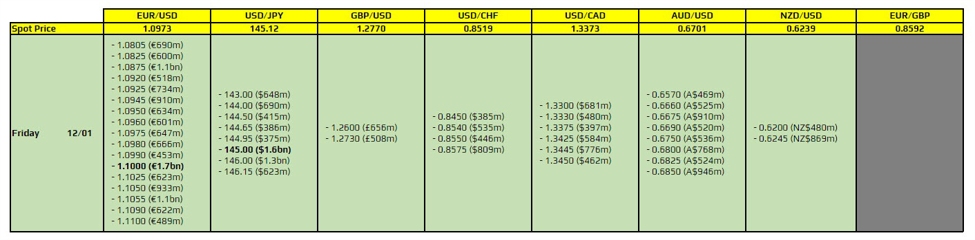

There are a couple to take note of, as highlighted in bold.

The first being for EUR/USD at the 1.1000 mark, which remains a key resistance point for the pair since the turn of the year. As such, the expiries will add another resistance layer to help limit any upside price action on the day before we get to the US PPI data later.

Then, there is the one for USD/JPY at the 145.00 level. Similarly, it should keep downside price action more contained for now so long as the bond market also holds up. If yields do track lower though, that will still be the key driver of momentum for USD/JPY in the bigger picture today.

For more information on how to use this data, you may refer to this post here.