Foreign portfolio investors (FPI) bought shares worth Rs 16,351 crore across 12 sectors on average between November 16 and 30, NSDL data showed. Inflows were highest for capital goods, consumer services, and automobiles, while outflows were highest from financial services, power, and FMCG sectors during this period.

FPIs demonstrated renewed interest in India’s IT sector, with an investment of Rs 1,991 crore in IT stocks in the second half of November. This shift in sentiment comes after they sold IT stocks worth Rs 13,063 crore between January and October. In 2022, they sold IT shares worth Rs 71,357 crore.

During the last 15 days of November, FPIs infused Rs 3,785 crore in capital goods, after they offloaded shares worth Rs 213 crore in the first half of the month. Consumer services and automobile segments received flows worth Rs 3,534 crore and Rs 2,132 crore, respectively, after facing outflows in the first half of the month.

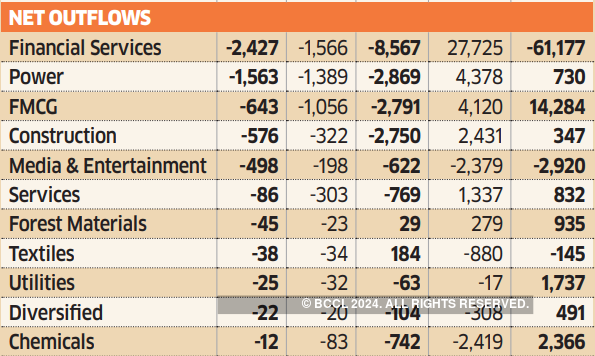

During the latter half, overseas investors were sellers to the tune of Rs 5,935 crore. Financial services witnessed a profit booking of Rs 2,427 crore, while it was Rs 1,389 crore for power and Rs 643 crore for FMCG. The financial services sector has seen outflows of Rs 1,566 crore in the first half of November and Rs 8,567 crore between January and October.