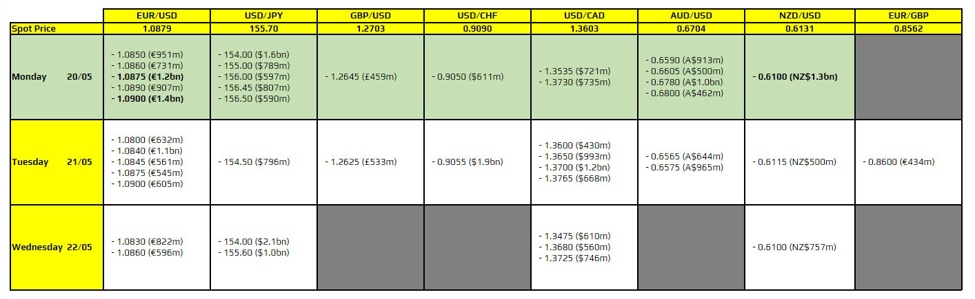

There are a couple to take note of on the day, as highlighted in bold.

The first ones are for EUR/USD at 1.0875 and 1.0900. That is likely to keep price action more compact in that range on the day, considering little to work with in European trading as well. It’s a holiday in most parts of Europe, so market appetite is likely to be sapped to start the week.

Then, there is one for NZD/USD at the 0.6100 level. That should help to hold price action from falling below the figure mark before the expiries roll off later.

Besides that, it’s a bit of a quiet one on the expiries board compared to the week before. That exemplifies a lack of important events on the economic calendar, relative to what we saw last week of course.

For more information on how to use this data, you may refer to this post here.