by OverviewFX | Aug 16, 2024 | Forex

Daily Pivots: (S1) 1.2811; (P) 1.2841; (R1) 1.2884; More… GBP/USD’s rise from 1.2664 resumed after brief consolidations and intraday bias is back on the upside. As noted before, pullback from 1.3043 could have completed at 1.2664 already. Further rally should be seen...

by OverviewFX | Aug 16, 2024 | Forex

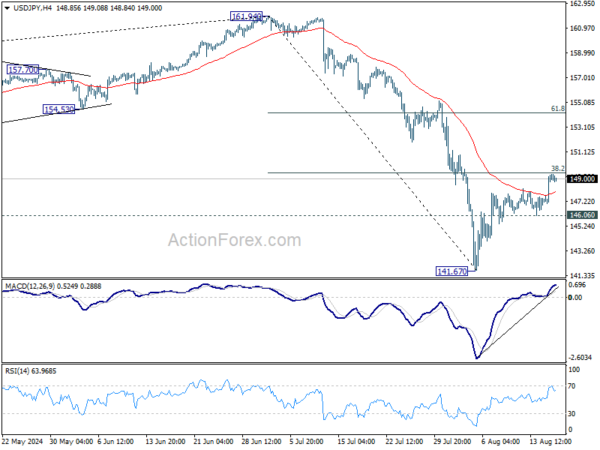

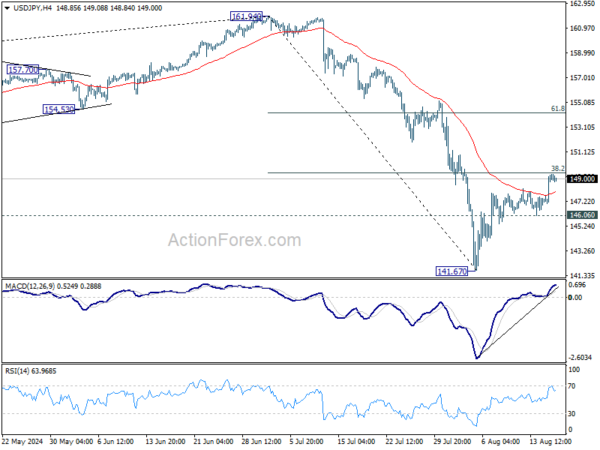

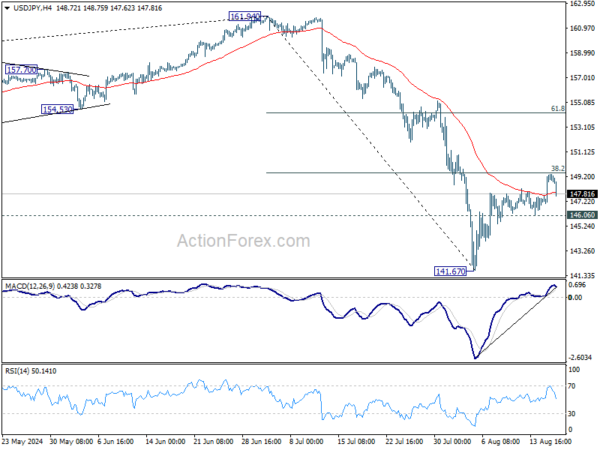

Daily Pivots: (S1) 147.76; (P) 148.58; (R1) 150.09; More… Immediate focus stays on 38.2% retracement of 161.94 to 141.67 at 149.41. Decisive break there will bring stronger rally to 61.8% retracement at 154.19, even as a corrective move. On the downside, break of...

by OverviewFX | Aug 16, 2024 | Forex

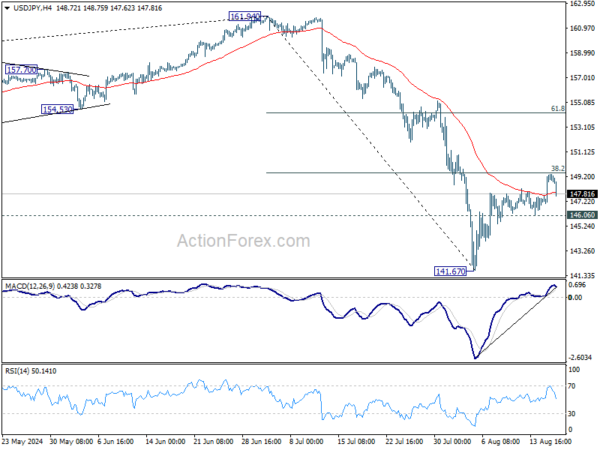

Daily Pivots: (S1) 147.76; (P) 148.58; (R1) 150.09; More… Intraday bias in USD/JPY is turned neutral as it retreated after failing to break through 38.2% retracement of 161.94 to 141.67 at 149.41. On the downside, break of 146.06 minor support will suggest rejection...

by OverviewFX | Aug 16, 2024 | Forex

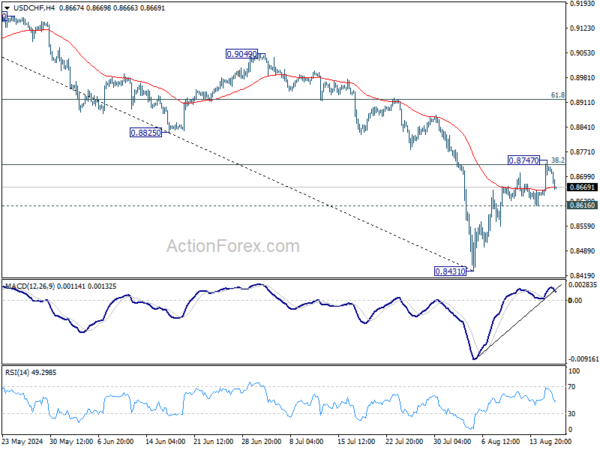

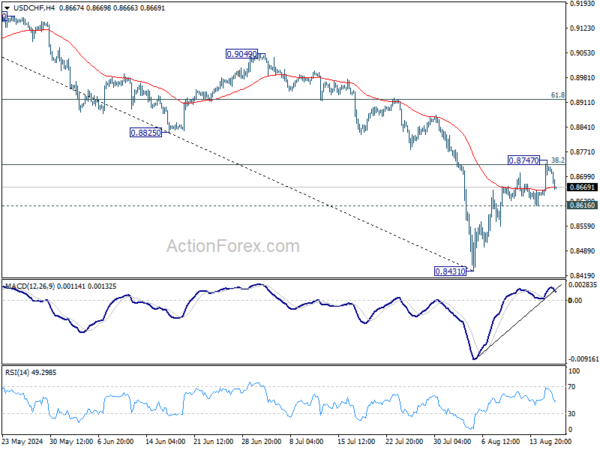

Daily Pivots: (S1) 0.8666; (P) 0.8707; (R1) 0.8768; More…. Intraday bias in USD/CHF is turned neutral first as it retreated after hitting 0.8747. On the upside, sustained break of 38.2% retracement of 0.9223 to 0.8431 at 0.8734 will extend the rebound from 0.8431 to...

by OverviewFX | Aug 16, 2024 | Forex

Daily Pivots: (S1) 1.0942; (P) 1.0980; (R1) 1.1010; More….. EUR/USD is staying in consolidation below 1.1046 and intraday bias remains neutral. Another rally is in favor as long as 1.0880 support holds. Firm break of 100% projection of 1.0665 to 1.0947 from 1.0776 at...

by OverviewFX | Aug 16, 2024 | Forex

Daily Pivots: (S1) 1.2811; (P) 1.2841; (R1) 1.2884; More… Intraday bias in GBP/USD remains on the upside for retesting 1.3043 high. Decisive break there will resume whole rally from 1.2998 to 61.8% projection of 1.2298 to 1.3043 from 1.2664 at 1.3124, which is close...