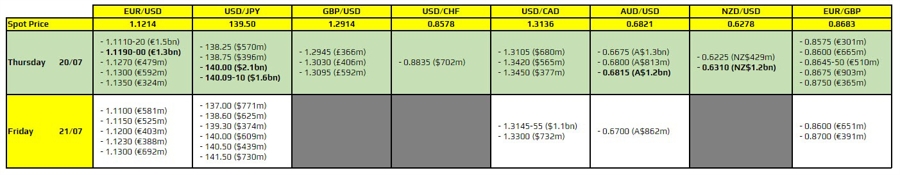

There are quite a number of large expiries to take note of for the day, as highlighted in bold.

The first being for EUR/USD near the 1.1200 mark, so that will likely help to play a role in limiting any downside pull in the pair. This fits with the recent price action that we have seen this week, holding just above 1.1200 so the expiries will only add to that similar conviction.

Then, there are some notably large ones for USD/JPY at 140.00-10 which should keep price action held below the figure level before rolling off later in the day. This adds to the natural resistance in that level itself, as what we saw yesterday.

There is also a large one for AUD/USD at 0.6815, which could offer a bit of a pull to price action. However, the expiry level doesn’t offer any technical significance and the key resistance region for the pair remains closer to 0.6900. So, keep that in mind as the aussie is looking rather buoyed today as noted here.

And lastly, we have one for NZD/USD at 0.6310 and that might play a bit of a role alongside the 100-hour moving average at 0.6313 in limiting any upside price movements in the session ahead before rolling off later.

For more information on how to use this data, you may refer to this post here.