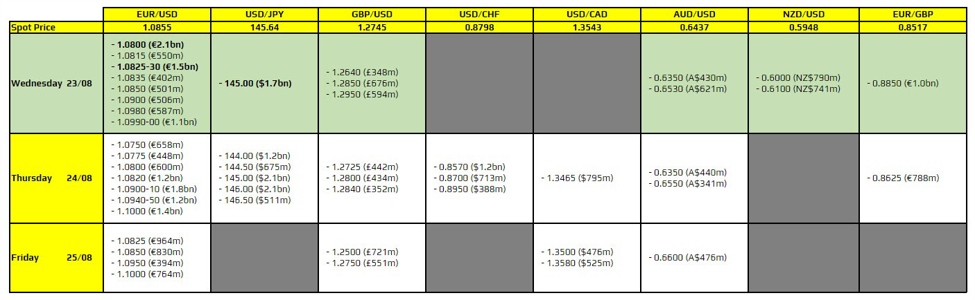

There are a couple to take note of, as highlighted in bold.

The first ones being for EUR/USD, which I would say the expiries at 1.0800 would be more of a significant factor if we do see price action roam towards that level in the session ahead. Such a play would be subject to the PMI data to come but as pointed out here, there is key technical support at the figure level for the pair so the expiries will provide an additional layer on top of that for today.

Then, there is the one for USD/JPY at 145.00 but that would be subject to bond market developments for the most part. Buyers are also defending the figure level in order to keep the upside momentum, so that makes it a point of interest. But if things keep quieter until US trading, the expiries today may not see much pull but keep in mind that there is another big chunk at 145.00 again (and at 146.00 as well) for tomorrow.

For more information on how to use this data, you may refer to this post here.