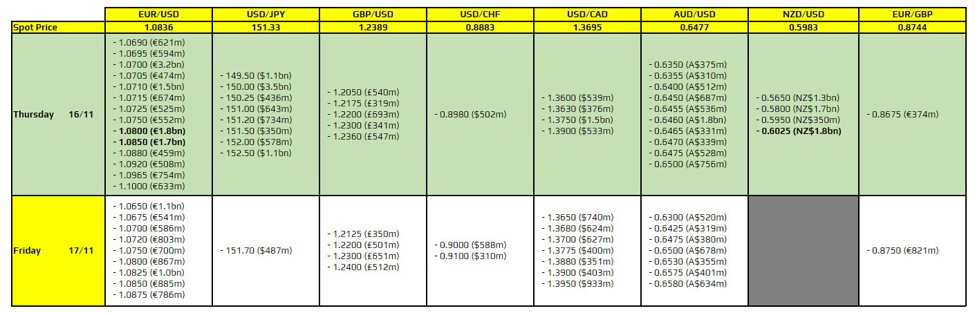

There are a couple to take note of, as highlighted in bold.

The first ones being for EUR/USD at 1.0800 and 1.0850, which are likely to help keep price action more contained in between the two levels before rolling off later in the day. A quieter European morning session should aid with that too but keep in mind that trading sentiment can shift quickly on a dime based on what we see with risk and the bond market right now.

Then, the other is for NZD/USD at 0.6025 which doesn’t offer any technical significance. But it could limit any upside movement in the pair alongside the 100-day moving average at 0.6001 currently, before the expiries roll off.

For more information on how to use this data, you may refer to this post here.