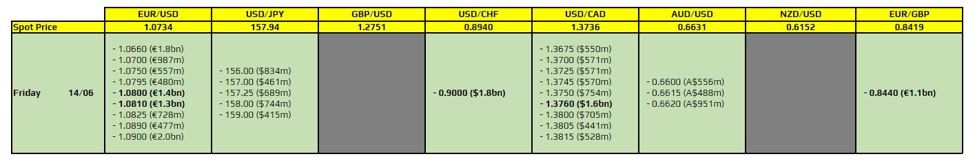

There are a couple to take note of, as highlighted in bold. But barring any surprise moves, they aren’t likely to feature much into play.

The first ones are for EUR/USD at 1.0800-10, which aren’t likely to be of much impact. The euro is weighed down by political angst on the week with the dollar keeping more resilient. The expiries are an additional layer of resistance alongside offers but should not factor much, if at all, into price movements in European trading.

Then, there is one for USD/CHF at the 0.9000 level. It also isn’t one that should come into play given the way price action has been behaving in the last week. But the expiries do come alongside a key resistance (previously support) for the pair.

And there is one for USD/CAD at the 1.3760 level. It isn’t one that offers much technical significance but could hold price action just below there and thereabouts before we get to US trading at least.

Lastly, there is one for EUR/GBP at the 0.8440 level. With the euro weighed down, the expiries here might just act as a bit of a ceiling to price action before rolling off later.

For more information on how to use this data, you may refer to this post here.