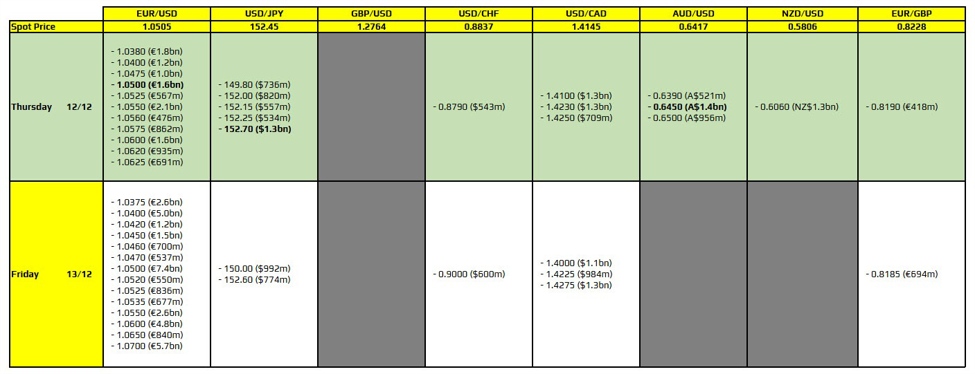

There are a couple to take note of on the board for today, as highlighted in bold.

The first one is for EUR/USD at the 1.0500 level. That should help to keep price action more limited ahead of the ECB policy decision later in the day. But from a technical perspective, the pair is pinned down by the key hourly moving averages at 1.0530-40 currently. So, that will help to keep a lid on things with the expiries perhaps helping to keep a bit of a pull as well.

Then, there is one for USD/JPY at the 152.70 level. It isn’t one that offers much technical significance, so the expiries might just help keep any upside from overextending before rolling off. There is the 50.0 Fib retracement level of the swing lower since November at 152.69 though, so that might act alongside the expiries in helping to limit short-term movement.

But keep in mind that the pair broke above its 200-day moving average of 152.01 yesterday already, so there is scope to extend higher from here if other market conditions align.

The final set of expiries is the one for AUD/USD at the 0.6450 level. The pair is facing a rather back and forth week with the latest bounce today being moderately encouraging. It comes after the pair tested the April and August lows yesterday, with buyers holding the line for now. There is the 200-hour moving average at 0.6429 next before the expiries come into play. So, that should offer more of a near-term resistance point with the expiries not being all too significant as such.

For more information on how to use this data, you may refer to this post here.