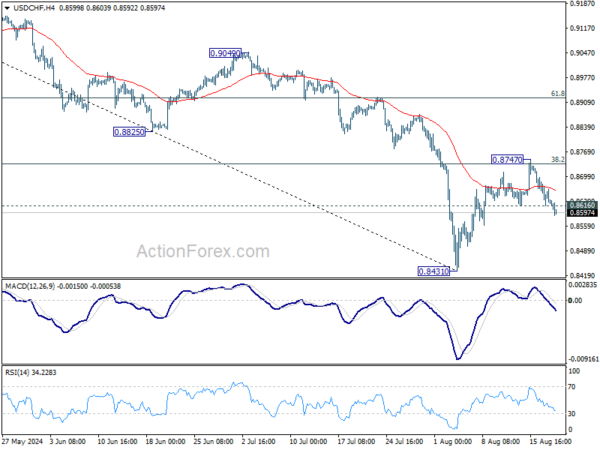

Daily Pivots: (S1) 0.8604; (P) 0.8641; (R1) 0.8666; More….. USD/CHF’s break of 0.8616 support should indicate that rebound from 0.8431 has completed at 0.8747, after rejection by 38.2% retracement of 0.9223 to 0.8431 at 0.8734. Intraday bias is back on the downside...

by OverviewFX | Aug 20, 2024 | Forex

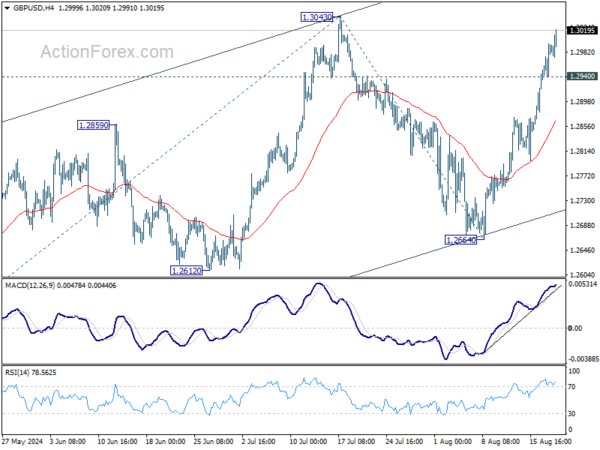

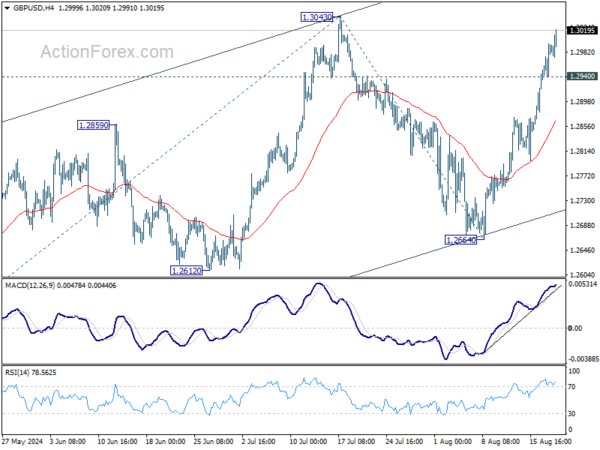

Daily Pivots: (S1) 1.2951; (P) 1.2974; (R1) 1.3013; More… GBP/USD’s rally from 1.2664 continues today and intraday bias stays on the upside for retesting 1.3043. Firm break there will resume whole rally from 1.2998 to 61.8% projection of 1.2298 to 1.3043 from 1.2664...