by OverviewFX | Aug 15, 2024 | Forex

Yesterday, important U.S. inflation data was released, as reported by ForexFactory: → Core CPI (MoM): actual = 0.2%, forecast = 0.2%; previous = 0.1%; → CPI (YoY): actual = 2.9%, forecast = 3.0%; previous = 3.0%. Today, market participants learned about the change in...

by OverviewFX | Aug 15, 2024 | Forex

Looking at the 4-hour time frame of the Kiwi with ticker NZDUSD, we can see a strong rebound after a completed final subwave “v” of C of (C), as Zealand beat jobs data, so seems like a new three-wave A-B-C rally can be in play within higher degree wave (D) that can...

by OverviewFX | Aug 15, 2024 | Forex

Gold prices rebounded after a post-CPI selloff, aided by a struggling US Dollar Index. A sustained move above $2500/oz for gold may require an additional catalyst, like geopolitical risks. The DXY faces challenges and is likely to remain subdued, with technical...

by OverviewFX | Aug 15, 2024 | Forex

Daily Pivots: (S1) 1.6596; (P) 1.6648; (R1) 1.6748; More… Intraday bias in EUR/AUD remains neutral as range trading continues. Outlook stays bullish with 1.6474 support intact. On the upside, above 1.6798 minor resistance will bring retest of 1.7180 resistance first....

by OverviewFX | Aug 15, 2024 | Forex

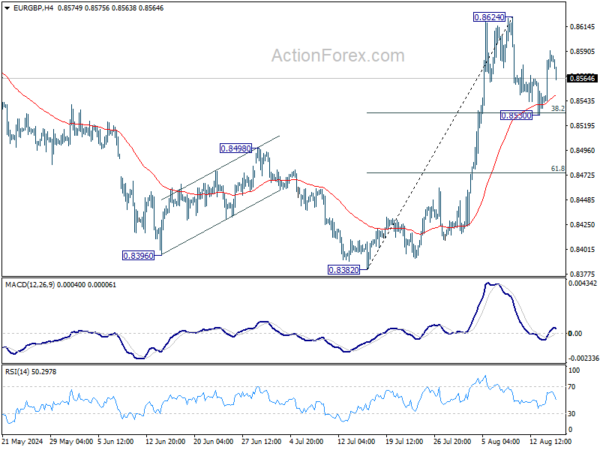

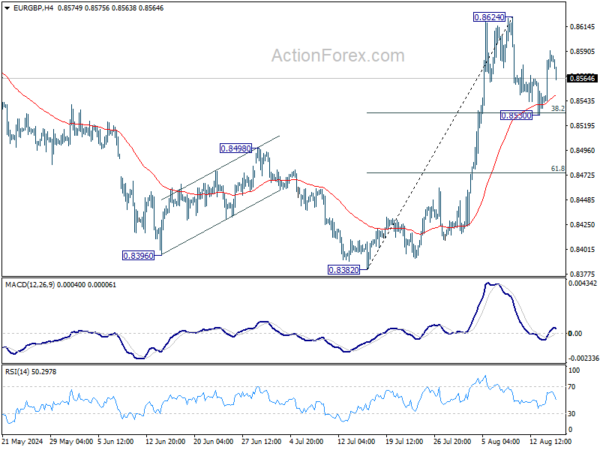

Daily Pivots: (S1) 0.8554; (P) 0.8573; (R1) 0.8605; More…. Intraday bias in EUR/GBP is turned neutral first with current retreat, and more consolidations could be seen below 0.8624. But outlook stays bullish as long as 38.2% retracement of 0.8382 to 0.8624 at 0.8532...

by OverviewFX | Aug 15, 2024 | Forex

Daily Pivots: (S1) 161.02; (P) 161.81; (R1) 163.02; More… Intraday bias in EUR/JPY stays neutral and outlook remains bearish with 38.2% retracement of 175.41 to 154.40 at 162.42 intact. On the downside, below 157.71 minor support will bring retest of 154.40 first....