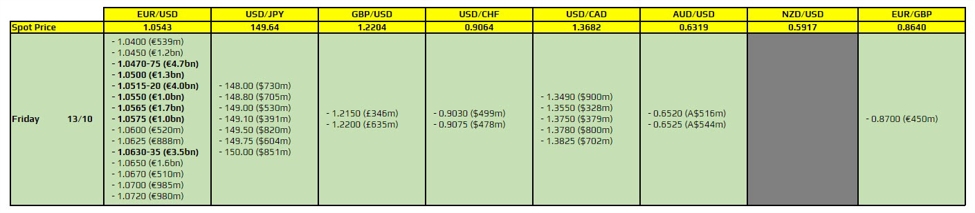

There are a handful of significantly large option expiries for EUR/USD to take note of, as highlighted in bold.

The key ones based on the current spot price are layered around 1.0500 to 1.0575 but those expiries are sandwiched in between some massive ones at 1.0470-75 and 1.0630-35. So, keep that range in mind for any extension in price action on the day. Otherwise, we are likely to see EUR/USD get stuck in the narrower range with the bigger pull at 1.0515-20 to limit any potential downside before rolling off later in the day.

All that being said, the key to trading sentiment right now is bond market developments. For now, the rout has cooled off but as has been the case in the few weeks, the heavy selling only tends to hit in US trading. And that once again could be a trigger for a turnaround to help the dollar strengthen later today. This for me, is still the number one driver at the moment.

For more information on how to use this data, you may refer to this post here.