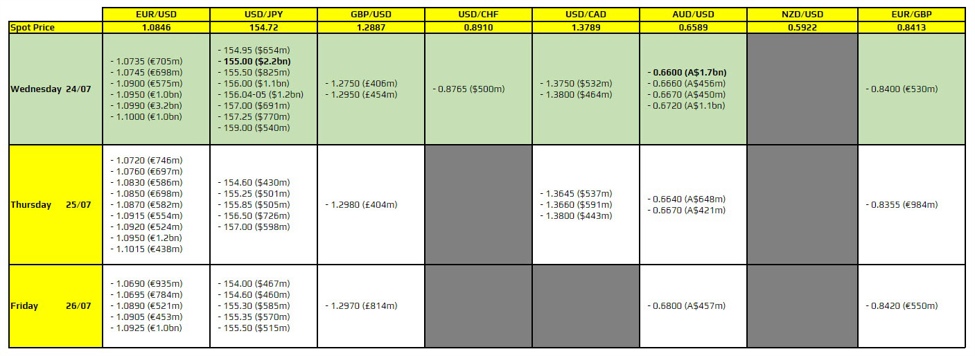

There are a couple to take note of, as highlighted in bold.

However, they may not feature too much into play given the state of play in major currencies this week.

The first one being for USD/JPY at the 155.00 mark but the pair is feeling rather heavy already in the handover from Asia to Europe today as seen here. The break of the 100-day moving average at 155.35 is arguably the more important one from a technical perspective. So, that doesn’t put too much significance on the figure level on the day. But still, it could act as a bit of a magnet in drawing price action in the hours ahead. That at least until we get to the US PMI data later on.

Then, there is one for AUD/USD at 0.6600 which could help to keep price action more contained alongside some key technical levels. The 100 and 200-day moving averages for the pair are resting in the region of 0.6584-07 currently. And that could help to limit losses for now, barring any major selloff in risk trades today. But that might only come later on in US trading, when Wall Street enters the fray.

For more information on how to use this data, you may refer to this post here.