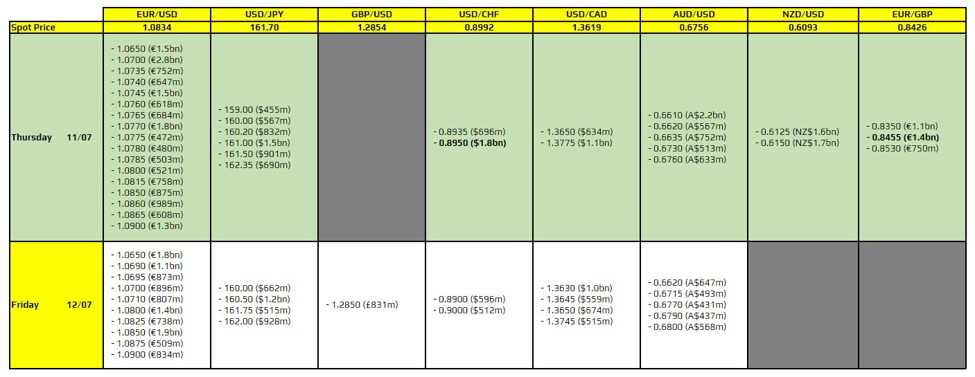

There are just a couple to take note of on the day, as highlighted in bold.

The first being for USD/CHF at the 0.8950 level. It isn’t one that holds any technical significance but could hold any downside pressure as it coincides with the weekly pivot. The ceiling for price action in the pair is more interesting though, seen at around 0.9000 level. That is hugging the 200-hour moving average as well as the 100-day moving average as well.

Then, there is one for EUR/GBP at the 0.8455 level. I would argue that it shouldn’t be one to factor into play though. All eyes today are on the US CPI report, so the dollar is the one that will be the main mover. In any case, EUR/GBP has seen upside hold at its 100-hour moving average yesterday and that is seen at 0.8451. So, it may help to just limit any surprise pushes during the session ahead. But again, very unlikely to feature.

For more information on how to use this data, you may refer to this post here.