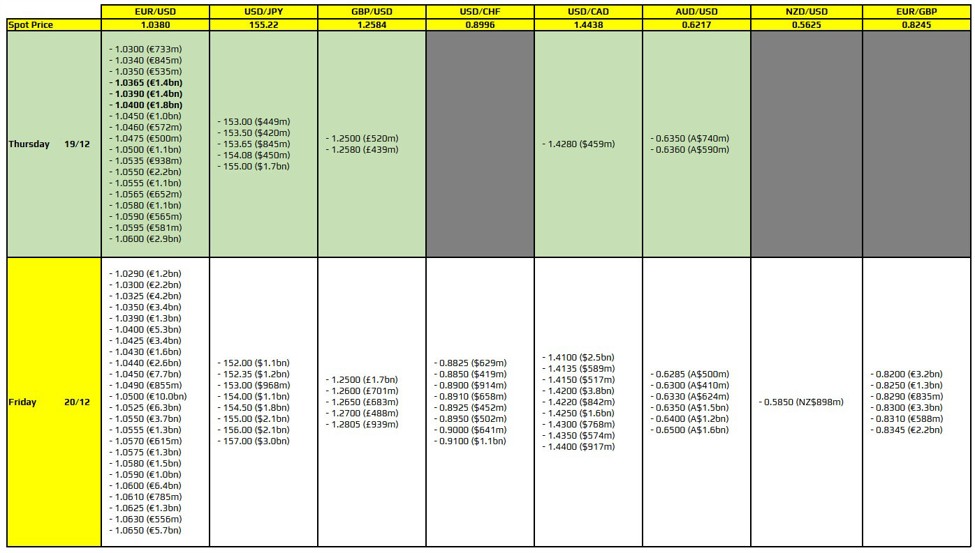

There are a couple to take note of on the day, as highlighted in bold.

And they are for EUR/USD once again, layered between 1.0365 to 1.0400. The pair is catching a notable downside break under 1.0400 after the Fed yesterday. The low touched 1.0343 and is just shy of the 22 November low of 1.0331. However, sellers have secured a daily close below the 1.0400 mark so that might count for something.

And the larger expiries today might keep that downside momentum intact in the absence of stronger catalysts. That before we get to US trading where there will be the weekly initial jobless claims to scrutinise.

Just be mindful that there are also plenty of extremely large expiries under 1.0400 for tomorrow as well. It’s the final real trading week of the year, so everything and everyone has something lined up for tomorrow it would seem. But if the pair can secure a clean break under 1.0400 going into next year, that will set up for a potential look towards parity next based on the technical argument.

For more information on how to use this data, you may refer to this post here.