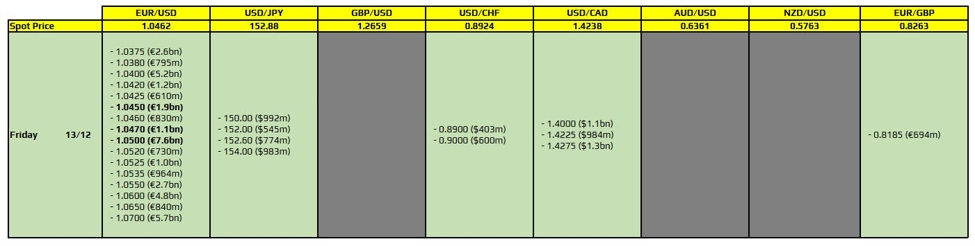

There are a couple to take note of on the day, as highlighted in bold.

They are all for EUR/USD and layered between 1.0450 through to 1.0500. The big one of course is the over €7 billion in expiries at the 1.0500 level. That might offer some pull factor for EUR/USD in the session ahead and if anything else, keep a lid on things after the ECB policy decision yesterday.

After some modest swings back and forth near 1.0500 in overnight trading, we’re seeing the price movements calm down a fair bit. That as the pair is on course for a sixth straight day of losses.

Given the expiries above, we might just see price action feel more trapped but just be wary that there are some relatively large ones as well closer towards the 1.0400 level. So, it is not to say that those might not factor into the equation in pulling price action lower in the session ahead. That especially with sellers well in near-term control of the pair at the moment.

For more information on how to use this data, you may refer to this post here.