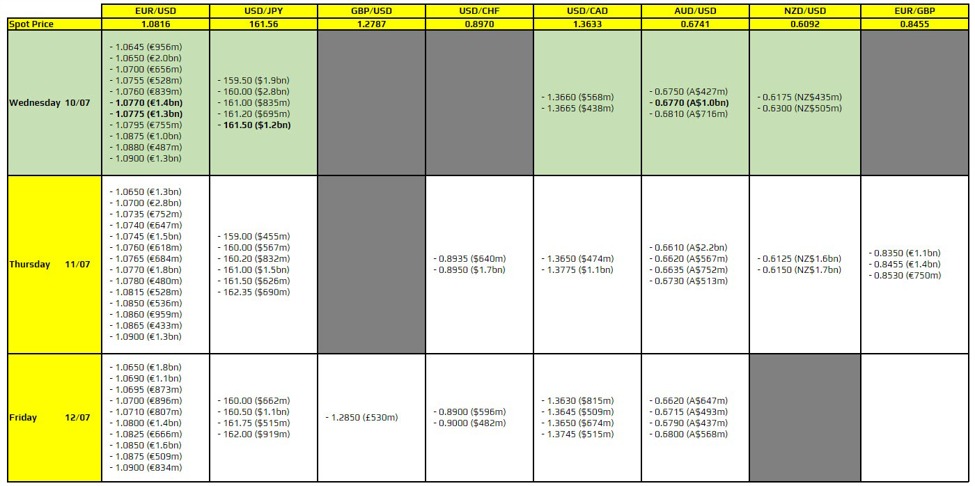

There are a couple to take note of, as highlighted in bold.

The first ones are for EUR/USD at 1.0770-75. However, the expiries do not hold much technical significance with key support still seen at around 1.0795-00 currently. That coincides with the confluence of the key daily moving averages. As such, I wouldn’t expect the expiries here to be much of a draw for the pair in the session ahead.

Then, there is one for USD/JPY at 161.50 near the current spot level. It also isn’t one that holds much technical significance and the pair is very much still impacted more heavily by psychological flows. The expiries could offer an anchor if markets stay quiet but otherwise, we might see the pair continue to trend higher as it has the last few sessions.

And lastly, there is one for AUD/USD at the 0.6770 level. Similar to the others, it is not one that holds any technical significance. So, it might be tough to argue on the expiries being a pull factor in this case.

For more information on how to use this data, you may refer to this post here.