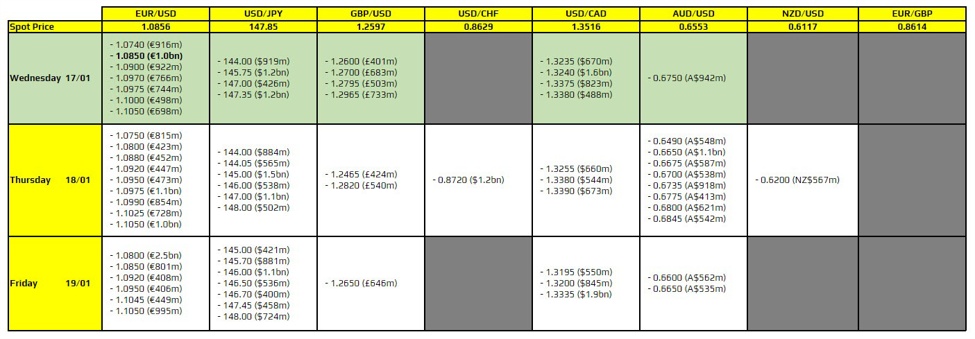

There is just one to take note of for the day, as highlighted in bold.

That being for EUR/USD at 1.0850, which sits relatively close to the 200-day moving average for the pair at 1.0846. Put together, they might act as a sticking point for downside price action in the session ahead before we get to the US retail sales data.

The dollar is looking to build on yesterday’s gains and is racing higher ahead of European trading, so the expiry level above is one to be mindful about alongside the key technical level outlined.

Besides that, there is a large one for USD/JPY at 147.35 but the pair looks to be moving past that now and any reaction to dampen the upside momentum is likely one to be data-driven. In other words, it will boil down to the US retail sales data later in the day to validate/invalidate the early moves.

For more information on how to use this data, you may refer to this post here.