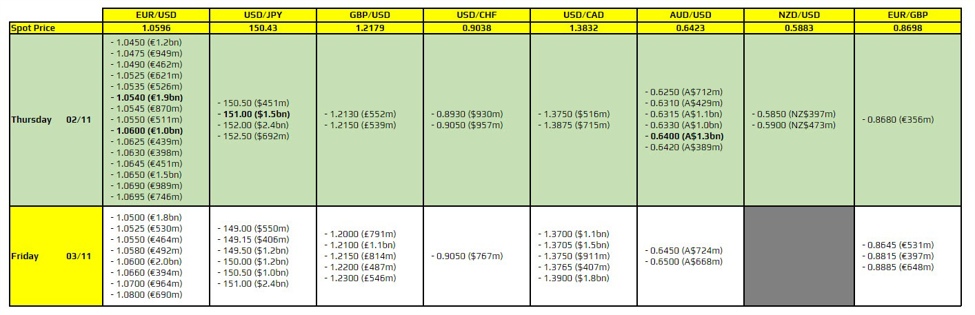

There are a couple to take note of on the day, as highlighted in bold.

The first ones are for EUR/USD at 1.0540 and 1.0600. Both do not hold much technical significance, so the one at 1.0540 is not likely to factor into play too much especially as the dollar keeps on the softer side amid a squeeze in the bond market. The ones at 1.0600 could keep price action more contained (there is also a large set at the same level for tomorrow) but again, it matters more what happens in Treasury yields at this point.

Then, there is the one for USD/JPY at 151.00 but also not likely to see much effect. The pair is dragged down amid lower yields and so unless that turns around, the expiries aren’t going to be much of a factor in the session ahead.

And lastly, there is the ones for AUD/USD at 0.6400 on the day. Similar to the rest, it isn’t one that has any technical significance so it shouldn’t be offer much influence to price action. But if anything else, considering the broader market sentiment now, it should keep AUD/USD above the figure level in the session ahead barring any reversal to yesterday’s market moves.

For more information on how to use this data, you may refer to this post here.