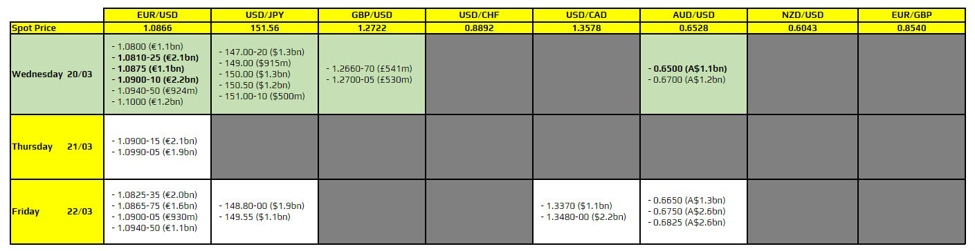

There are a couple to take note of, as highlighted in bold.

The first ones are for EUR/USD as they are layered from 1.0810 through to 1.0910. That is going to help keep price action more muted around the current levels, with the technicals also in play. The 200-day moving average at 1.0839 and 100-day moving average at 1.0866 are key levels to be mindful of. Put together with the expiries, it should keep the price action battle in between the above region until we get to the Fed.

Then, there is one for AUD/USD at the 0.6500 level. That should help to keep price just above the figure level alongside bids for the time being. All that until we get to the Fed of course.

For more information on how to use this data, you may refer to this post here.