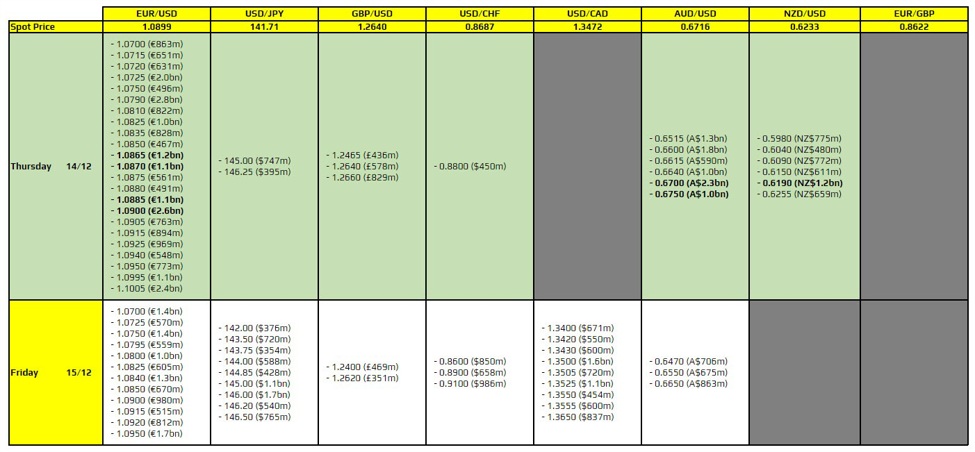

There are quite a number to take note of, as highlighted in bold.

The first ones are for EUR/USD, which could keep price action more contained just below 1.0900 before we get to the ECB later in the day. The most notable of those expiries is the one at the figure level itself, which is rather large in size.

Then, there are the ones for AUD/USD at 0.6700 and 0.6750. But I don’t really see the expiries as being too limiting a factor considering that the pair has cleared the technical resistance hurdle around 0.6690 and is now scaling to fresh highs since the end of July.

And lastly, there is the one for NZD/USD at 0.6190 but that also doesn’t offer much technical significance. So, I wouldn’t expect the expiries to matter too much in this instance for price action in the pair.

All that being said, just be wary that right now trading sentiment is all about the post-FOMC reaction. Taking that into consideration, the softer dollar mood and lower bond yields are the two key drivers and overrides everything else at the moment.

For more information on how to use this data, you may refer to this post here.